AMC Mergers and Acquisitions Presentation Deck

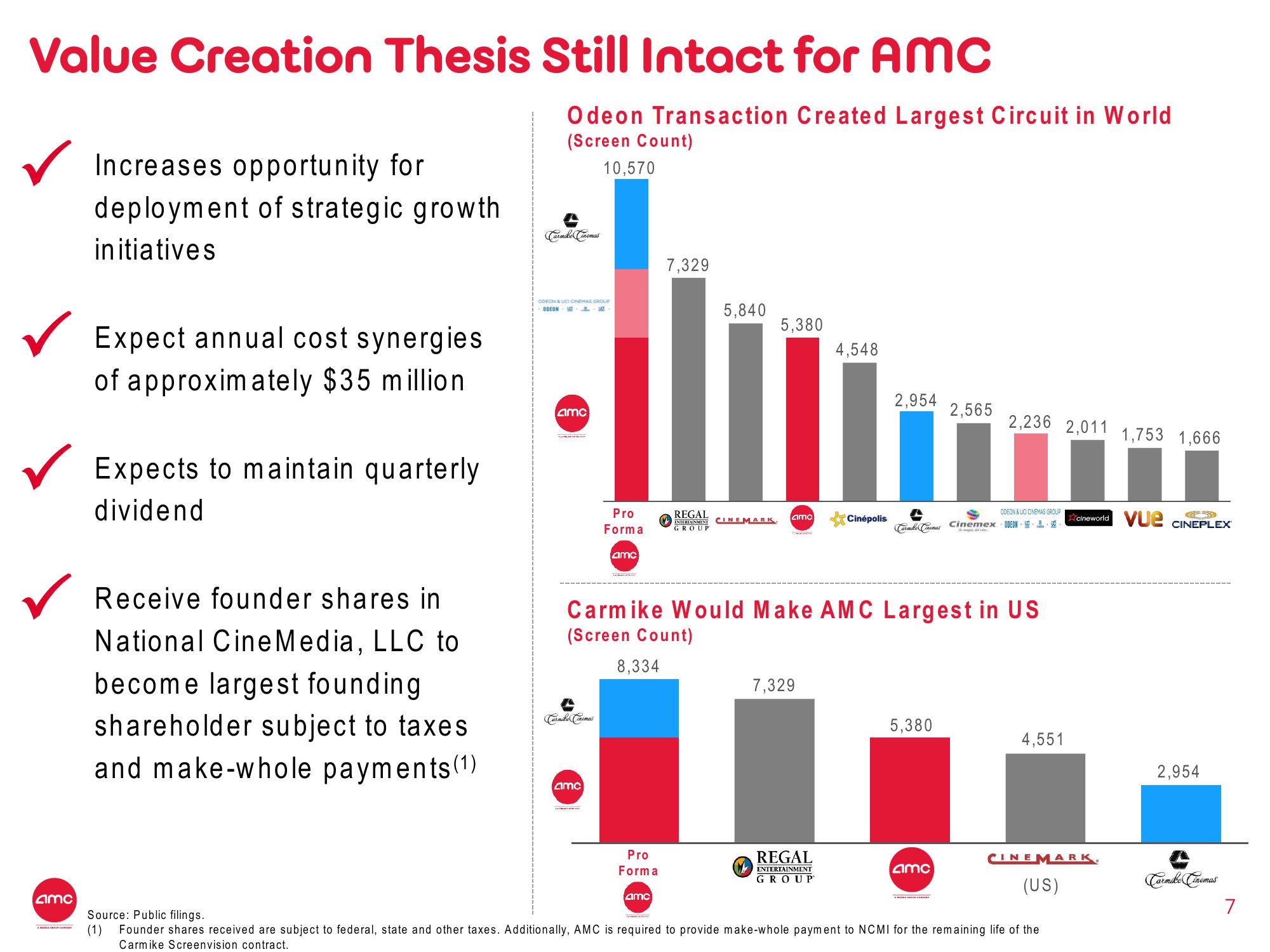

Value Creation Thesis Still Intact for AMC

amc

Increases opportunity for

deployment of strategic growth

initiatives

Expect annual cost synergies

of approximately $35 million.

Expects to maintain quarterly

dividend

Receive founder shares in

National Cine Media, LLC to

become largest founding

shareholder subject to taxes

and make-whole payments (1)

Odeon Transaction Created Largest Circuit in World

(Screen Count)

10,570

COFON &UCI CINEMAS GROUP

ODEON-

1

amc

Pro

Forma

amc

amc

Pro

Forma

7,329

amc

REGAL

ENTERTAINMENT

GROUP

5,840

5,380

amc

CINEMARK

7,329

4,548

REGAL

ENTERTAINMENT

GROUP

Cinépolis

2,954

Carmike Would Make AMC Largest in US

(Screen Count)

8,334

Cinemas

5,380

2,565

amc

2,236 2,011 1,753 1,666

ODEON&UO CINEMAS GROUP

Cinemex ODEON-

4,551

Xxcineworld Vue

CINEMARK.

(US)

Source: Public filings.

(1) Founder shares received are subject to federal, state and other taxes. Additionally, AMC is required to provide make-whole payment to NCMI for the remaining life of the

Carmike Screenvision contract.

CINEPLEX

2,954

Carmike Cinemas

7View entire presentation