Ratification of PwC as Auditor

MANAGEMENT PROPOSALS

For additional detail, see 2015

Proxy Statement pages 30-68

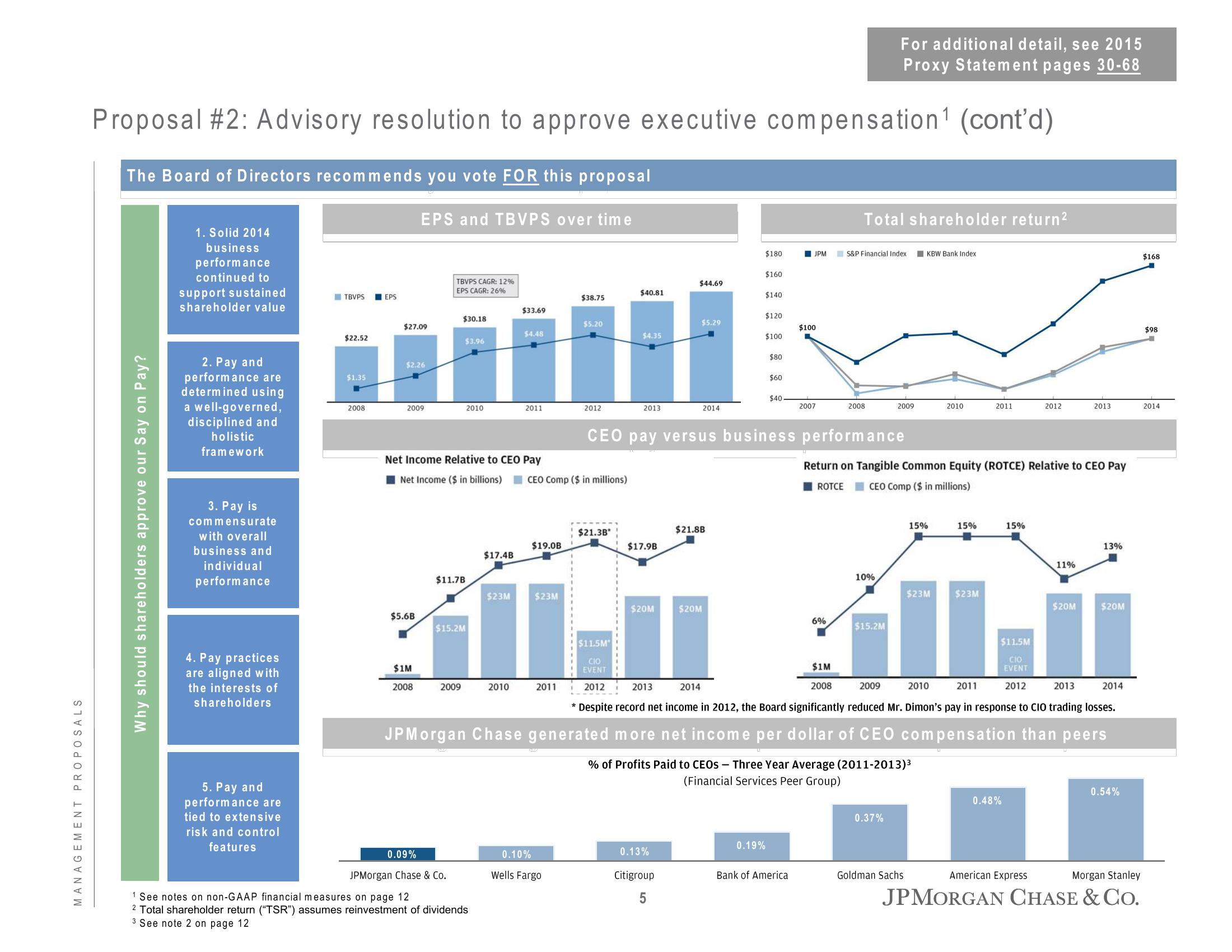

Proposal #2: Advisory resolution to approve executive compensation¹ (cont'd)

The Board of Directors recommends you vote FOR this proposal

Why should shareholders approve our Say on Pay?

1. Solid 2014

business

performance

continued to

support sustained

shareholder value

2. Pay and

performance are

determined using

a well-governed,

disciplined and

holistic

framework

3. Pay is

commensurate

with overall

business and

individual

performance

4. Pay practices

are aligned with

the interests of

shareholders

5. Pay and

performance are

tied to extensive

risk and control

features

TBVPS

$22.52

$1.35

2008

EPS

$27.09

EPS and TBVPS over time

$2.26

2009

$5.6B

$1M

2008

TBVPS CAGR: 12%

EPS CAGR: 26%

$30.18

$11.7B

$3.96

Net Income Relative to CEO Pay

Net Income ($ in billions)

$15.2M

2009

0.09%

JPMorgan Chase & Co.

2010

$17.4B

1 See notes on non-GAAP financial measures on page 12

2 Total shareholder return ("TSR") assumes reinvestment of dividends

3 See note 2 on page 12

$23M

$33.69

$4.48

2010

2011

$19.0B

0.10%

$23M

CEO Comp ($ in millions)

$38.75

2011

$5.20

Wells Fargo

2012

$21.3B

$40.81

$11.5M

CIO

EVENT

2012

$4.35

2013

$17.9B

$20M

$44.69

2013

0.13%

Citigroup

5

$5.29

$20M

2014

$21.8B

2014

$180

$160

$140

$120

$100

CEO pay versus business performance

0.19%

$80

$60

$40

JPM

$100

2007

Bank of America

Total shareholder return²

S&P Financial Index

6%

2008

10%

2009

$15.2M

Return on Tangible Common Equity (ROTCE) Relative to CEO Pay

ROTCE CEO Comp ($ in millions)

% of Profits Paid to CEOs - Three Year Average (2011-2013)³

(Financial Services Peer Group)

0.37%

KBW Bank Index

$1M

2008

2009

2011

2013

* Despite record net income in 2012, the Board significantly reduced Mr. Dimon's pay in response to CIO trading losses.

JPMorgan Chase generated more net income per dollar of CEO compensation than peers

15%

Goldman Sachs

$23M

2010

2010

15%

2011

$23M

15%

$11.5M

CIO

EVENT

2012

0.48%

2012

American Express

11%

2013

$20M

13%

$20M

2014

0.54%

Morgan Stanley

JPMORGAN CHASE & Co.

$168

$98

2014View entire presentation