Melrose Investor Presentation Deck

Business results: expanded margins and strong cash flow

Melrose

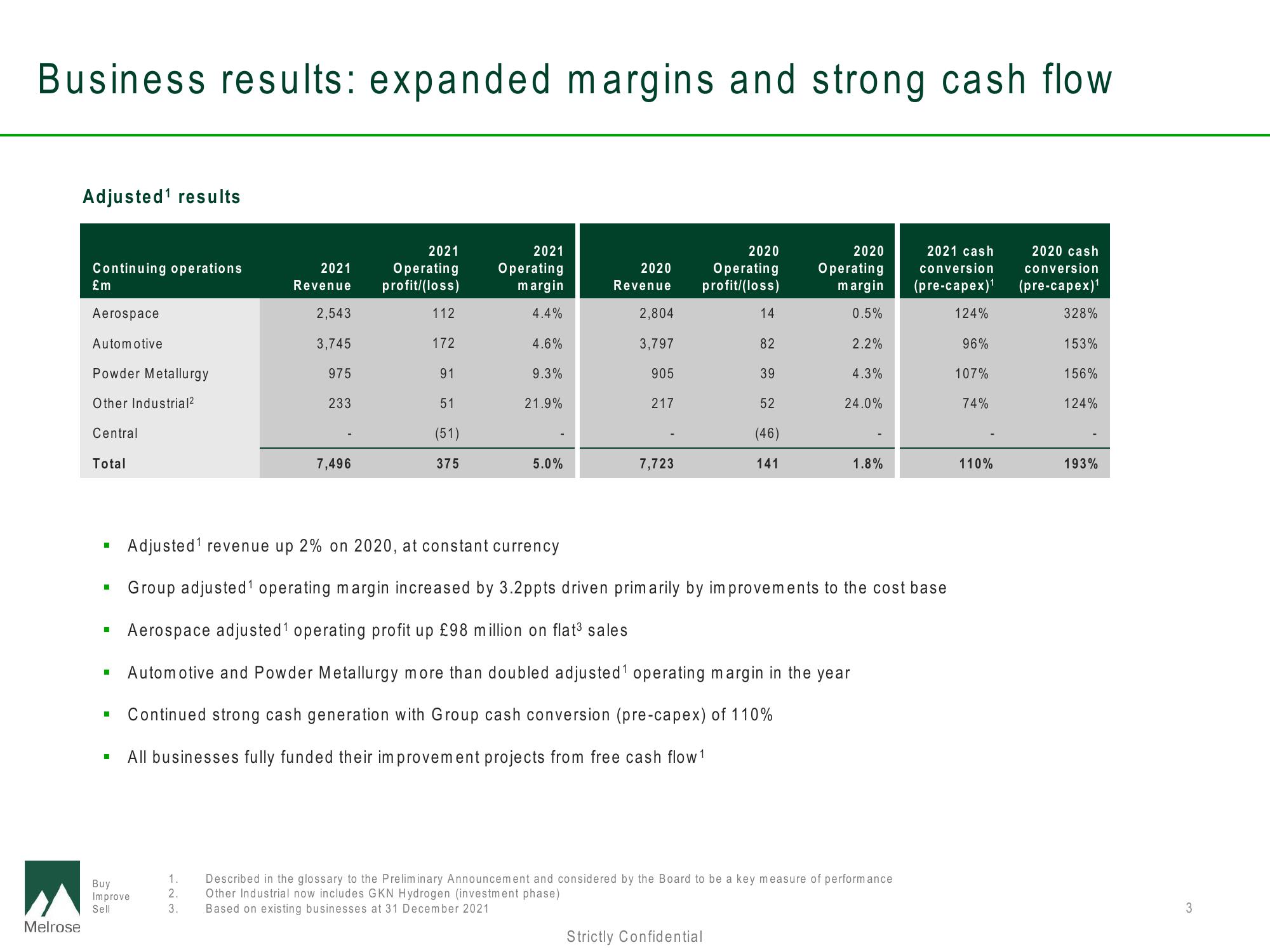

Adjusted¹ results

Continuing operations

£m

Aerospace

Automotive

Powder Metallurgy

Other Industrial²

Central

Total

■

I

I

I

I

I

Buy

Improve

Sell

2021

Revenue

2,543

3,745

975

233

1.

2.

7,496

2021

Operating

profit/(loss)

112

172

91

51

(51)

375

2021

Operating

margin

4.4%

4.6%

9.3%

21.9%

5.0%

2020

Revenue

2,804

3,797

905

217

7,723

2020

2020

Operating Operating

profit/(loss)

margin

0.5%

14

Strictly Confidential

82

39

52

(46)

141

2.2%

4.3%

24.0%

Adjusted¹ revenue up 2% on 2020, at constant currency

Group adjusted¹ operating margin increased by 3.2 ppts driven primarily by improvements to the cost base

Aerospace adjusted ¹ operating profit up £98 million on flat³ sales

Automotive and Powder Metallurgy more than doubled adjusted¹ operating margin in the year

Continued strong cash generation with Group cash conversion (pre-capex) of 110%

All businesses fully funded their improvement projects from free cash flow ¹

1.8%

Described in the glossary to the Preliminary Announcement and considered by the Board to be a key measure of performance

Other Industrial now includes GKN Hydrogen (investment phase)

3. Based on existing businesses at 31 December 2021

2020 cash

2021 cash

conversion conversion

(pre-capex)¹ (pre-capex)¹

124%

96%

107%

74%

110%

328%

153%

156%

124%

193%

3View entire presentation