Melrose Results Presentation Deck

Aerospace results: overview

Melrose

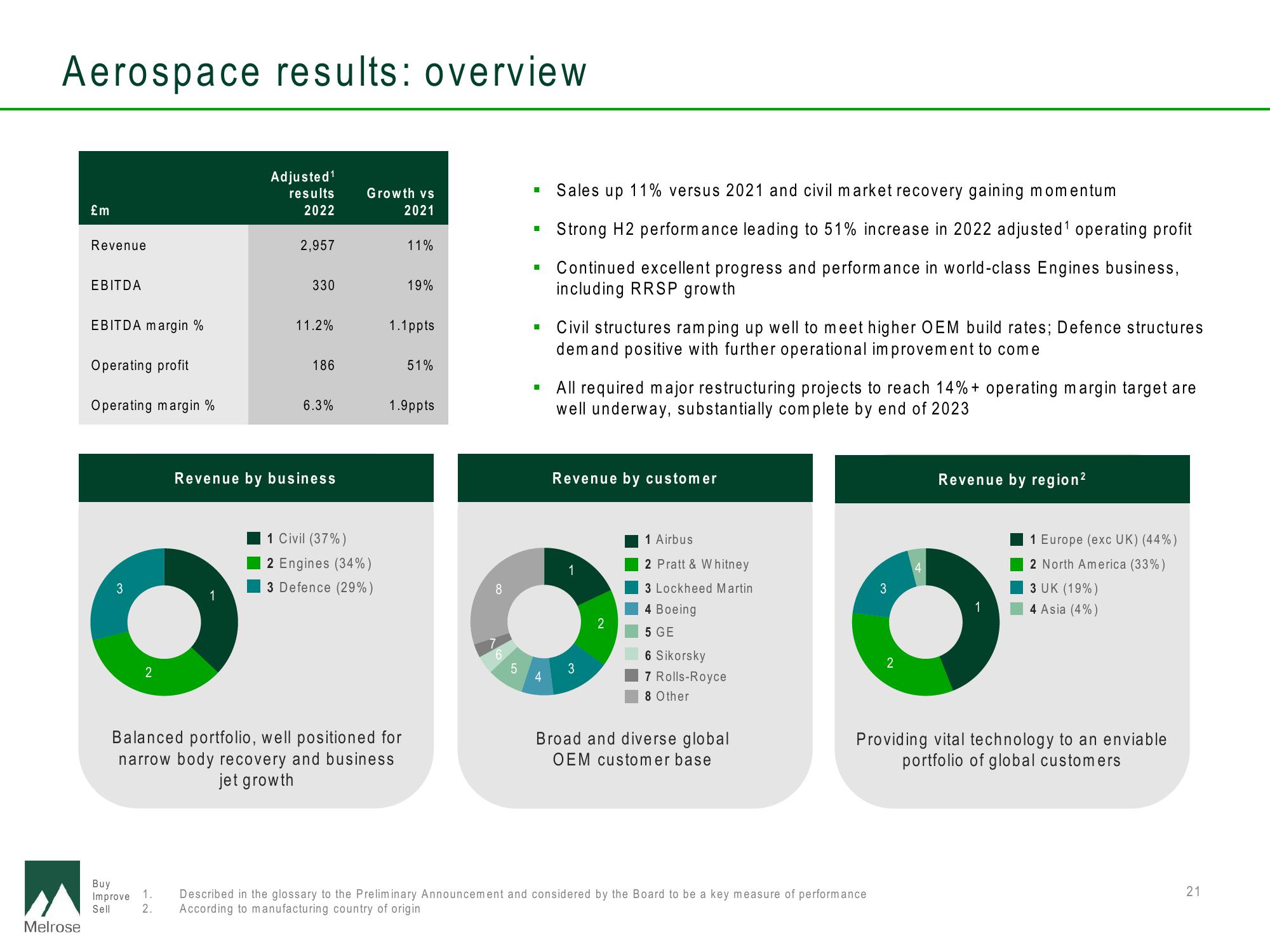

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

3

2

Buy

Improve. 1.

Sell

2.

Adjusted ¹

results

2022

1

2,957

330

11.2%

186

6.3%

Revenue by business

Growth vs

2021

1 Civil (37%)

2 Engines (34%)

3 Defence (29%)

11%

Balanced portfolio, well positioned for

narrow body recovery and business

jet growth

19%

1.1ppts

51%

1.9ppts

8

·

I

Sales up 11% versus 2021 and civil market recovery gaining momentum

Strong H2 performance leading to 51% increase in 2022 adjusted¹ operating profit

Continued excellent progress and performance in world-class Engines business,

including RRSP growth

Civil structures ramping up well to meet higher OEM build rates; Defence structures

demand positive with further operational improvement to come

All required major restructuring projects to reach 14% + operating margin target are

well underway, substantially complete by end of 2023

Revenue by customer

1

3

2

1 Airbus

2 Pratt & Whitney

3 Lockheed Martin

4 Boeing

5 GE

6 Sikorsky

7 Rolls-Royce

8 Other

Broad and diverse global

OEM customer base

3

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

According to manufacturing country of origin

2

4

Revenue by region²

1

1 Europe (exc UK) (44%)

2 North America (33%)

3 UK (19%)

4 Asia (4%)

Providing vital technology to an enviable

portfolio of global customers

21View entire presentation