jetBlue Results Presentation Deck

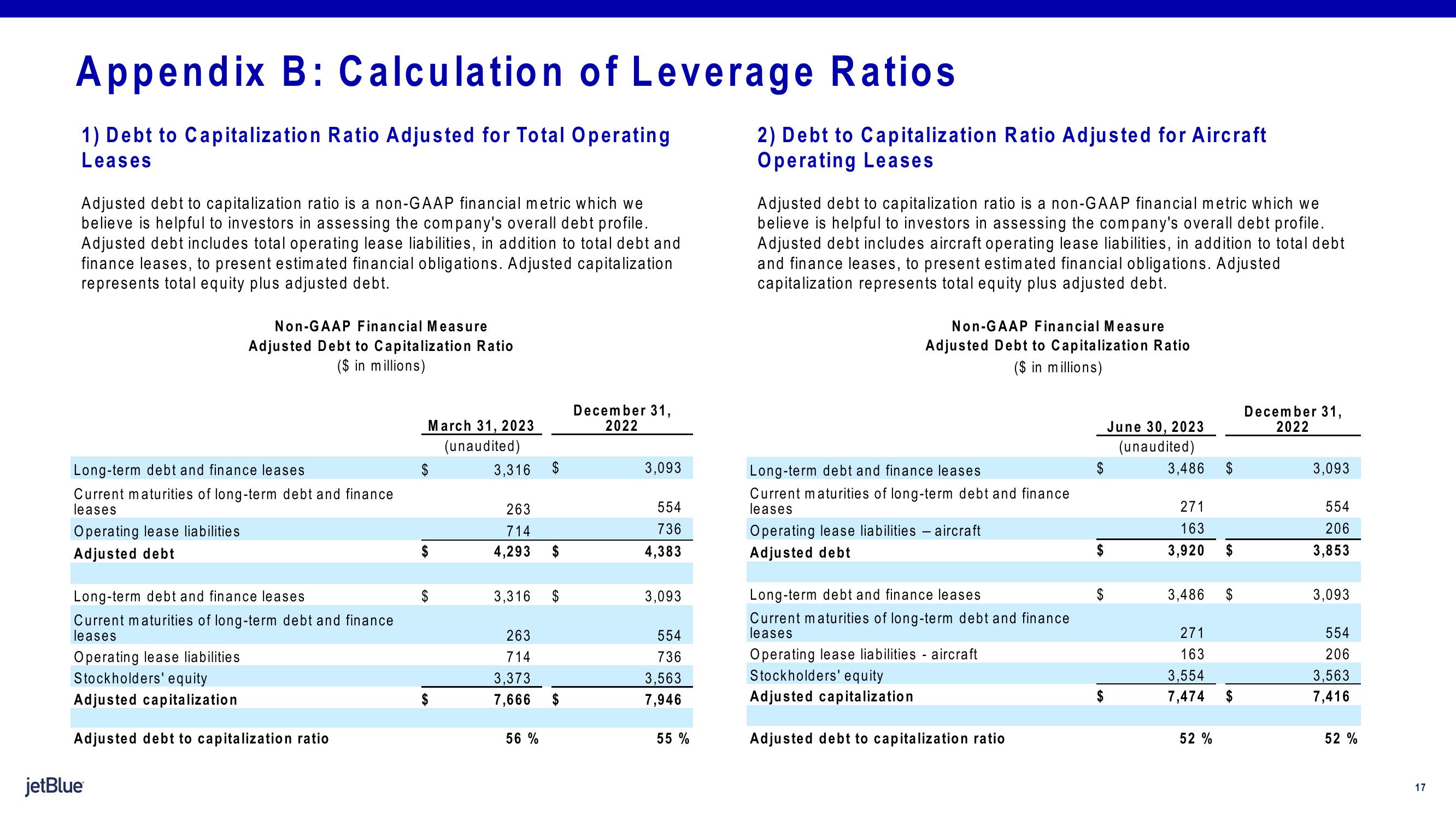

Appendix B: Calculation of Leverage Ratios

1) Debt to Capitalization Ratio Adjusted for Total Operating

Leases

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we

believe is helpful to investors in assessing the company's overall debt profile.

Adjusted debt includes total operating lease liabilities, in addition to total debt and

finance leases, to present estimated financial obligations. Adjusted capitalization

represents total equity plus adjusted debt.

Long-term debt and finance leases

Current maturities of long-term debt and finance

leases

Operating lease liabilities

Adjusted debt

Non-GAAP Financial Measure

Adjusted Debt to Capitalization Ratio

($ in millions)

Long-term debt and finance leases

Current maturities of long-term debt and finance

leases

Operating lease liabilities

Stockholders' equity

Adjusted capitalization

Adjusted debt to capitalization ratio

jetBlue

March 31, 2023

(unaudited)

3,316

263

714

4,293

3,316

263

714

3,373

7,666

56%

$

December 31,

2022

3,093

554

736

4,383

3,093

554

736

3,563

7,946

55%

2) Debt to Capitalization Ratio Adjusted for Aircraft

Operating Leases

Adjusted debt to capitalization ratio is a non-GAAP financial metric which we

believe is helpful to investors in assessing the company's overall debt profile.

Adjusted debt includes aircraft operating lease liabilities, in addition to total debt

and finance leases, to present estimated financial obligations. Adjusted

capitalization represents total equity plus adjusted debt.

Non-GAAP Financial Measure

Adjusted Debt to Capitalization Ratio

($ in millions)

Long-term debt and finance leases

Current maturities of long-term debt and finance

leases

Operating lease liabilities - aircraft

Adjusted debt

Long-term debt and finance leases

Current maturities of long-term debt and finance

leases

Operating lease liabilities - aircraft

Stockholders' equity

Adjusted capitalization

Adjusted debt to capitalization ratio

$

June 30, 2023

(unaudited)

3,486

271

163

3,920

3,486

271

163

3,554

7,474

52 %

$

$

$

December 31,

2022

3,093

554

206

3,853

3,093

554

206

3,563

7,416

52%

17View entire presentation