Credit Suisse Results Presentation Deck

Corporate Center

Revenues

PCL/

ability Costs

Profit-

Balance

Sheet

29

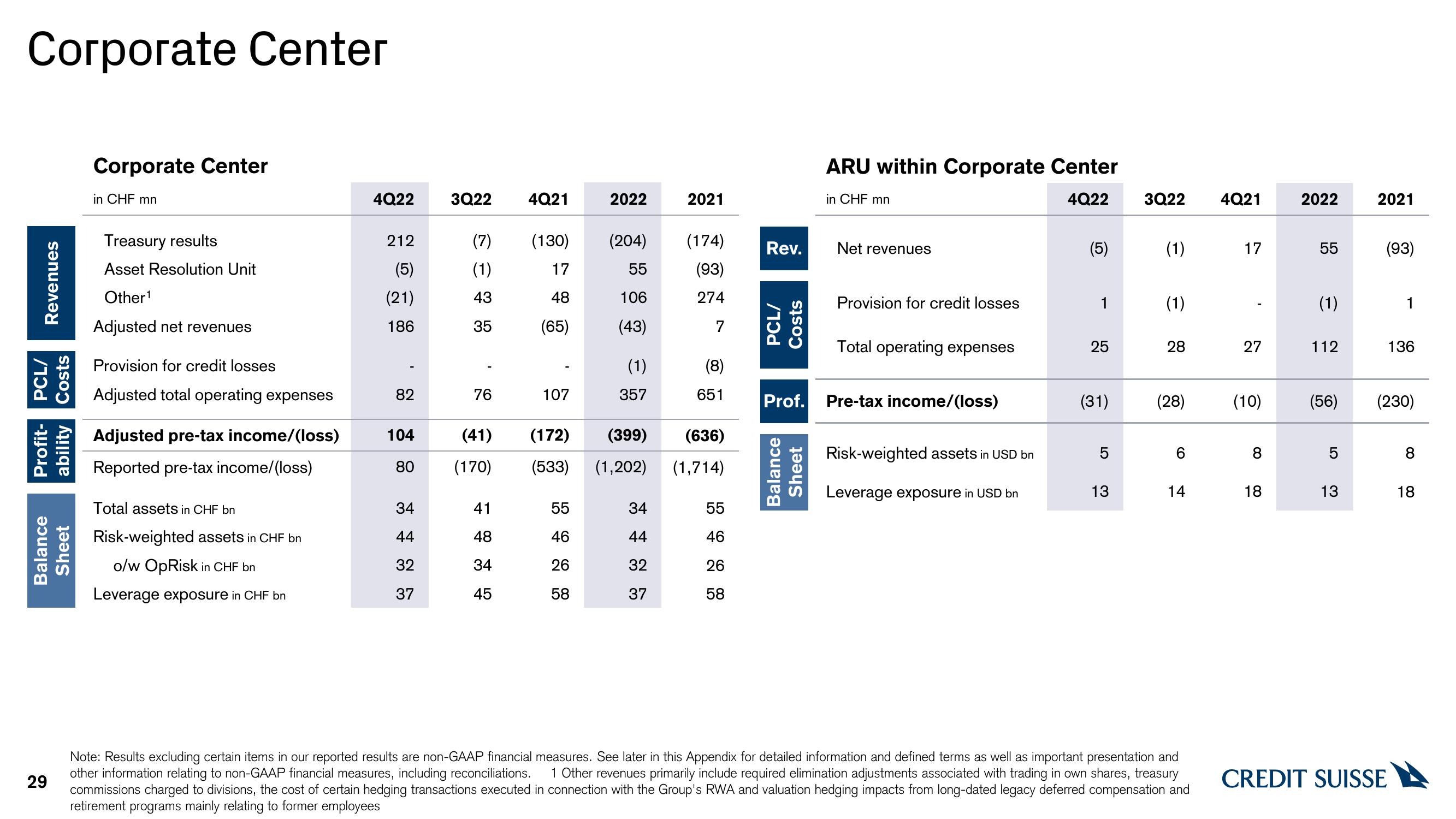

Corporate Center

in CHF mn

Treasury results

Asset Resolution Unit

Other¹

Adjusted net revenues

Provision for credit losses

Adjusted total operating expenses

Adjusted pre-tax income/(loss)

Reported pre-tax income/(loss)

Total assets in CHF bn

Risk-weighted assets in CHF bn

o/w OpRisk in CHF bn

Leverage exposure in CHF bn

4Q22 3Q22

212

(5)

(21)

186

82

104

80

34

44

32

37

(7)

(1)

43

35

76

4Q21

41

48

34

45

(130)

17

48

(65)

107

(41) (172)

(170) (533)

55

46

26

58

2022

(204)

55

106

(43)

(1)

357

(1,202)

2021

34

44

32

37

(174)

(93)

274

7

(399) (636)

(1,714)

(8)

651

55

46

26

58

Rev.

PCL/

Costs

Prof.

Balance

Sheet

ARU within Corporate Center

in CHF mn

4Q22

Net revenues

Provision for credit losses

Total operating expenses

Pre-tax income/(loss)

Risk-weighted assets in USD bn

Leverage exposure in USD bn

(5)

1

25

(31)

LO

5

13

3Q22 4Q21

(1)

(1)

28

(28)

6

14

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See later in this Appendix for detailed information and defined terms as well as important presentation and

other information relating to non-GAAP financial measures, including reconciliations. 1 Other revenues primarily include required elimination adjustments associated with trading in own shares, treasury

commissions charged to divisions, the cost of certain hedging transactions executed in connection with the Group's RWA and valuation hedging impacts from long-dated legacy deferred compensation and

retirement programs mainly relating to former employees

17

27

(10)

8

18

2022

55

(1)

112

(56)

13

2021

(93)

1

CREDIT SUISSE

136

(230)

8

18View entire presentation