Accel Entertaiment Results Presentation Deck

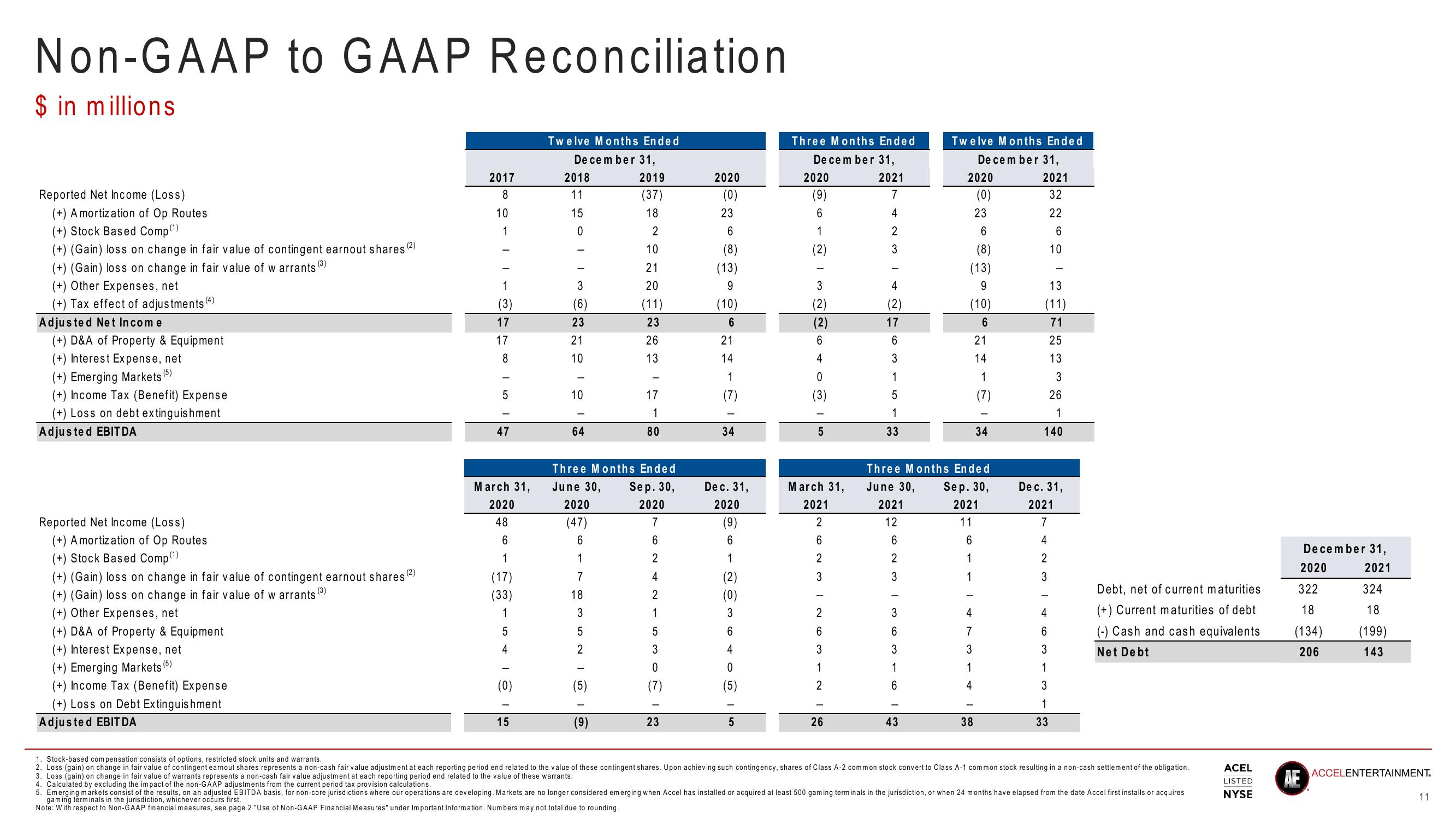

Non-GAAP to GAAP Reconciliation

$ in millions

Reported Net Income (Loss)

(+) Amortization of Op Routes

(+) Stock Based Comp (¹)

(+) (Gain) loss on change in fair value of contingent earnout shares (2)

(+) (Gain) loss on change in fair value of w arrants (3)

(+) Other Expenses, net

(+) Tax effect of adjustments (4)

Adjusted Net Income

(+) D&A of Property & Equipment

(+) Interest Expense, net

(5)

(+) Emerging Markets

(+) Income Tax (Benefit) Expense

(+) Loss on debt extinguishment

Adjusted EBITDA

Reported Net Income (Loss)

(+) Amortization of Op Routes

(+) Stock Based Comp (¹)

(+) (Gain) loss on change in fair value of contingent earnout shares (2)

(+) (Gain) loss on change in fair value of w arrants (3)

(+) Other Expenses, net

(+) D&A of Property & Equipment

(+) Interest Expense, net

(+) Emerging Markets (5)

(+) Income Tax (Benefit) Expense

(+) Loss on Debt Extinguishment

Adjusted EBIT DA

2017

ܣ ܘ ܝ . ܙ ܝ ܚ ܒ ܒ ܣ ܙ ܗ

(3)

17

17

47

March 31,

2020

48

6

1

(17)

(33)

1

5

4

(0)

15

Twelve Months Ended

December 31,

2018

11

15

0

3

(6)

23

21

10

10

64

2020

(47)

6

1

7

18

3

5

2

(5)

2019

(37)

18

(9)

* * F !

2

Three Months Ended

June 30,

Sep. 30,

2020

7

6

2

4

2

1

5

3

0

10

21

20

(11)

23

26

13

17

1

80

23

2020

(0)

23

6

(8)

(13)

9

(10)

6

21

14

1

34

Dec. 31,

2020

(9)

6

1

(0)

EMOTOSI

5

Three Months Ended

December 31,

2021

7

4

2

3

2020

(9)

ON TO

(2)

(2)

5

March 31,

2021

2

6

NW O NI W NO

2

3

2

6

3

1

2

26

4

(2)

17

6

3

1

5

1

33

-

3

6

3

1

6

Twelve Months Ended

December 31,

43

2020

(0)

Three Months Ended

Sep. 30,

June 30,

2021

2021

12

11

6

2

3

23

6

(8)

(13)

9

(10)

6

21

14

1

6

1

1

4

7

3

1

4

34

38

2021

32

22

6

10

13

(11)

71

25

13

3

26

1

140

De c. 31,

2021

7

4

2

3

4

6

3

1

3

1

33

Debt, net of current maturities

(+) Current maturities of debt

(-) Cash and cash equivalents

Net Debt

1. Stock-based compensation consists of options, restricted stock units and warrants.

2. Loss (gain) on change in fair value of contingent earnout shares represents a non-cash fair value adjustment at each reporting period end related to the value of these contingent shares. Upon achieving such contingency, shares of Class A-2 common stock convert to Class A-1 common stock resulting in a non-cash settlement of the obligation.

3. Loss (gain) on change in fair value of warrants represents a non-cash fair value adjustment at each reporting period end related to the value of these warrants.

4. Calculated by excluding the impact of the non-GAAP adjustments from the current period tax provision calculations.

5. Emerging markets consist of the results, on an adjusted EBITDA basis, for non-core jurisdictions where our operations are developing. Markets are no longer considered emerging when Accel has installed or acquired at least 500 gaming terminals in the jurisdiction, or when 24 months have elapsed from the date Accel first installs or acquires

gaming terminals in the jurisdiction, whichever occurs first.

Note: With respect to Non-GAAP financial measures, see page 2 "Use of Non-GAAP Financial Measures" under Important Information. Numbers may not total due to rounding.

ACEL

LISTED

NYSE

December 31,

2021

2020

322

18

(134)

206

AE

324

18

(199)

143

ACCELENTERTAINMENT.

11View entire presentation