Advent Capital Balanced Strategy Update

BALANCED STRATEGY PERFORMANCE

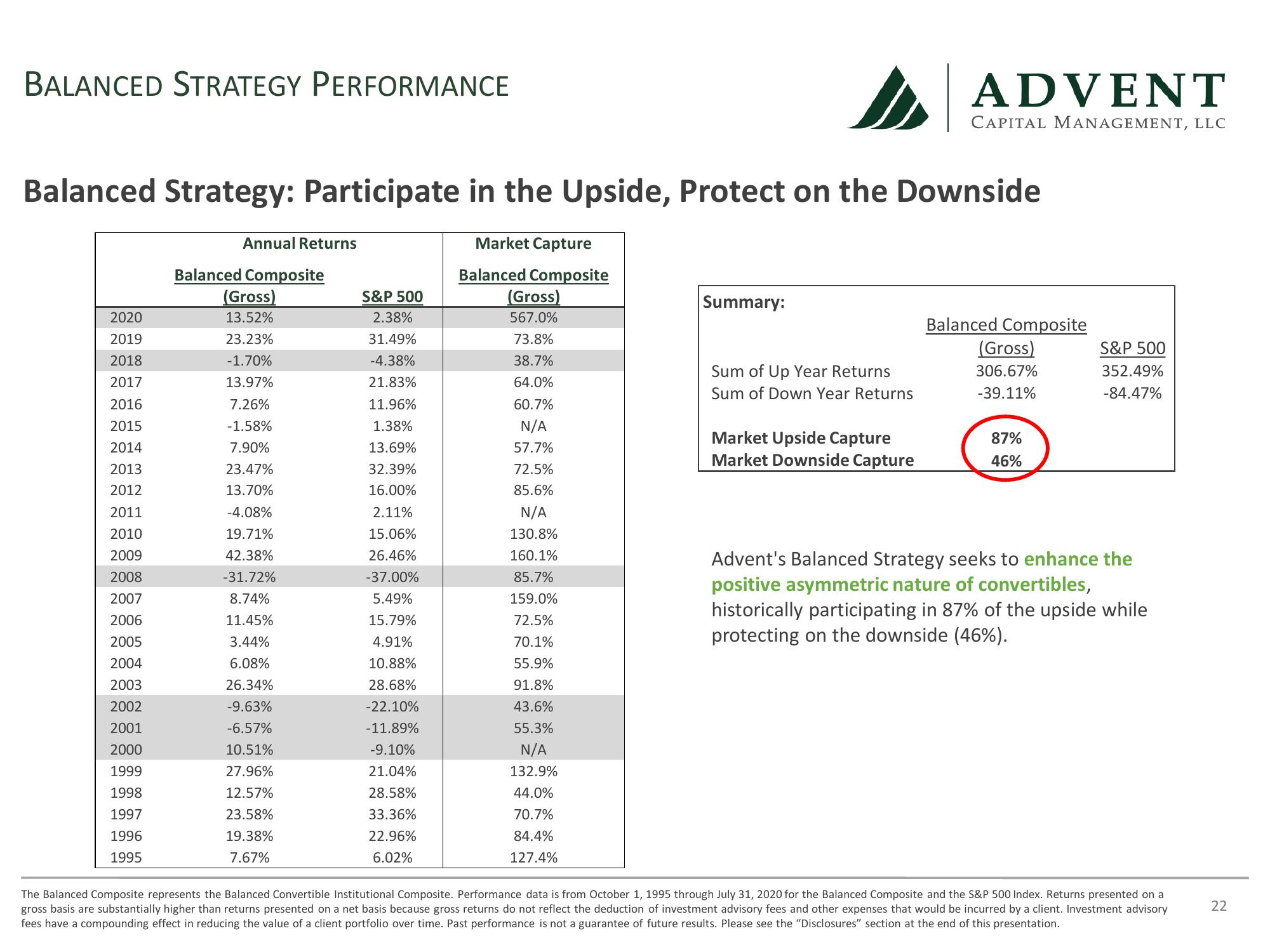

Balanced Strategy: Participate in the Upside, Protect on the Downside

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

1995

Annual Returns

Balanced Composite

(Gross)

13.52%

23.23%

-1.70%

13.97%

7.26%

-1.58%

7.90%

23.47%

13.70%

-4.08%

19.71%

42.38%

-31.72%

8.74%

11.45%

3.44%

6.08%

26.34%

-9.63%

-6.57%

10.51%

27.96%

12.57%

23.58%

19.38%

7.67%

S&P 500

2.38%

31.49%

-4.38%

21.83%

11.96%

1.38%

13.69%

32.39%

16.00%

2.11%

15.06%

26.46%

-37.00%

5.49%

15.79%

4.91%

10.88%

28.68%

-22.10%

-11.89%

-9.10%

21.04%

28.58%

33.36%

22.96%

6.02%

Market Capture

Balanced Composite

(Gross)

567.0%

73.8%

38.7%

64.0%

60.7%

N/A

57.7%

72.5%

85.6%

N/A

130.8%

160.1%

85.7%

159.0%

72.5%

70.1%

55.9%

91.8%

43.6%

55.3%

N/A

132.9%

44.0%

70.7%

84.4%

127.4%

Summary:

Sum of Up Year Returns

Sum of Down Year Returns

ADVENT

CAPITAL MANAGEMENT, LLC

Market Upside Capture

Market Downside Capture

Balanced Composite

(Gross)

306.67%

-39.11%

87%

46%

S&P 500

352.49%

-84.47%

Advent's Balanced Strategy seeks to enhance the

positive asymmetric nature of convertibles,

historically participating in 87% of the upside while

protecting on the downside (46%).

The Balanced Composite represents the Balanced Convertible Institutional Composite. Performance data from October 1, 1995 through July 31, 2020 for the Balanced Composite and the S&P 500 Index. Returns presented on a

gross basis are substantially higher than returns presented on a net basis because gross returns do not reflect the deduction of investment advisory fees and other expenses that would be incurred by a client. Investment advisory

fees have a compounding effect in reducing the value of a client portfolio over time. Past performance is not a guarantee of future results. Please see the "Disclosures" section at the end of this presentation.

22View entire presentation