Presentation to Vermont Pension Investment Committee

Case Study: Healthcare Receivables Facility - ESG Review

Applying the Ares Framework

Pre-Screen Criteria

Healthcare services / positive impact on society

>> Highlights

Innovative financing product that generates attractive returns

while providing consumers critical access to healthcare and

compelling value for healthcare providers

Consumer Benefits

Access to 0% non-recourse financing for medical care that

otherwise may have been avoided or delayed due to affordability

33% of Americans have chosen to delay medical treatment

due to out-of-pocket costs¹

●

●

●

Healthcare Provider Benefits

Immediate capital solution and accretion to ROI on unpaid

accounts receivable

●

62% of personal bankruptcies can be attributed to medical bills²

Delay of medical treatment due to cost has contributed to the

recent increase in U.S. deaths from treatable causes³

●

Company's 83% purchase price represents approximately

6x the average collection rate achieved by Providers on their

self-collected unpaid accounts receivable

Uncompensated healthcare costs exceed $41 billion annually4

Key source of liquidity during COVID crisis

Increased patient satisfaction and retention of patient

relationship that would have otherwise been sold to a debt

collection agency

Helps ensure consumer payments are serviced and collected

with "best-in-class" compliance

1. Source: Gallup, December 2019.

2. Source: Himmelstein et al. American Journal of Public Health, November 2018.

3. Source: Tipirneni et al. Society for Medical Decision Making Annual Meeting, 2017.

4. Source: American Hospital Association, January 2021.

Confidential - Not for Publication or Distribution.

31

●

●

●

●

●

Diligence

Detailed review of compliance infrastructure and

consumer engagement practices with specialty

third party regulatory counsel

Recommended certain updates to provider and

consumer contracts to align with current industry

best practices

Structure

Use of receivable and facility level covenants to

help ensure ongoing, continued compliance with

Ares ESG standards and latest regulations

Monitoring

At least quarterly reviews of ESG matters with third

party auditors

Automated ongoing monitoring for ESG related

incidents through RepRisk software

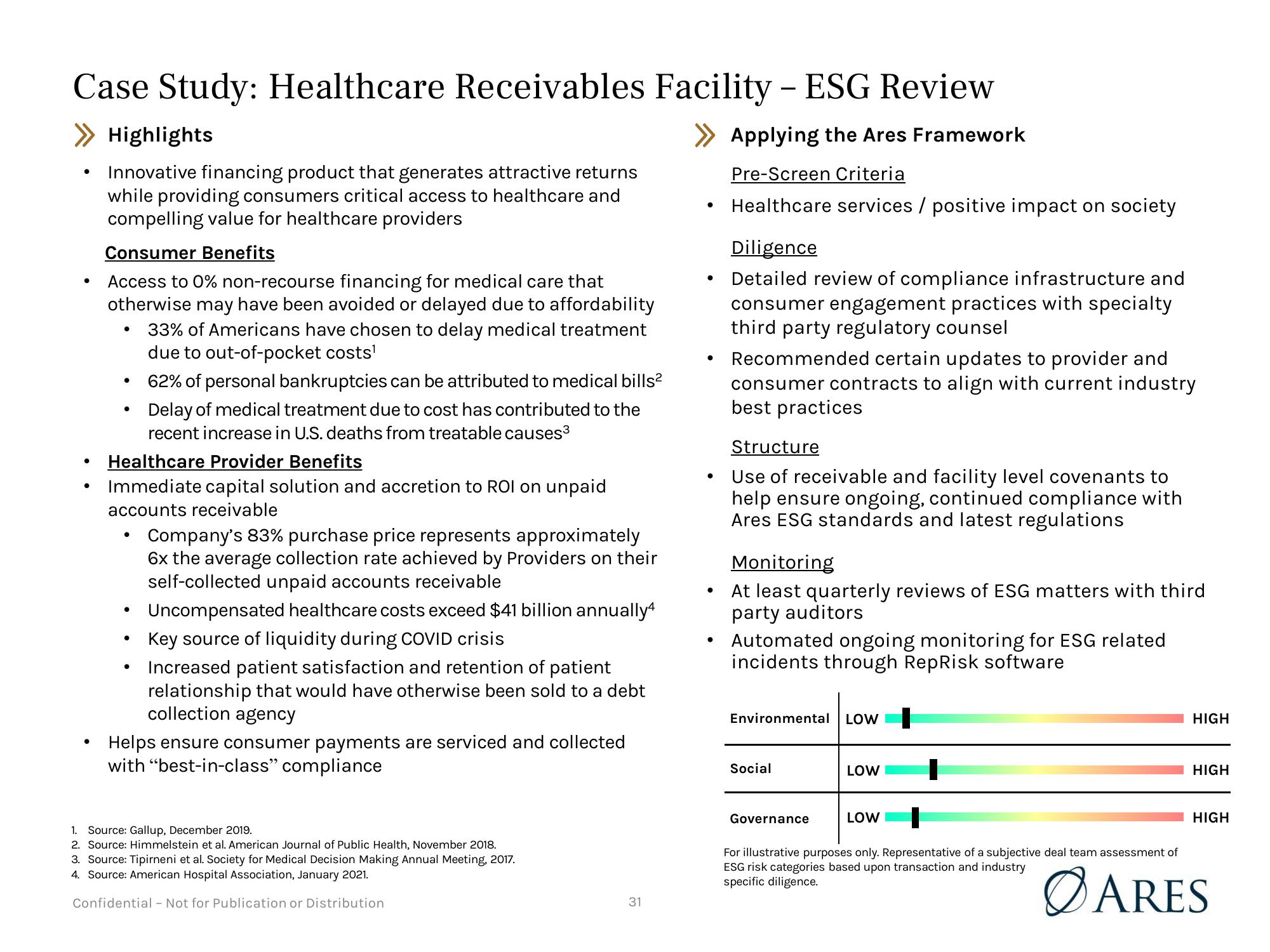

Environmental LOW

Social

Governance

LOW

LOW

HIGH

HIGH

HIGH

For illustrative purposes only. Representative of a subjective deal team assessment of

ESG risk categories based upon transaction and industry

specific diligence.

ØARESView entire presentation