Commercial Metals Company Investor Presentation Deck

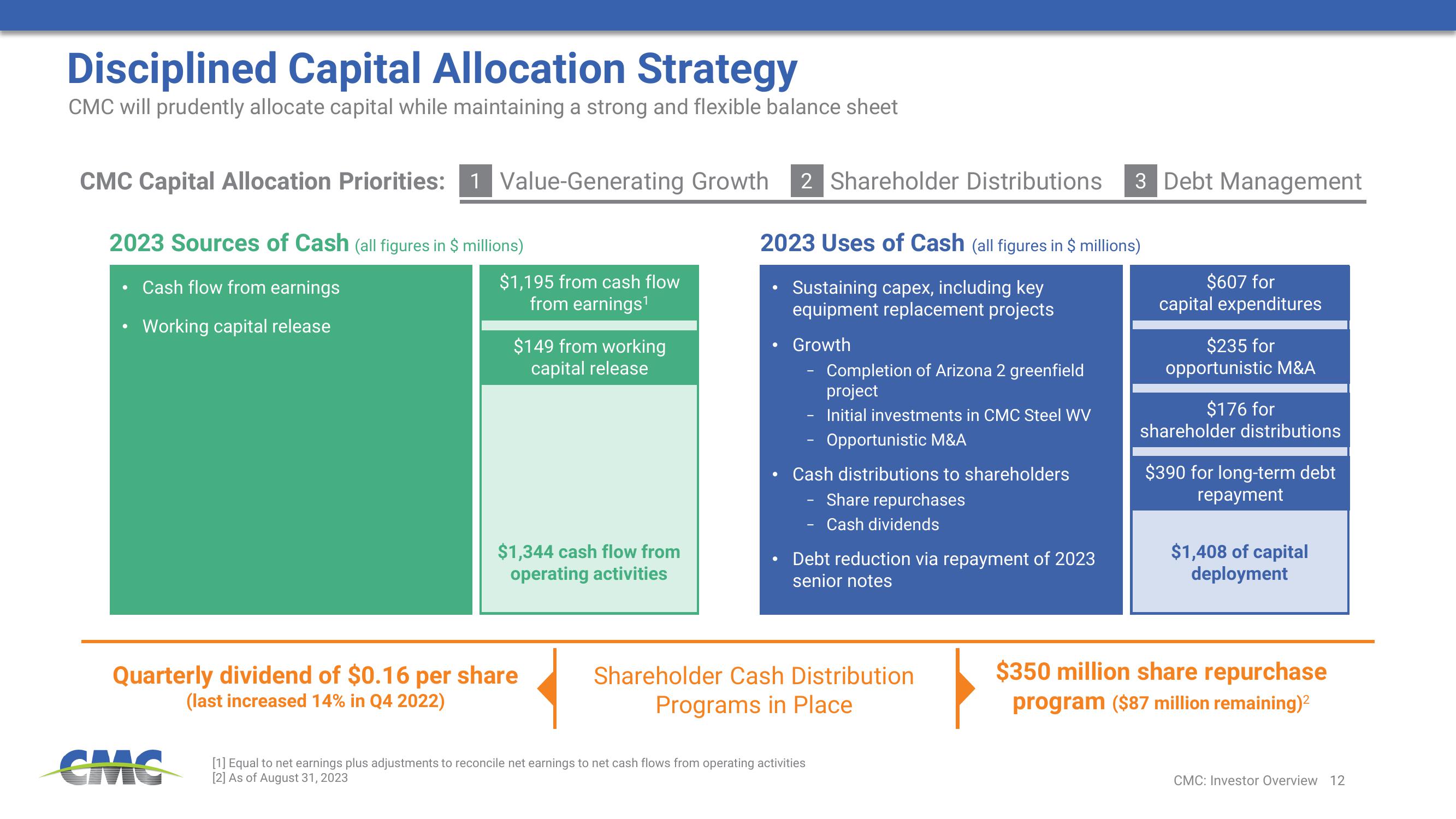

Disciplined Capital Allocation Strategy

CMC will prudently allocate capital while maintaining a strong and flexible balance sheet

CMC Capital Allocation Priorities: 1 Value-Generating Growth 2 Shareholder Distributions 3 Debt Management

2023 Sources of Cash (all figures in $ millions)

2023 Uses of Cash (all figures in $ millions)

Cash flow from earnings

Sustaining capex, including key

equipment replacement projects

• Working capital release

Growth

●

$1,195 from cash flow

from earnings¹

$149 from working

capital release

$1,344 cash flow from

operating activities

Quarterly dividend of $0.16 per share

(last increased 14% in Q4 2022)

●

Completion of Arizona 2 greenfield

project

- Initial investments in CMC Steel WV

Opportunistic M&A

Cash distributions to shareholders

Share repurchases

Cash dividends

Debt reduction via repayment of 2023

senior notes

Shareholder Cash Distribution

Programs in Place

[1] Equal to net earnings plus adjustments to reconcile net earnings to net cash flows from operating activities

[2] As of August 31, 2023

$607 for

capital expenditures

$235 for

opportunistic M&A

$176 for

shareholder distributions

$390 for long-term debt

repayment

$1,408 of capital

deployment

$350 million share repurchase

program ($87 million remaining)²

CMC: Investor Overview 12View entire presentation