Skillz SPAC Presentation Deck

PROPOSED TRANSACTION SUMMARY

skillz

Flying Eagle Acquisition Corp. ("FEAC") is a publicly listed special purpose

acquisition company with over $690 million of cash in trust

FEAC has agreed to combine with Skillz based on a $3.5 billion pre-money

equity value

■ Historical annual revenue growth of over 100%¹

. Andrew Paradise will hold approximately 18% of the equity post-transaction

. 24-Month Lockup: Substantially all shares held by existing Skillz

stockholders and the Founder group subject to a 24-month lock-up period

with limited 1.5m share quarterly releases per stockholder commencing

180 days post-closing

Skillz will maintain, post-closing, a dual class stockholder structure with

super voting rights for Andrew Paradise at a ratio of 20:1

. After giving effect to the transaction, the company will have approximately

$250 million of unrestricted cash with public equity currency to accelerate

growth

. Total merger consideration to Skillz stockholders of $3.5 billion, which is

expected to be comprised of $609 million in cash consideration (assuming

no redemptions) and the remainder in stock issued by FEAC

. Andrew Paradise and Casey Chafkin, founders of Skillz, have indicated they

currently intend to receive substantially all of their merger consideration in

the form of stock

skillz

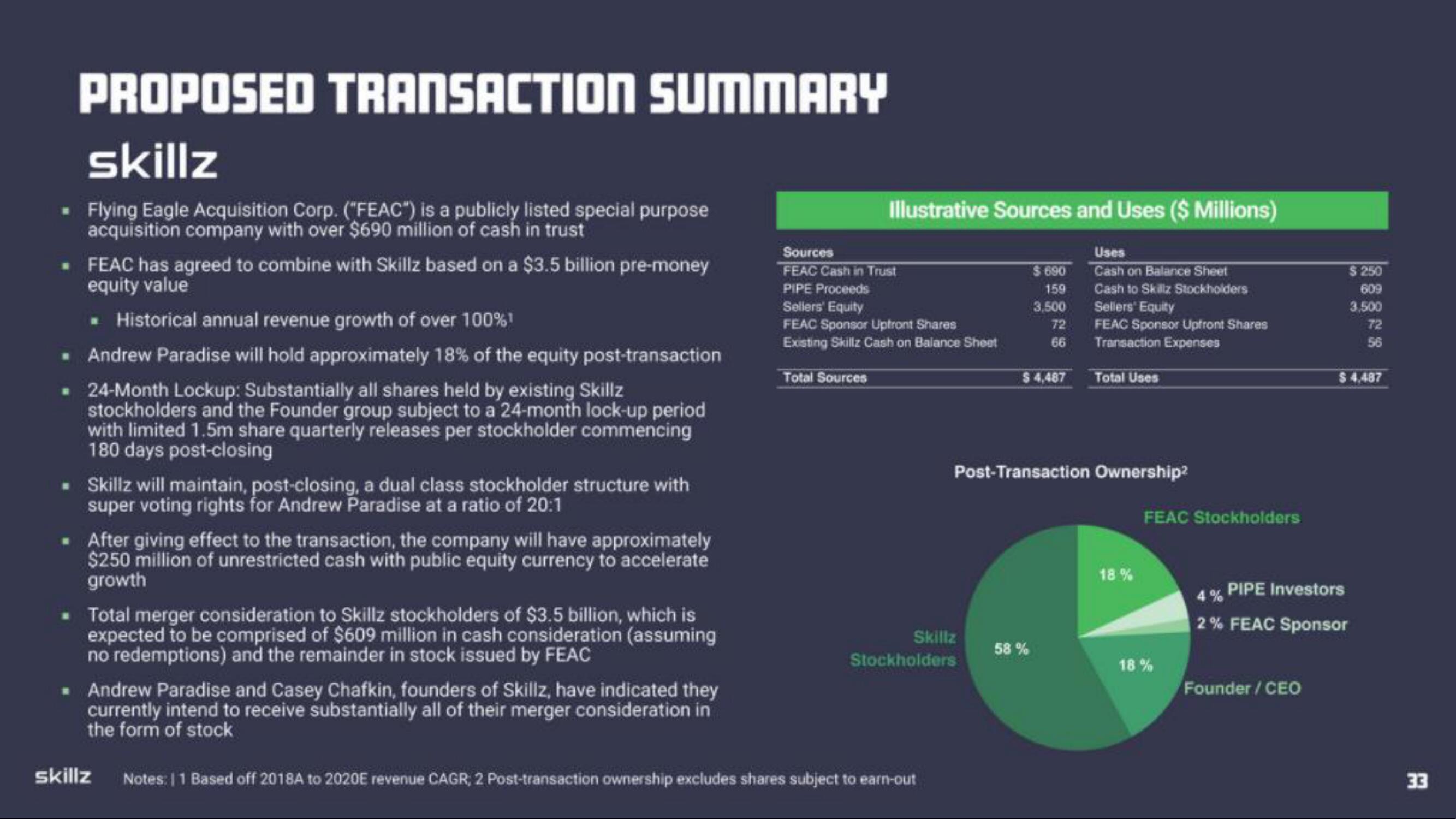

Illustrative Sources and Uses ($ Millions)

Sources

FEAC Cash in Trust

PIPE Proceeds

Sellers Equity

FEAC Sponsor Uptront Shares

Existing Skillz Cash on Balance Sheet

Total Sources

Skillz

Stockholders

Notes: 11 Based off 2018A to 2020E revenue CAGR, 2 Post-transaction ownership excludes shares subject to earn-out

$ 690

159

3,500

72

66

$ 4,487

58%

Uses

Cash on Balance Sheet

Cash to Skillz Stockholders

Sellers' Equity

FEAC Sponsor Upfront Shares

Transaction Expenses

Post-Transaction Ownership²

Total Uses

18 %

FEAC Stockholders

18%

$ 250

609

3,500

Founder/CEO

4% PIPE Investors

2% FEAC Sponsor

72

56

$4,487

33View entire presentation