FlexJet SPAC Presentation Deck

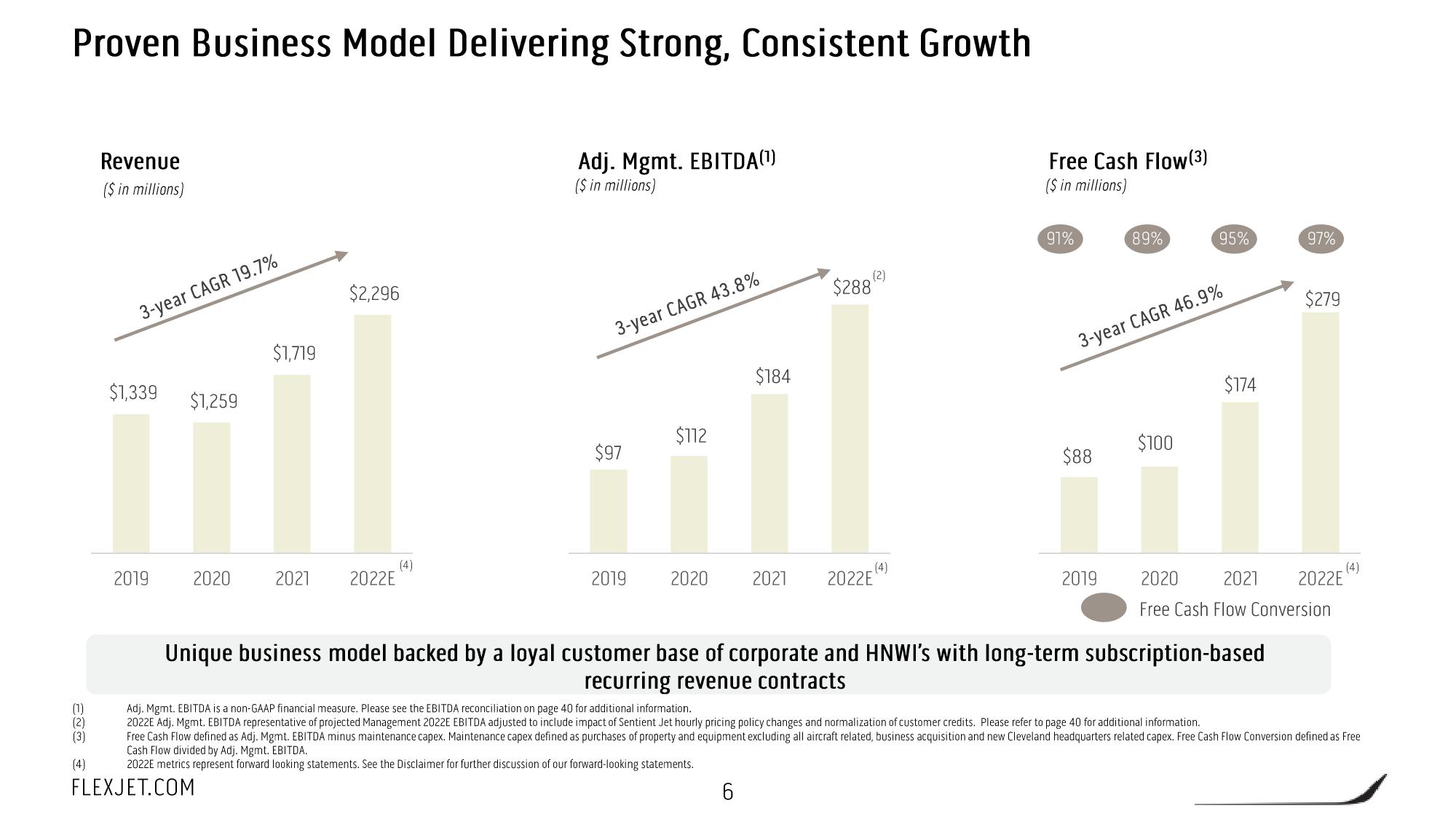

Proven Business Model Delivering Strong, Consistent Growth

(1)

(3)

(4)

Revenue

($ in millions)

3-year CAGR 19.7%

$1,339

2019

$1,259

2020

$1,719

$2,296

2021 2022E

(4)

Adj. Mgmt. EBITDA(¹)

($ in millions)

3-year CAGR 43.8%

$97

2019

$112

2020

$184

$288

6

(2)

2021 2022E

(4)

Free Cash Flow (3)

($ in millions)

91%

$88

89%

3-year CAGR 46.9%

2019

95%

$100

$174

Unique business model backed by a loyal customer base of corporate and HNWI's with long-term subscription-based

recurring revenue contracts

97%

$279

2020

2021 2022E

Free Cash Flow Conversion

Adj. Mgmt. EBITDA is a non-GAAP financial measure. Please see the EBITDA reconciliation on page 40 for additional information.

2022E Adj. Mgmt. EBITDA representative of projected Management 2022E EBITDA adjusted to include impact of Sentient Jet hourly pricing policy changes and normalization of customer credits. Please refer to page 40 for additional information.

Free Cash Flow defined as Adj. Mgmt. EBITDA minus maintenance capex. Maintenance capex defined as purchases of property and equipment excluding all aircraft related, business acquisition and new Cleveland headquarters related capex. Free Cash Flow Conversion defined as Free

Cash Flow divided by Adj. Mgmt. EBITDA.

2022E metrics represent forward looking statements. See the Disclaimer for further discussion of our forward-looking statements.

FLEXJET.COMView entire presentation