Bausch Health Companies Investor Conference Presentation Deck

Granite Trust Transaction Continued

15

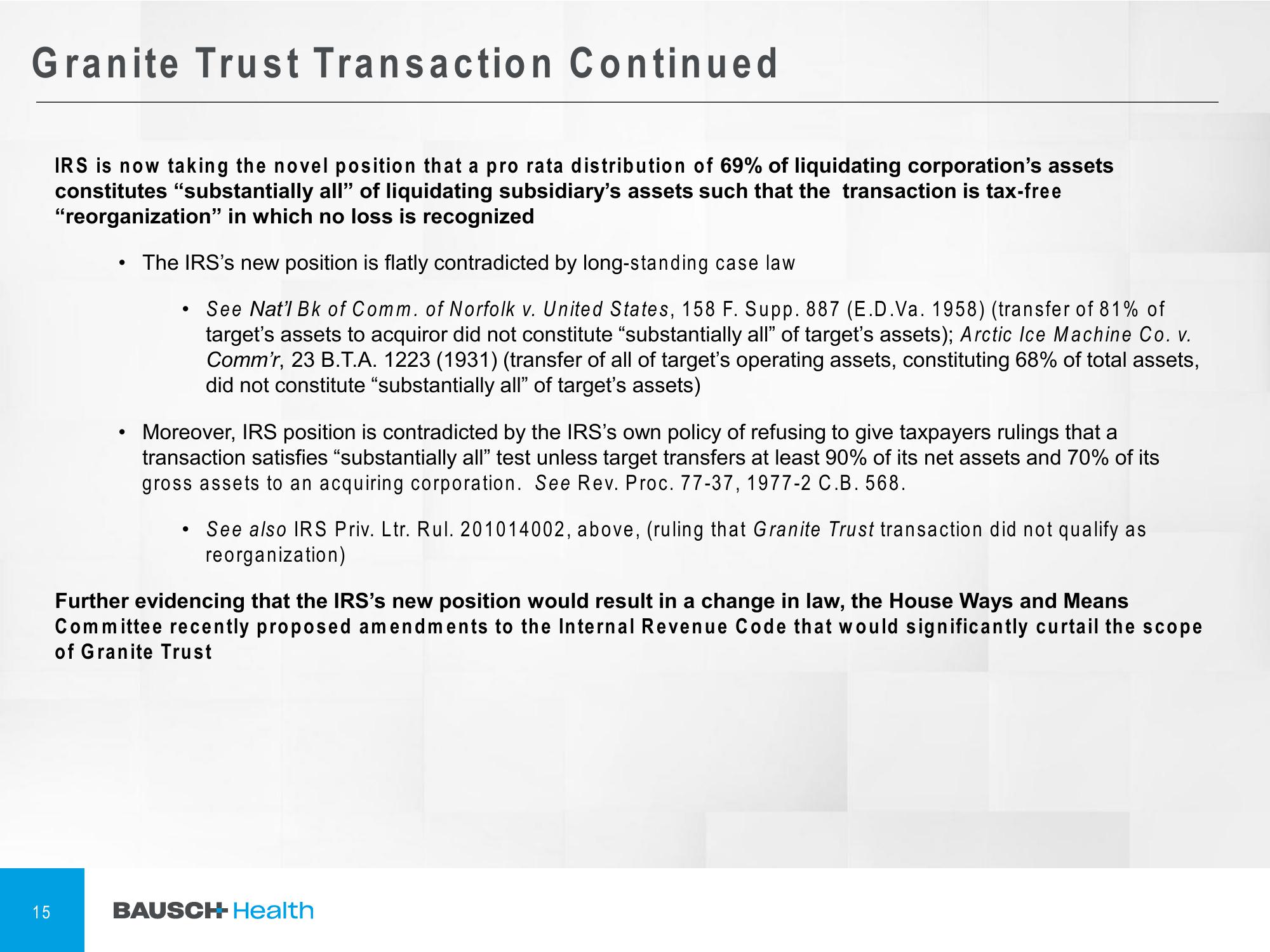

IRS is now taking the novel position that a pro rata distribution of 69% of liquidating corporation's assets

constitutes "substantially all" of liquidating subsidiary's assets such that the transaction is tax-free

"reorganization” in which no loss is recognized

The IRS's new position is flatly contradicted by long-standing case law

See Nat'l Bk of Comm. of Norfolk v. United States, 158 F. Supp. 887 (E.D.Va. 1958) (transfer of 81% of

target's assets to acquiror did not constitute "substantially all" of target's assets); Arctic Ice Machine Co. v.

Comm'r, 23 B.T.A. 1223 (1931) (transfer of all of target's operating assets, constituting 68% of total assets,

did not constitute "substantially all" of target's assets)

●

●

●

Moreover, IRS position is contradicted by the IRS's own policy of refusing to give taxpayers rulings that a

transaction satisfies “substantially all" test unless target transfers at least 90% of its net assets and 70% of its

gross assets to an acquiring corporation. See Rev. Proc. 77-37, 1977-2 C.B. 568.

●

See also IRS Priv. Ltr. Rul. 201014002, above, (ruling that Granite Trust transaction did not qualify as

reorganization)

Further evidencing that the IRS's new position would result in a change in law, the House Ways and Means

Committee recently proposed amendments to the Internal Revenue Code that would significantly curtail the scope

of Granite Trust

BAUSCH- HealthView entire presentation