LSE Results Presentation Deck

Minor business revenue reallocation

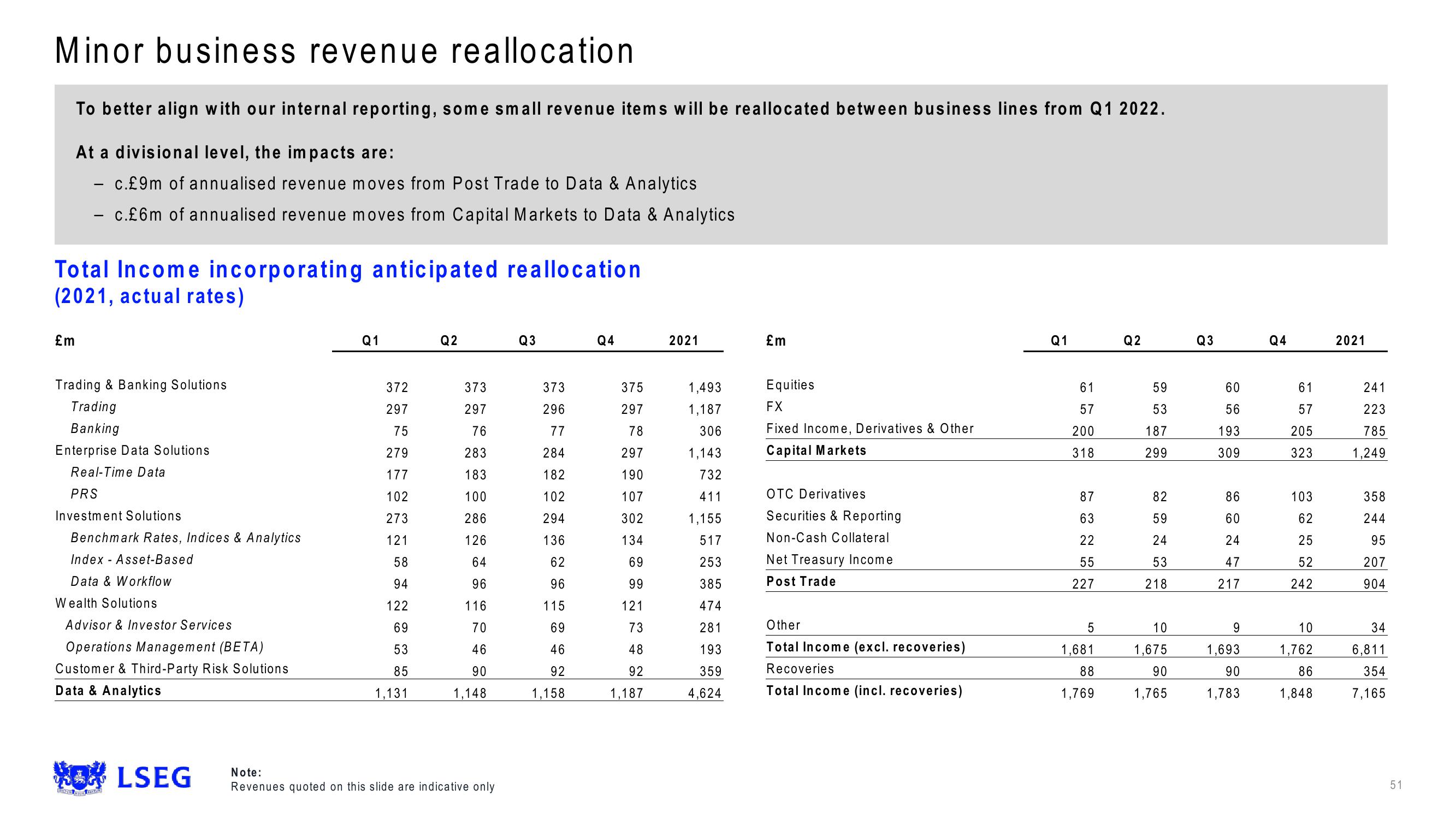

To better align with our internal reporting, some small revenue items will be reallocated between business lines from Q1 2022.

At a divisional level, the impacts are:

- c.£9m of annualised revenue moves from Post Trade to Data & Analytics

- c.£6m of annualised revenue moves from Capital Markets to Data & Analytics

Total Income incorporating anticipated reallocation

(2021, actual rates)

£m

Trading & Banking Solutions

Trading

Banking

Enterprise Data Solutions

Real-Time Data

PRS

Investment Solutions

Benchmark Rates, Indices & Analytics

Index - Asset-Based

Data & Workflow

Wealth Solutions

Advisor & Investor Services

Operations Management (BETA)

Customer & Third-Party Risk Solutions

Data & Analytics

WOLSEG

Q1

372

297

75

279

177

102

273

121

58

94

122

69

53

85

1,131

Q2

373

297

76

283

183

100

286

126

64

96

116

70

46

90

1,148

Note:

Revenues quoted on this slide are indicative only

Q3

373

296

77

284

182

102

294

136

62

96

115

69

46

92

1,158

Q4

375

297

78

297

190

107

302

134

69

99

121

73

48

92

1,187

2021

1,493

1,187

306

1,143

732

411

1,155

517

253

385

474

281

193

359

4,624

£m

Equities

FX

Fixed Income, Derivatives & Other

Capital Markets

OTC Derivatives

Securities & Reporting

Non-Cash Collateral

Net Treasury Income

Post Trade

Other

Total Income (excl. recoveries)

Recoveries

Total Income (incl. recoveries)

Q1

61

57

200

318

87

63

22

55

227

5

1,681

88

1,769

Q2

59

53

187

299

82

59

24

53

218

10

1,675

90

1,765

Q3

60

56

193

309

86

60

24

47

217

9

1,693

90

1,783

Q4

61

57

205

323

103

62

25

52

242

10

1,762

86

1,848

2021

241

223

785

1,249

358

244

95

207

904

34

6,811

354

7,165

51View entire presentation