UBS Fixed Income Presentation Deck

Balance sheet

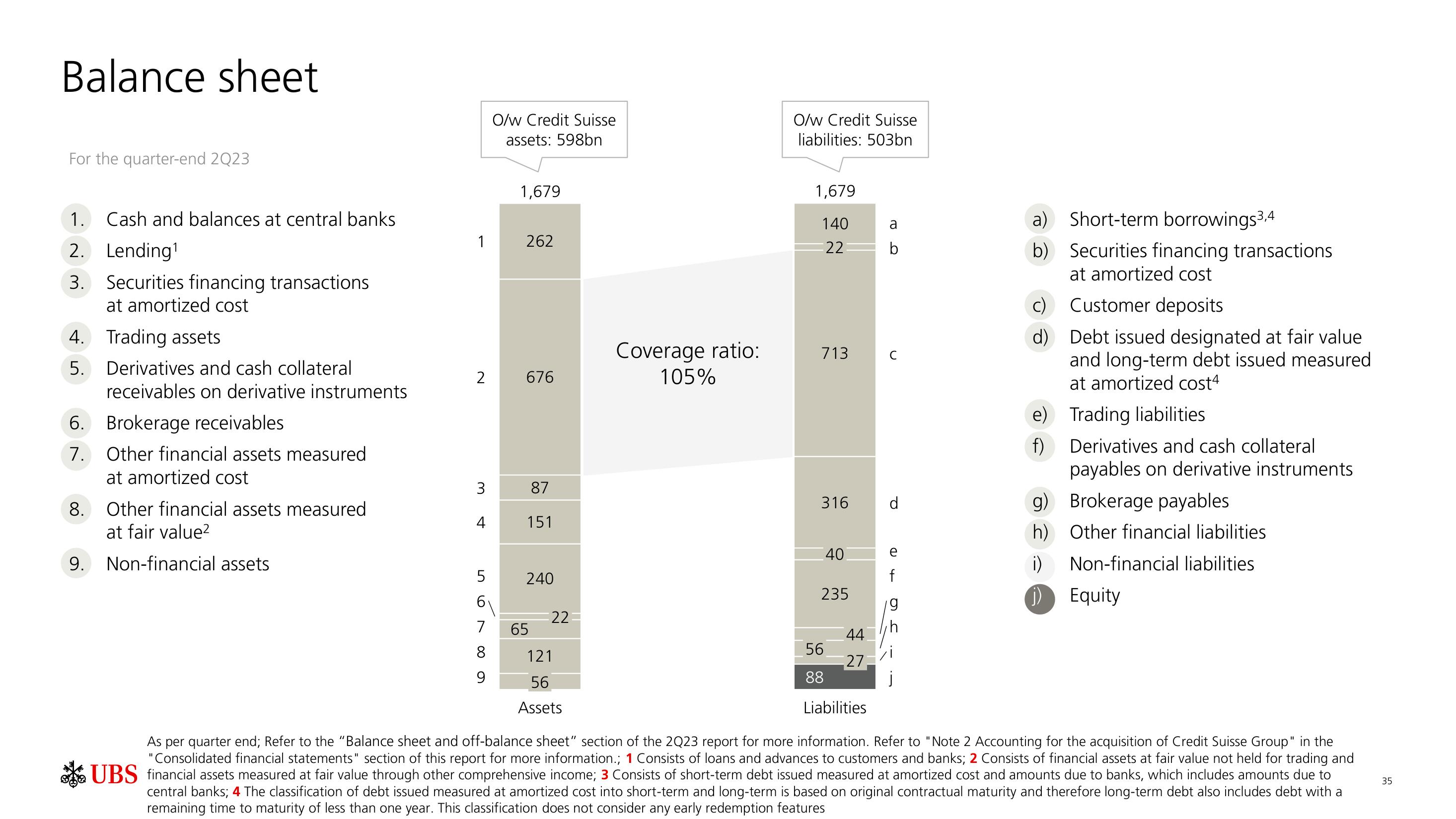

For the quarter-end 2Q23

1. Cash and balances at central banks

2. Lending¹

Securities financing transactions

at amortized cost

4. Trading assets

5. Derivatives and cash collateral

6.

7.

receivables on derivative instruments

Brokerage receivables

Other financial assets measured

at amortized cost

8. Other financial assets measured

at fair value²

9. Non-financial assets

1

2

3

4

6

7

8

O/w Credit Suisse

assets: 598bn

1,679

262

676

87

151

240

65

22

Coverage ratio:

105%

121

56

Assets

O/w Credit Suisse

liabilities: 503bn

1,679

140

22

713

316

40

235

44

27,

a

с

d

e

f

a) Short-term borrowings3,4

b)

Securities financing transactions

at amortized cost

Customer deposits

d) Debt issued designated at fair value

and long-term debt issued measured.

at amortized cost4

e)

f)

Trading liabilities

Derivatives and cash collateral

payables on derivative instruments

Brokerage payables

g)

h) Other financial liabilities

i) Non-financial liabilities

j)

Equity

56

88

Liabilities

As per quarter end; Refer to the "Balance sheet and off-balance sheet" section of the 2Q23 report for more information. Refer to "Note 2 Accounting for the acquisition of Credit Suisse Group" in the

"Consolidated financial statements" section of this report for more information.; 1 Consists of loans and advances to customers and banks; 2 Consists of financial assets at fair value not held for trading and

UBS financial assets measured at fair value through other comprehensive income; 3 Consists of short-term debt issued measured at amortized cost and amounts due to banks, which includes amounts due to

central banks; 4 The classification of debt issued measured at amortized cost into short-term and long-term is based on original contractual maturity and therefore long-term debt also includes debt with a

remaining time to maturity of less than one year. This classification does not consider any early redemption features

35View entire presentation