FlexJet SPAC Presentation Deck

Transaction Summary

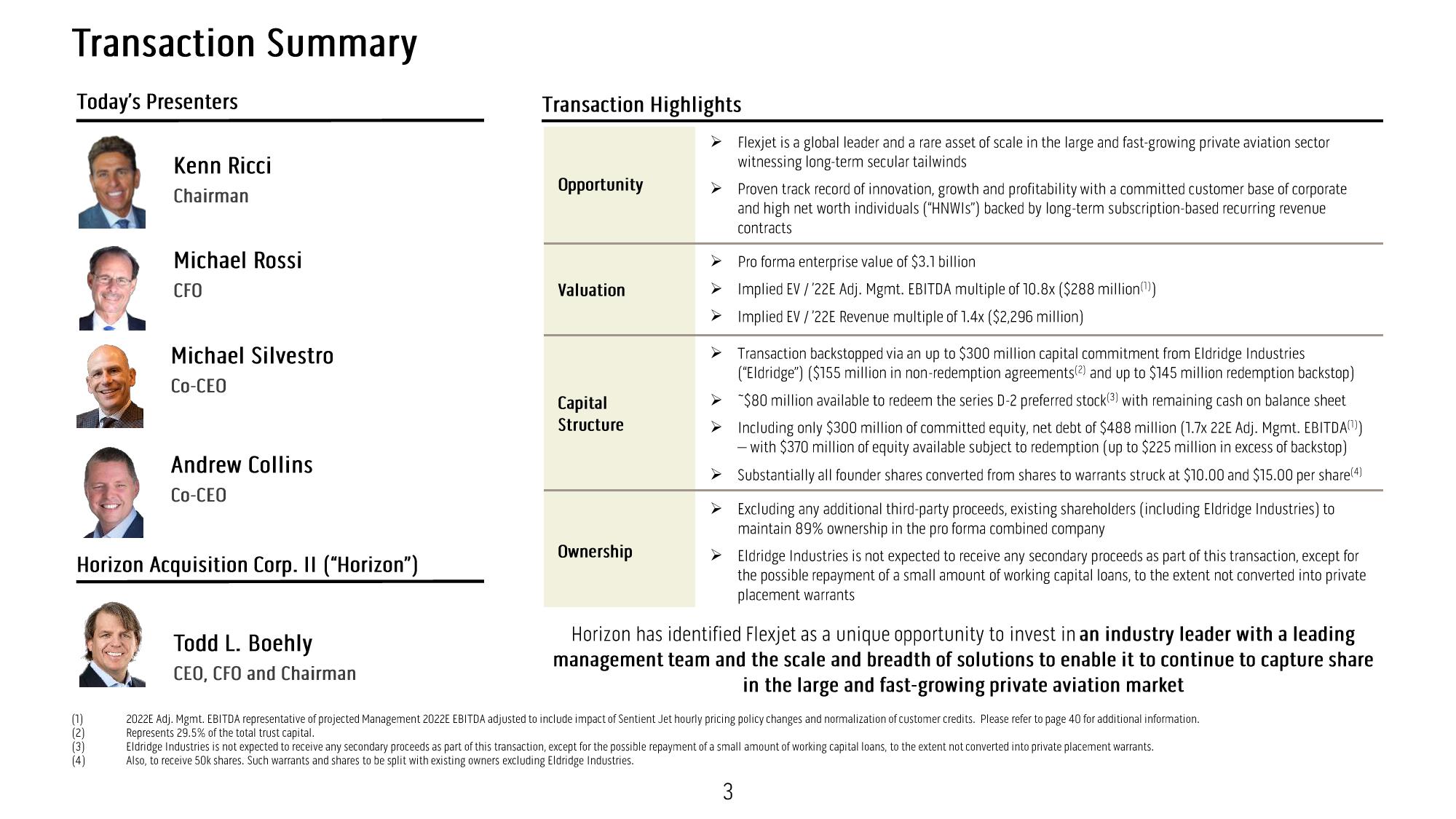

Today's Presenters

(1)

(2)

Kenn Ricci

Chairman

(3)

(4)

Michael Rossi

CFO

Michael Silvestro

Co-CEO

Horizon Acquisition Corp. II ("Horizon")

Andrew Collins

Co-CEO

Todd L. Boehly

CEO, CFO and Chairman

Transaction Highlights

Opportunity

Valuation

Capital

Structure

Ownership

Flexjet is a global leader and a rare asset of scale in the large and fast-growing private aviation sector

witnessing long-term secular tailwinds

Proven track record of innovation, growth and profitability with a committed customer base of corporate

and high net worth individuals ("HNWIS") backed by long-term subscription-based recurring revenue

contracts

Pro forma enterprise value of $3.1 billion

> Implied EV /'22E Adj. Mgmt. EBITDA multiple of 10.8x ($288 million(¹)

> Implied EV /'22E Revenue multiple of 1.4x ($2,296 million)

Transaction backstopped via an up to $300 million capital commitment from Eldridge Industries

("Eldridge") ($155 million in non-redemption agreements(2) and up to $145 million redemption backstop)

$80 million available to redeem the series D-2 preferred stock(3) with remaining cash on balance sheet

▸ Including only $300 million of committed equity, net debt of $488 million (1.7x 22E Adj. Mgmt. EBITDA(¹)

- with $370 million of equity available subject to redemption (up to $225 million in excess of backstop)

Substantially all founder shares converted from shares to warrants struck at $10.00 and $15.00 per share(4)

Excluding any additional third-party proceeds, existing shareholders (including Eldridge Industries) to

maintain 89% ownership in the pro forma combined company

▸ Eldridge Industries is not expected to receive any secondary proceeds as part of this transaction, except for

the possible repayment of a small amount of working capital loans, to the extent not converted into private

placement warrants

Horizon has identified Flexjet as a unique opportunity to invest in an industry leader with a leading

management team and the scale and breadth of solutions to enable it to continue to capture share

in the large and fast-growing private aviation market

2022E Adj. Mgmt. EBITDA representative of projected Management 2022E EBITDA adjusted to include impact of Sentient Jet hourly pricing policy changes and normalization of customer credits. Please refer to page 40 for additional information.

Represents 29.5% of the total trust capital.

Eldridge Industries is not expected to receive any secondary proceeds as part of this transaction, except for the possible repayment of a small amount of working capital loans, to the extent not converted into private placement warrants.

Also, to receive 50k shares. Such warrants and shares to be split with existing owners excluding Eldridge Industries.

3View entire presentation