Pershing Square Activist Presentation Deck

B. PF McDonald's Financial Analysis

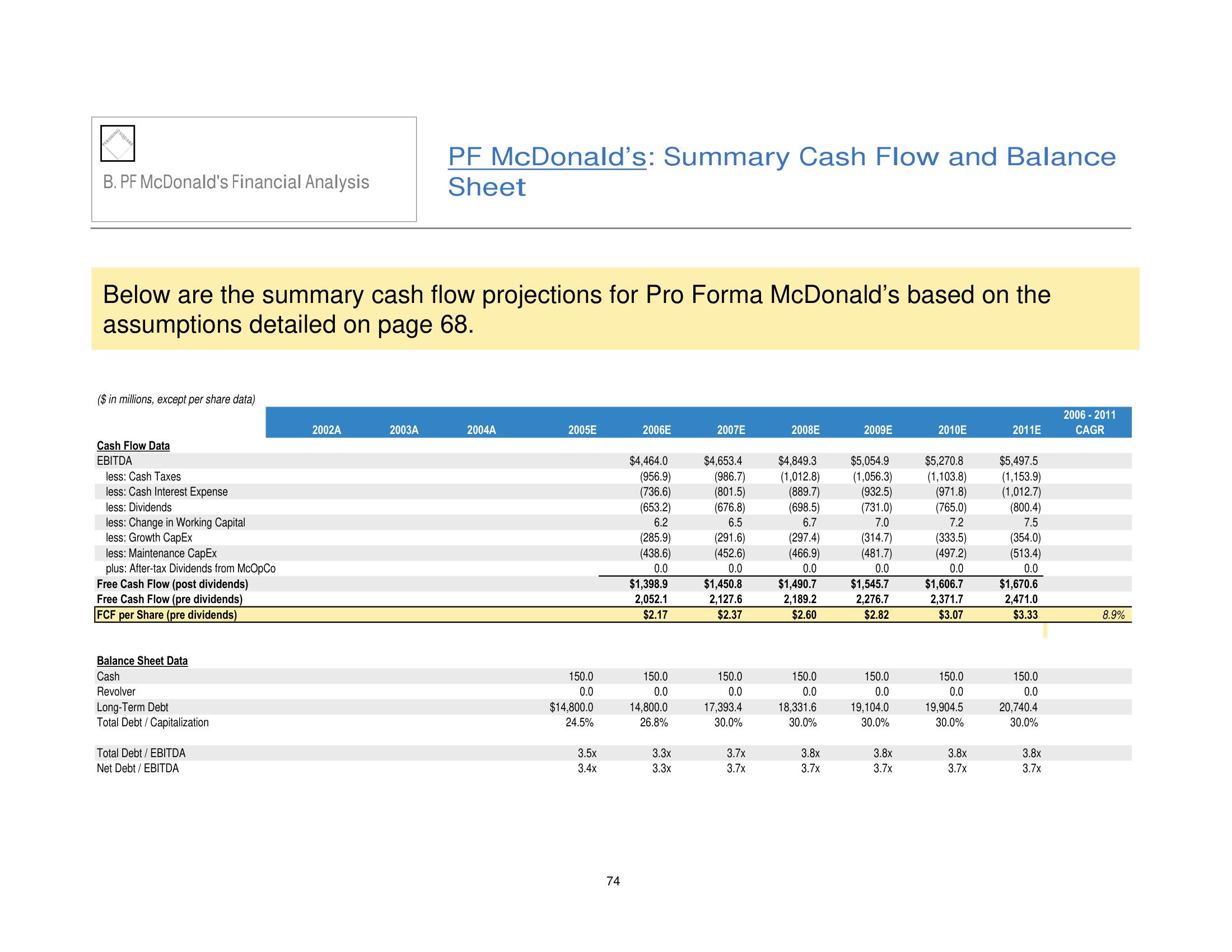

Below are the summary cash flow projections for Pro Forma McDonald's based on the

assumptions detailed on page 68.

($ in millions, except per share data)

Cash Flow Data

EBITDA

less: Cash Taxes

less: Cash Interest Expense

less: Dividends

less: Change in Working Capital

less: Growth CapEx

less: Maintenance CapEx

plus: After-tax Dividends from McOpCo

Free Cash Flow (post dividends)

Free Cash Flow (pre dividends)

FCF per Share (pre dividends)

Balance Sheet Data

Cash

Revolver

Long-Term Debt

Total Debt / Capitalization

Total Debt / EBITDA

Net Debt / EBITDA

2002A

PF McDonald's: Summary Cash Flow and Balance

Sheet

2003A

2004A

2005E

150.0

0.0

$14,800.0

24.5%

3.5x

3.4x

74

2006E

$4,464.0

(956.9)

(736.6)

(653.2)

6.2

(285.9)

(438.6)

0.0

$1,398.9

2,052.1

$2.17

150.0

0.0

14,800.0

26.8%

3.3x

3.3x

2007E

$4,653.4

(986.7)

(801.5)

(676.8)

6.5

(291.6)

(452.6)

0.0

$1,450.8

2,127.6

$2.37

150.0

0.0

17,393.4

30.0%

3.7x

3.7x

2008E

$4,849.3

(1,012.8)

(889.7)

(698.5)

6.7

(297.4)

(466.9)

0.0

$1,490.7

2,189.2

$2.60

150.0

0.0

18,331.6

30.0%

3.8x

3.7x

2009E

$5,054.9

(1,056.3)

(932.5)

(731.0)

7.0

(314.7)

(481.7)

0.0

$1,545.7

2,276.7

$2.82

150.0

0.0

19,104.0

30.0%

3.8x

3.7x

2010E

$5,270.8

(1,103.8)

(971.8)

(765.0)

7.2

(333.5)

(497.2)

0.0

$1,606.7

2,371.7

$3.07

150.0

0.0

19,904.5

30.0%

3.8x

3.7x

2011E

$5,497.5

(1,153.9)

(1,012.7)

(800.4)

7.5

(354.0)

(513.4)

0.0

$1,670.6

2,471.0

$3.33

150.0

0.0

20,740.4

30.0%

3.8x

3.7x

2006 - 2011

CAGR

8.9%View entire presentation