Affirm Results Presentation Deck

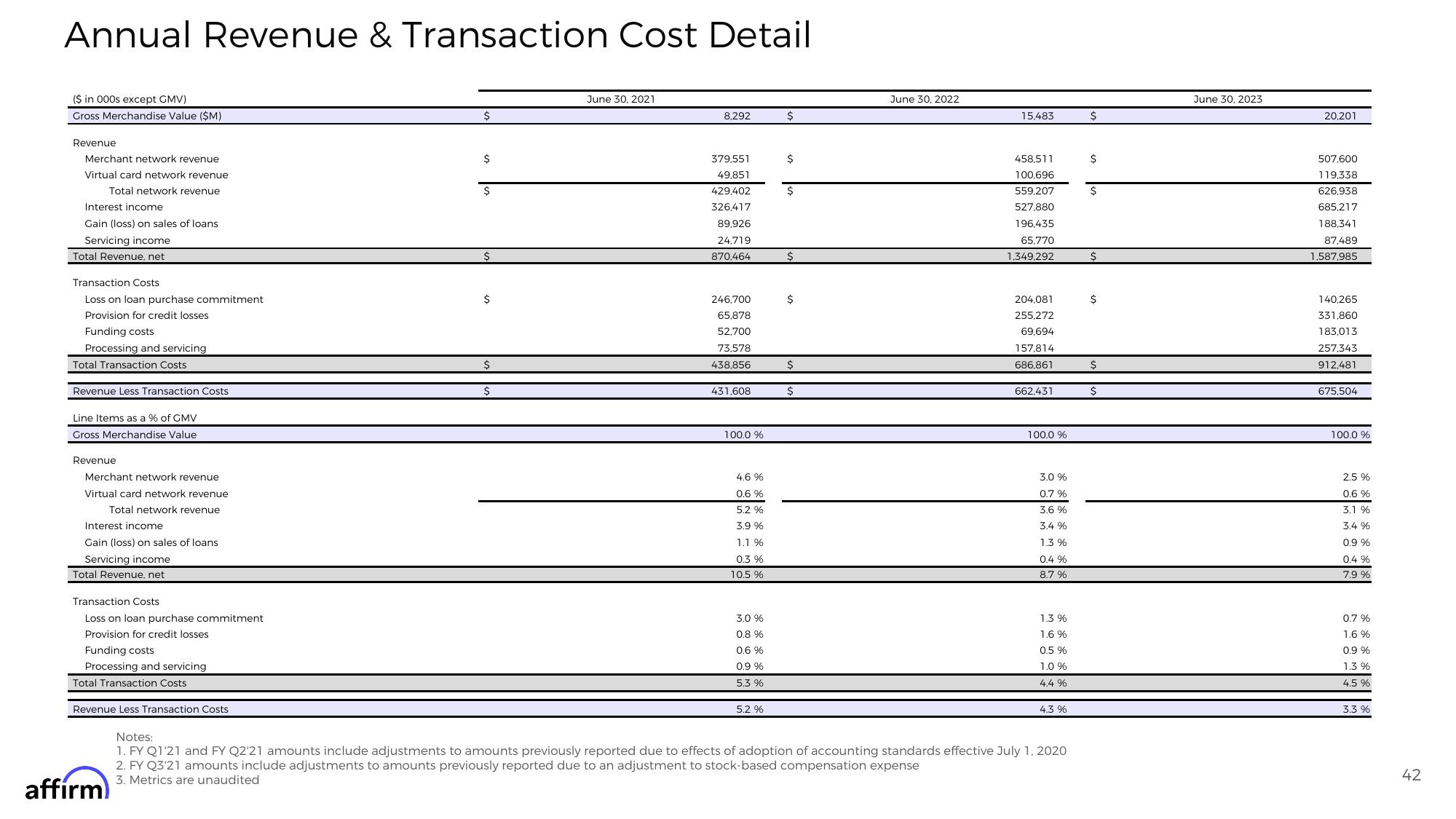

Annual Revenue & Transaction Cost Detail

($ in 000s except GMV)

Gross Merchandise Value ($M)

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Revenue Less Transaction Costs

Line Items as a % of GMV

Gross Merchandise Value

Revenue

Merchant network revenue

Virtual card network revenue

Total network revenue

Interest income

Gain (loss) on sales of loans

Servicing income

Total Revenue, net

Transaction Costs

Loss on loan purchase commitment.

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Revenue Less Transaction Costs

affirm

$

$

$

$

$

June 30, 2021

8,292

379,551

49,851

429,402

326,417

89,926

24,719

870.464

246,700

65.878

52,700

73,578

438,856

431,608

100.0 %

4.6 %

0.6 %

5.2 %

3.9 %

1.1 %

0.3 %

10.5 %

3.0 %

0.8 %

0.6 %

0.9 %

5.3 %

5.2 %

$

$

Ś

$

$

$

$

June 30, 2022

15.483

458,511

100,696

559,207

527,880

196,435

65,770

1,349,292

204,081

255,272

69,694

157,814

686,861

662,431

100.0 %

3.0 %

0.7 %

3.6%

3.4 %

1.3%

0.4 %

8.7 %

1.3 %

1.6 %

0.5 %

1.0 %

4.4%

4.3 %

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020

2. FY Q3'21 amounts include adjustments to amounts previously reported due to an adjustment to stock-based compensation expense

3. Metrics are unaudited

S

$

$

$

$

$

$

June 30, 2023

20,201

507,600

119,338

626,938

685,217

188,341

87,489

1,587,985

140,265

331,860

183,013

257,343

912,481

675,504

100.0 %

2.5 %

0.6 %

3.1 %

3.4 %

0.9 %

0.4 %

7.9 %

0.7 %

1.6 %

0.9 %

1.3 %

4.5 %

3.3 %

42View entire presentation