Credit Suisse Investment Banking Pitch Book

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

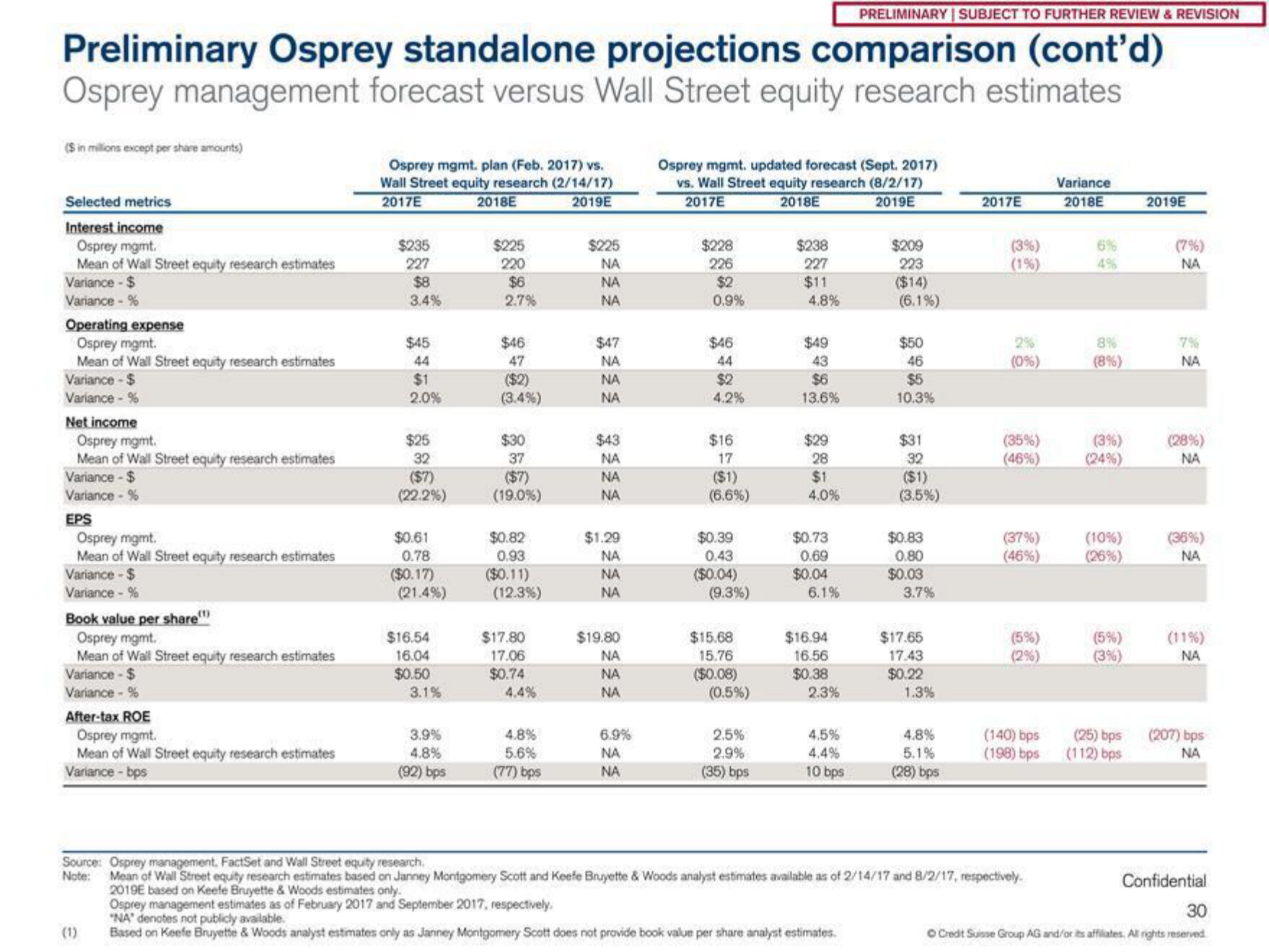

Preliminary Osprey standalone projections comparison (cont'd)

Osprey management forecast versus Wall Street equity research estimates

(Sin millions except per share amounts)

Selected metrics

Interest income

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance - $

Variance - %

Operating expense

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance-$

Variance - %

Net income

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance - $

Variance - %

EPS

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance-$

Variance - %

Book value per share

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance - $

Variance - %

After-tax ROE

Osprey mgmt.

Mean of Wall Street equity research estimates

Variance-bps

Osprey mgmt. plan (Feb. 2017) vs.

Wall Street equity research (2/14/17)

2017E

2018E

2019E

(1)

$235

227

$8

3.4%

$45

44

$1

2.0%

$25

32

($7)

(22.2%)

$0.61

0.78

($0.17)

(21.4%)

$16.54

16.04

$0.50

3.1%

3.9%

4.8%

(92) bps

$225

220

$6

2.7%

$46

47

($2)

(3.4%)

$30

37

($7)

(19.0%)

$0.82

0.93

($0.11)

(12.3%)

$17.80

17.06

$0.74

4.4%

4.8%

5.6%

(77) bps

$225

NA

ΝΑ

ΝΑ

$47

NA

NA

NA

$43

NA

NA

ΝΑ

$1.29

ΝΑ

NA

ΝΑ

$19.80

NA

ΝΑ

NA

6.9%

NA

ΝΑ

Osprey mgmt. updated forecast (Sept. 2017)

vs. Wall Street equity research (8/2/17)

2017E

2018E

2019E

$228

226

$2

0.9%

$46

44

$2

4.2%

$16

17

($1)

(6.6%)

$0.39

0.43

($0.04)

(9.3%)

$15.68

15.76

($0.08)

(0.5%)

2.5%

2.9%

(35) bps

$238

227

$11

4.8%

$49

43

$6

13.6%

$29

28

$1

4.0%

$0.73

0.69

$0.04

6.1%

$16.94

16.56

$0.38

2.3%

4.5%

4.4%

10 bps

$209

223

($14)

"NA" denotes not publicly available.

Based on Keefe Bruyette & Woods analyst estimates only as Janney Montgomery Scott does not provide book value per share analyst estimates.

(6.1%)

$50

46

$5

10.3%

$31

32

($1)

(3.5%)

$0.83

0.80

$0.03

3.7%

$17.65

17.43

$0.22

1.3%

4.8%

5.1%

(28) bps

2017E

(3%)

(1%)

2%

(0%)

(35%)

(46%)

(37%)

(46%)

(5%)

(2%)

Source: Osprey management, FactSet and Wall Street equity research.

Note: Mean of Wall Street equity research estimates based on Janney Montgomery Scott and Keefe Bruyette & Woods analyst estimates available as of 2/14/17 and 8/2/17, respectively.

2019E based on Keele Bruyette & Woods estimates only.

Osprey management estimates as of February 2017 and September 2017, respectively,

(140) bps

(198) bps

Variance

2018E

6%

4%

8%

(8%)

(3%)

(24%)

(10%)

(26%)

(5%)

(3%)

(25) bps

(112) bps

2019E

NA

7%

NA

(28%)

NA

(35%)

ΝΑ

(11%)

NA

(207) bps

NA

Confidential

30

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation