Whitebread Annual Update

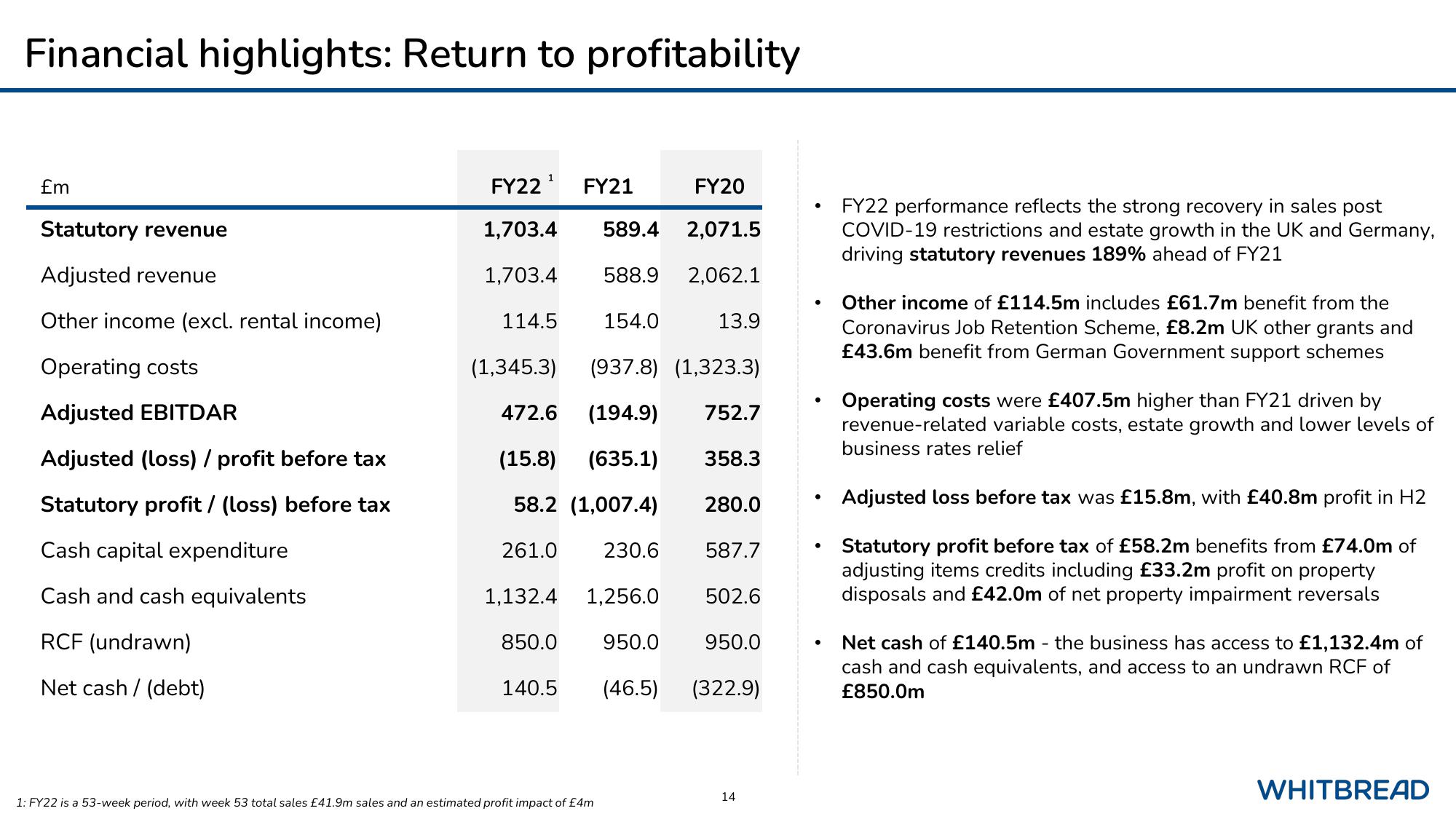

Financial highlights: Return to profitability

£m

Statutory revenue

Adjusted revenue

Other income (excl. rental income)

Operating costs

Adjusted EBITDAR

Adjusted (loss) / profit before tax

Statutory profit/ (loss) before tax

Cash capital expenditure

Cash and cash equivalents

RCF (undrawn)

Net cash / (debt)

FY22¹

1,703.4

1,703.4

114.5

FY20

589.4 2,071.5

588.9 2,062.1

154.0

(937.8) (1,323.3)

472.6 (194.9) 752.7

(15.8) (635.1)

58.2 (1,007.4)

261.0

230.6

1,256.0

950.0

(1,345.3)

1,132.4

850.0

140.5

FY21

1: FY22 is a 53-week period, with week 53 total sales £41.9m sales and an estimated profit impact of £4m

(46.5)

13.9

358.3

280.0

587.7

502.6

950.0

(322.9)

14

●

●

●

●

●

FY22 performance reflects the strong recovery in sales post

COVID-19 restrictions and estate growth in the UK and Germany,

driving statutory revenues 189% ahead of FY21

Other income of £114.5m includes £61.7m benefit from the

Coronavirus Job Retention Scheme, £8.2m UK other grants and

£43.6m benefit from German Government support schemes

Operating costs were £407.5m higher than FY21 driven by

revenue-related variable costs, estate growth and lower levels of

business rates relief

Adjusted loss before tax was £15.8m, with £40.8m profit in H2

Statutory profit before tax of £58.2m benefits from £74.0m of

adjusting items credits including £33.2m profit on property

disposals and £42.0m of net property impairment reversals

Net cash of £140.5m - the business has access to £1,132.4m of

cash and cash equivalents, and access to an undrawn RCF of

£850.0m

WHITBREADView entire presentation