Kinnevik Results Presentation Deck

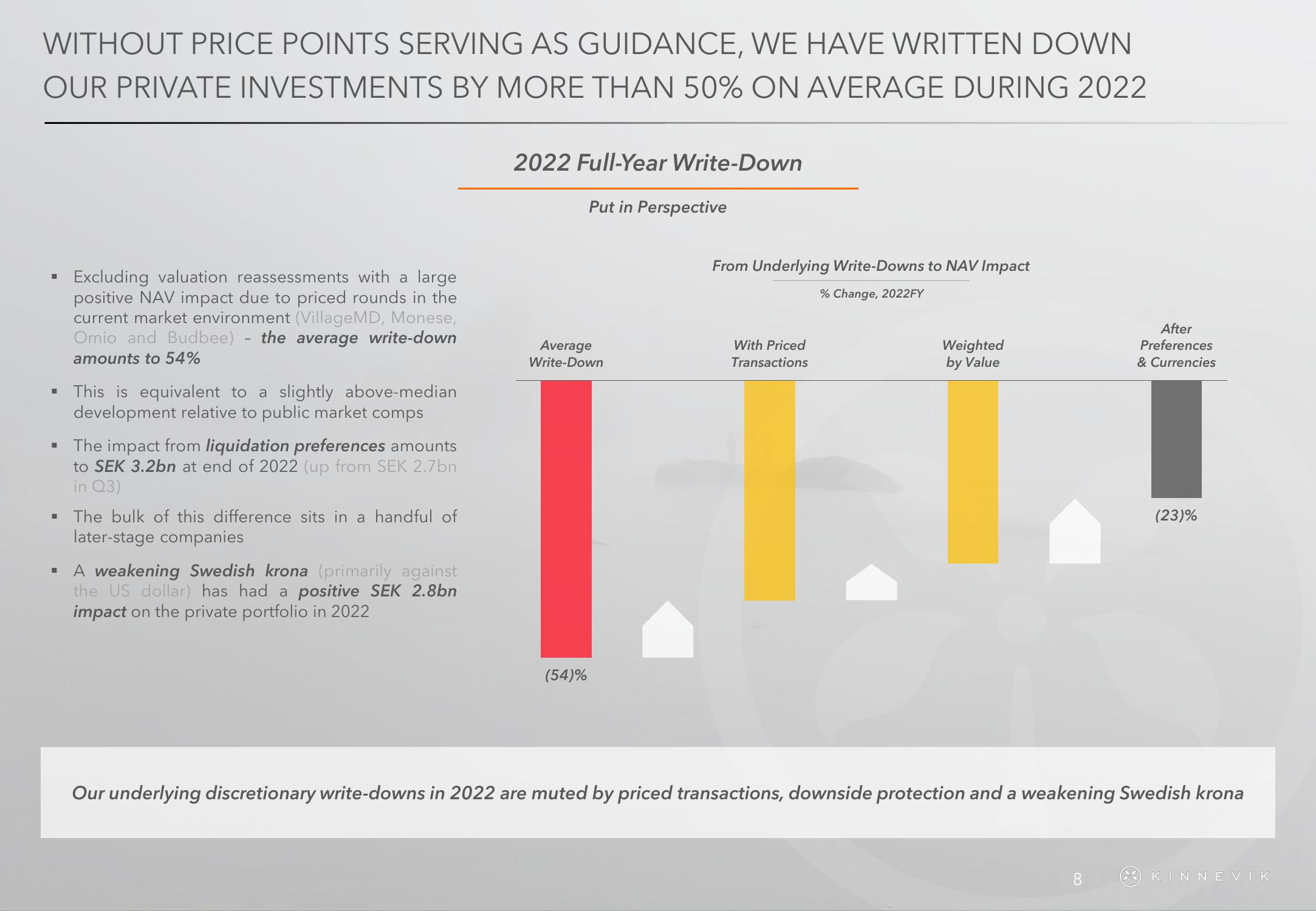

WITHOUT PRICE POINTS SERVING AS GUIDANCE, WE HAVE WRITTEN DOWN

OUR PRIVATE INVESTMENTS BY MORE THAN 50% ON AVERAGE DURING 2022

■

▪ This is equivalent to a slightly above-median

development relative to public market comps

■

■

Excluding valuation reassessments with a large

positive NAV impact due to priced rounds in the

current market environment (VillageMD, Monese,

Omio and Budbee) - the average write-down

amounts to 54%

■

The impact from liquidation preferences amounts

to SEK 3.2bn at end of 2022 (up from SEK 2.7bn

in Q3)

The bulk of this difference sits in a handful of

later-stage companies

A weakening Swedish krona (primarily against

the US dollar) has had a positive SEK 2.8bn

impact on the private portfolio in 2022

2022 Full-Year Write-Down

Put in Perspective

Average

Write-Down

From Underlying Write-Downs to NAV Impact

% Change, 2022FY

With Priced

Transactions

IT

(54)%

Weighted

by Value

After

Preferences

& Currencies

8

(23)%

Our underlying discretionary write-downs in 2022 are muted by priced transactions, downside protection and a weakening Swedish krona

KINNEVIKView entire presentation