Active and Passive Investing

What Are Good/Bad Times for Active Managers?

Common structural tilts can lead to head- or tailwinds in measured alpha

Recent years have seen historically low and often negative active returns for delegated managers

• Is this just a random bad spell, a sign of ever-tougher competition, or can some environmental features explain this underperformance?

Skill-based argument: Low dispersion across stocks and low market volatility may have given an abnormally poor opportunity set

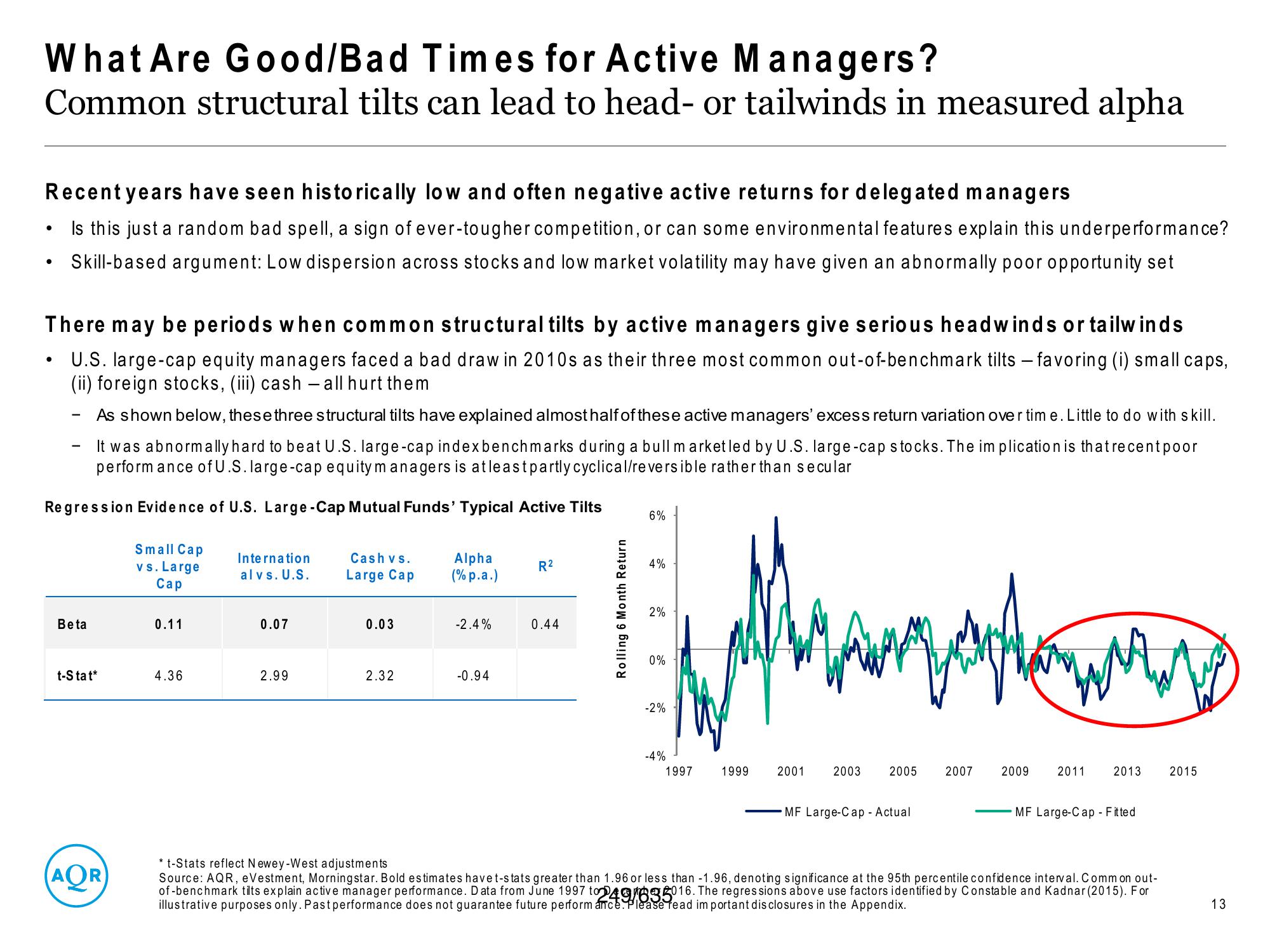

There may be periods when common structural tilts by active managers give serious headwinds or tailwinds

U.S. large-cap equity managers faced a bad draw in 2010s as their three most common out-of-benchmark tilts - favoring (i) small caps,

(ii) foreign stocks, (iii) cash - all hurt them

●

As shown below, these three structural tilts have explained almost half of these active managers' excess return variation over time. Little to do with skill.

It was abnormally hard to beat U.S. large-cap indexbenchmarks during a bull market led by U.S. large-cap stocks. The implication is that recentpoor

performance of U.S.large-cap equity managers is at least partly cyclical/reversible rather than secular

Regression Evidence of U.S. Large-Cap Mutual Funds' Typical Active Tilts

Beta

t-Stat*

AQR

Small Cap

vs. Large

Cap

0.11

4.36

Internation

al vs. U.S.

0.07

2.99

Cash vs.

Large Cap

0.03

2.32

Alpha

(% p.a.)

-2.4%

-0.94

R²

0.44

Rolling 6 Month Return

6%

4%

2%

0%

-2%

-4%

1997

Минзорати

1999

2001

2003

2005

MF Large-Cap - Actual

2007

2009

2011

2013

MF Large-Cap-Fitted

*t-Stats reflect Newey-West adjustments

Source: AQR, eVestment, Morningstar. Bold estimates have t-stats greater than 1.96 or less than -1.96, denoting significance at the 95th percentile confidence interval. Common out-

of-benchmark tilts explain active manager performance. Data from June 1997 to 4935016. The regressions above use factors identified by Constable and Kadnar (2015). For

illustrative purposes only. Past performance does not guarantee future performance. Please read important disclosures in the Appendix.

2015

13View entire presentation