WeWork Results Presentation Deck

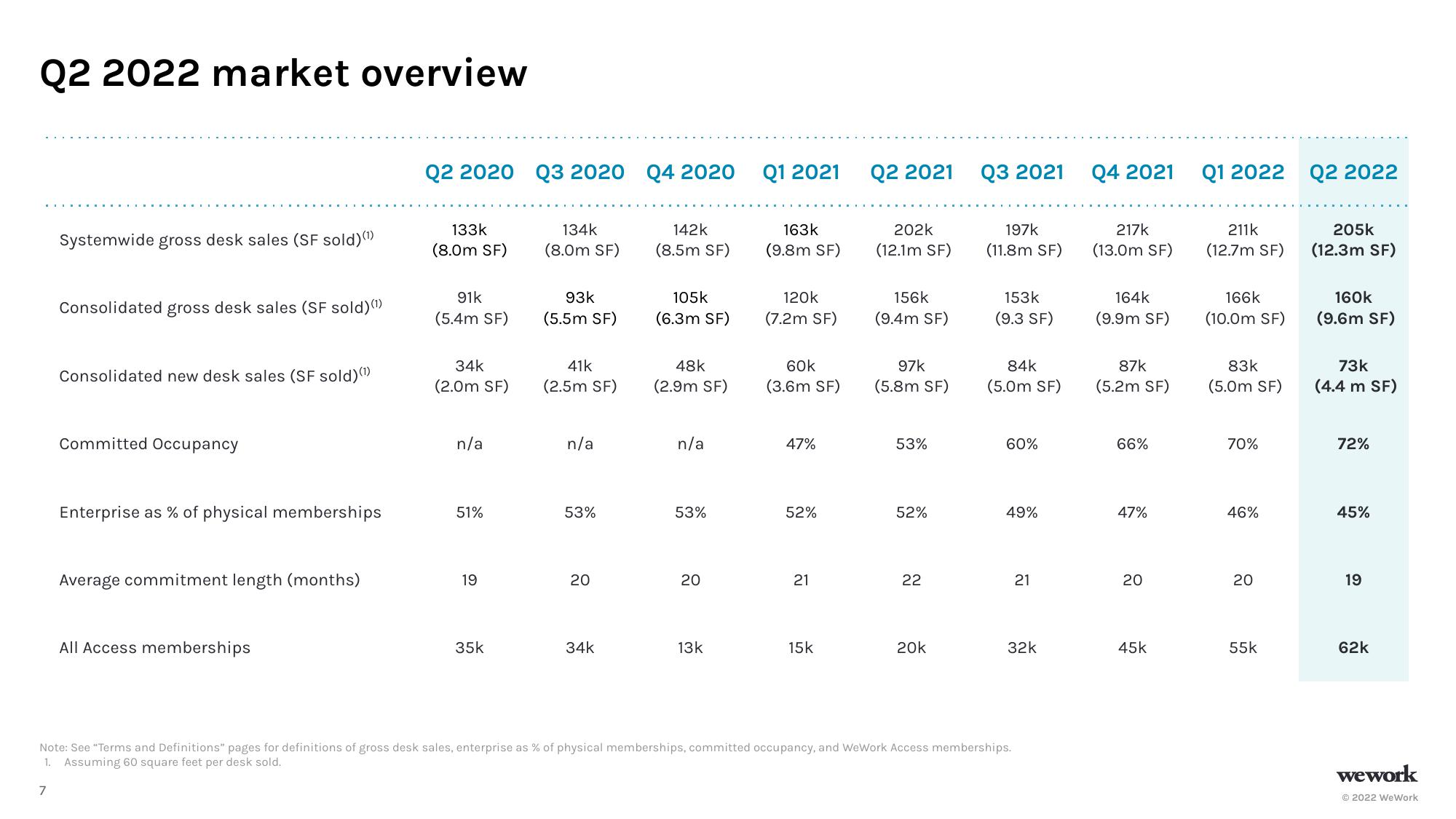

Q2 2022 market overview

Systemwide gross desk sales (SF sold)(¹)

Consolidated gross desk sales (SF sold)(¹)

Consolidated new desk sales (SF sold)(¹)

Committed Occupancy

Enterprise as % of physical memberships

Average commitment length (months)

All Access memberships

Q2 2020 Q3 2020

133k

(8.0m SF)

91k

(5.4m SF)

34k

(2.0m SF)

n/a

51%

19

35k

134k

(8.0m SF)

93k

(5.5m SF)

41k

(2.5m SF)

n/a

53%

20

34k

Q4 2020

142k

(8.5m SF)

105k

(6.3m SF)

48k

(2.9m SF)

n/a

53%

20

13k

Q1 2021

163k

(9.8m SF)

120k

(7.2m SF)

60k

(3.6m SF)

47%

52%

21

15k

Q2 2021

202k

(12.1m SF)

156k

(9.4m SF)

97k

(5.8m SF)

53%

52%

22

20k

Q3 2021

197k

(11.8m SF)

153k

(9.3 SF)

84k

(5.0m SF)

60%

49%

21

32k

Note: See "Terms and Definitions" pages for definitions of gross desk sales, enterprise as % of physical memberships, committed occupancy, and WeWork Access memberships.

1. Assuming 60 square feet per desk sold.

7

Q4 2021

217k

(13.0m SF)

164k

(9.9m SF)

87k

(5.2m SF)

66%

47%

20

45k

Q1 2022 Q2 2022

211k

(12.7m SF)

166k

(10.0m SF)

83k

(5.0m SF)

70%

46%

20

55k

205k

(12.3m SF)

160k

(9.6m SF)

73k

(4.4 m SF)

72%

45%

19

62k

wework

Ⓒ2022 WeWorkView entire presentation