Allwyn SPAC Presentation Deck

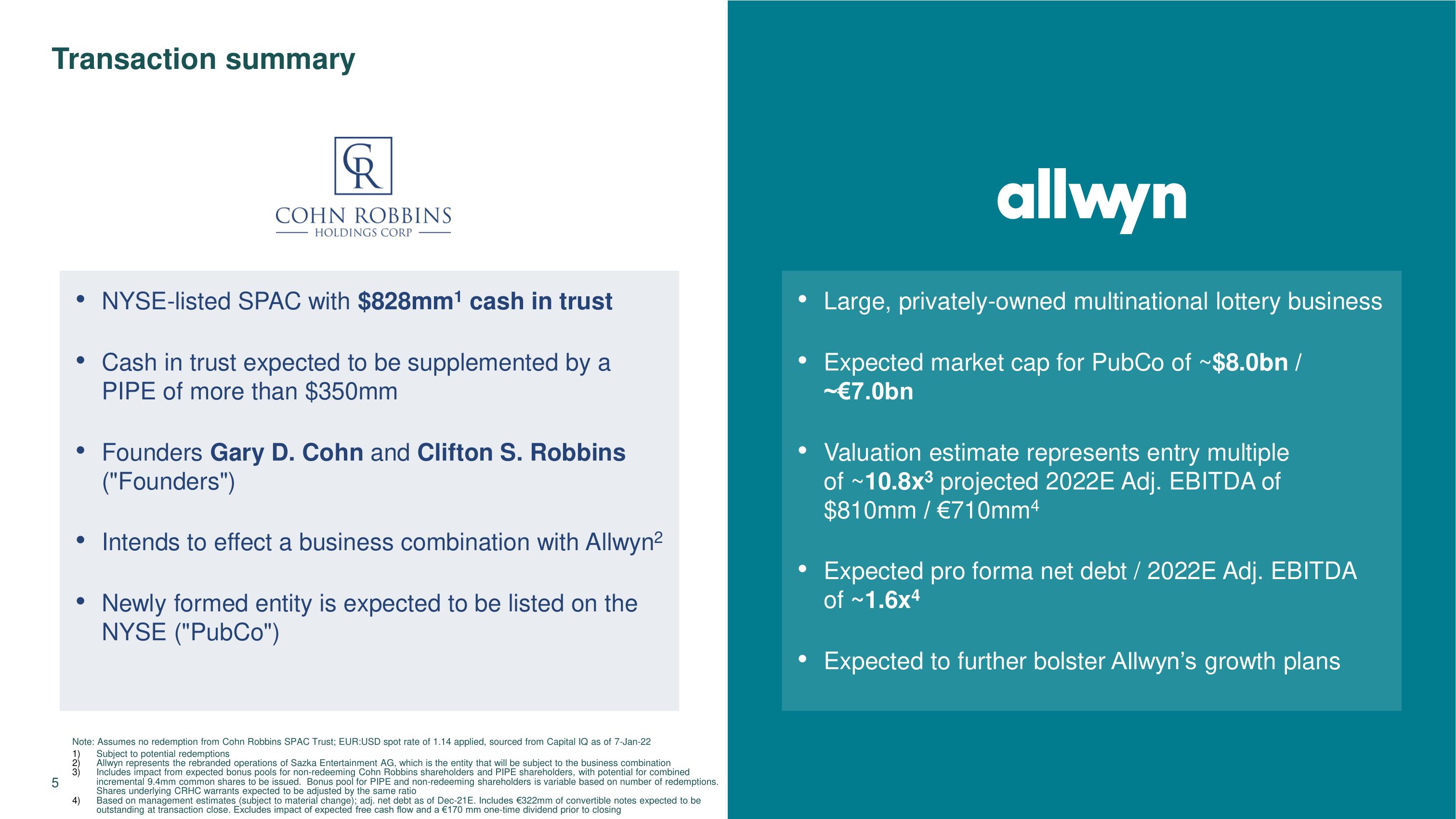

Transaction summary

5

• NYSE-listed SPAC with $828mm¹ cash in trust

Q

• Cash in trust expected to be supplemented by a

PIPE of more than $350mm

●

COHN ROBBINS

HOLDINGS CORP

• Founders Gary D. Cohn and Clifton S. Robbins

("Founders")

• Intends to effect a business combination with Allwyn²

Newly formed entity is expected to be listed on the

NYSE ("PubCo")

1)

2)

3)

Note: Assumes no redemption from Cohn Robbins SPAC Trust; EUR:USD spot rate of 1.14 applied, sourced from Capital IQ as of 7-Jan-22

Subject to potential redemptions

Allwyn represents the rebranded operations of Sazka Entertainment AG, which is the entity that will be subject to the business combination

Includes impact from expected bonus pools for non-redeeming Cohn Robbins shareholders and PIPE shareholders, with potential for combined

incremental 9.4mm common shares to be issued. Bonus pool for PIPE and non-redeeming shareholders is variable based on number of redemptions.

Shares underlying CRHC warrants expected to be adjusted by the same ratio

Based on management estimates_(subject to material change); adj. net debt as of Dec-21E. Includes €322mm of convertible notes expected to be

outstanding at transaction close. Excludes impact of expected free cash flow and a €170 mm one-time dividend prior to closing

4)

allwyn

Large, privately-owned multinational lottery business

Expected market cap for PubCo of ~$8.0bn /

~€7.0bn

Valuation estimate represents entry multiple

of ~10.8x³ projected 2022E Adj. EBITDA of

$810mm / €710mm4

Expected pro forma net debt / 2022E Adj. EBITDA

of ~1.6x4

Expected to further bolster Allwyn's growth plansView entire presentation