Capri Holdings Investor Day Presentation Deck

Gross profit

Total operating expenses

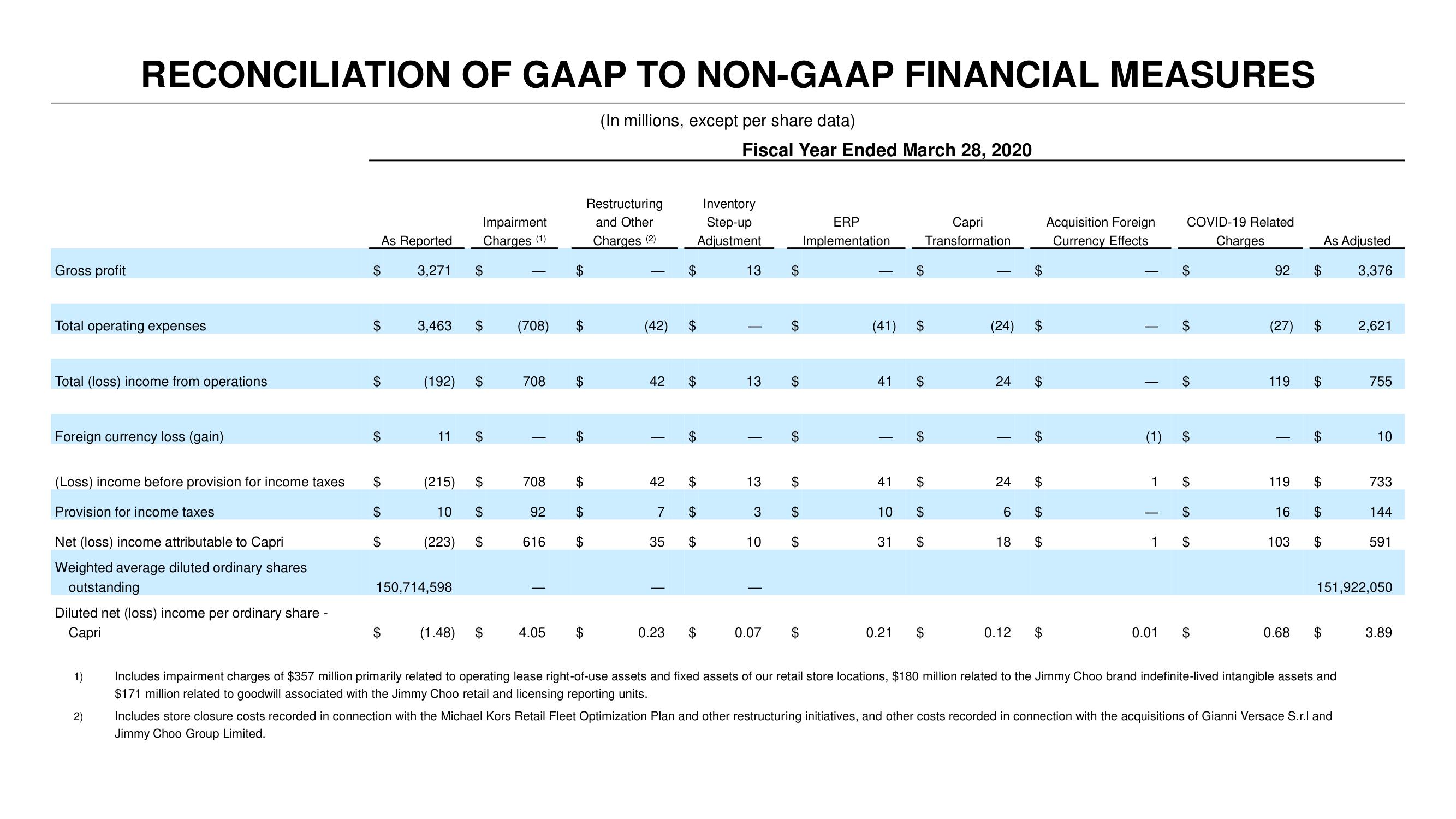

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In millions, except per share data)

Total (loss) income from operations

Foreign currency loss (gain)

(Loss) income before provision for income taxes

Provision for income taxes

Net (loss) income attributable to Capri

Weighted average diluted ordinary shares

outstanding

Diluted net (loss) income per ordinary share -

Capri

1)

2)

$

As Reported

3,271

$

3,463

$

(192)

11

(215)

10

(223)

150,714,598

(1.48)

Impairment

Charges (1)

$

$

GA

GA

(708)

T

708 $

92

$

616

$

708 $

4.05

$

$

$

$

Restructuring

and Other

Charges (2)

(42) $

T

42 $

42

$

7

35

GA

$

GA

$

$

EA

Inventory

Step-up

Adjustment

0.23 $

Fiscal Year Ended March 28, 2020

13 $

I

$

13 $

FA

0.07

FA

13 $

3

$

10

$

$

ERP

Implementation

(41)

41 $

T

41

10

31

0.21

$

SA

$

Capri

Transformation

$

$

(24) $

24

T

24

6

CO

$

18

$

$

$

$

$

0.12 $

Acquisition Foreign

Currency Effects

I

(1)

1

COVID-19 Related

0.01

$

GA

SA

GA

1 $

$

Charges

92

(27)

119 $

119

16

103

CA

$

$

As Adjusted

3,376

0.68 $

Includes impairment charges of $357 million primarily related to operating lease right-of-use assets and fixed assets of our retail store locations, $180 million related to the Jimmy Choo brand indefinite-lived intangible assets and

$171 million related to goodwill associated with the Jimmy Choo retail and licensing reporting units.

2,621

Includes store closure costs recorded in connection with the Michael Kors Retail Fleet Optimization Plan and other restructuring initiatives, and other costs recorded in connection with the acquisitions of Gianni Versace S.r.l and

Jimmy Choo Group Limited.

755

151,922,050

10

733

144

591

3.89View entire presentation