Bunzl Investor Day Presentation Deck

TRANSITION TO NORMALISATION

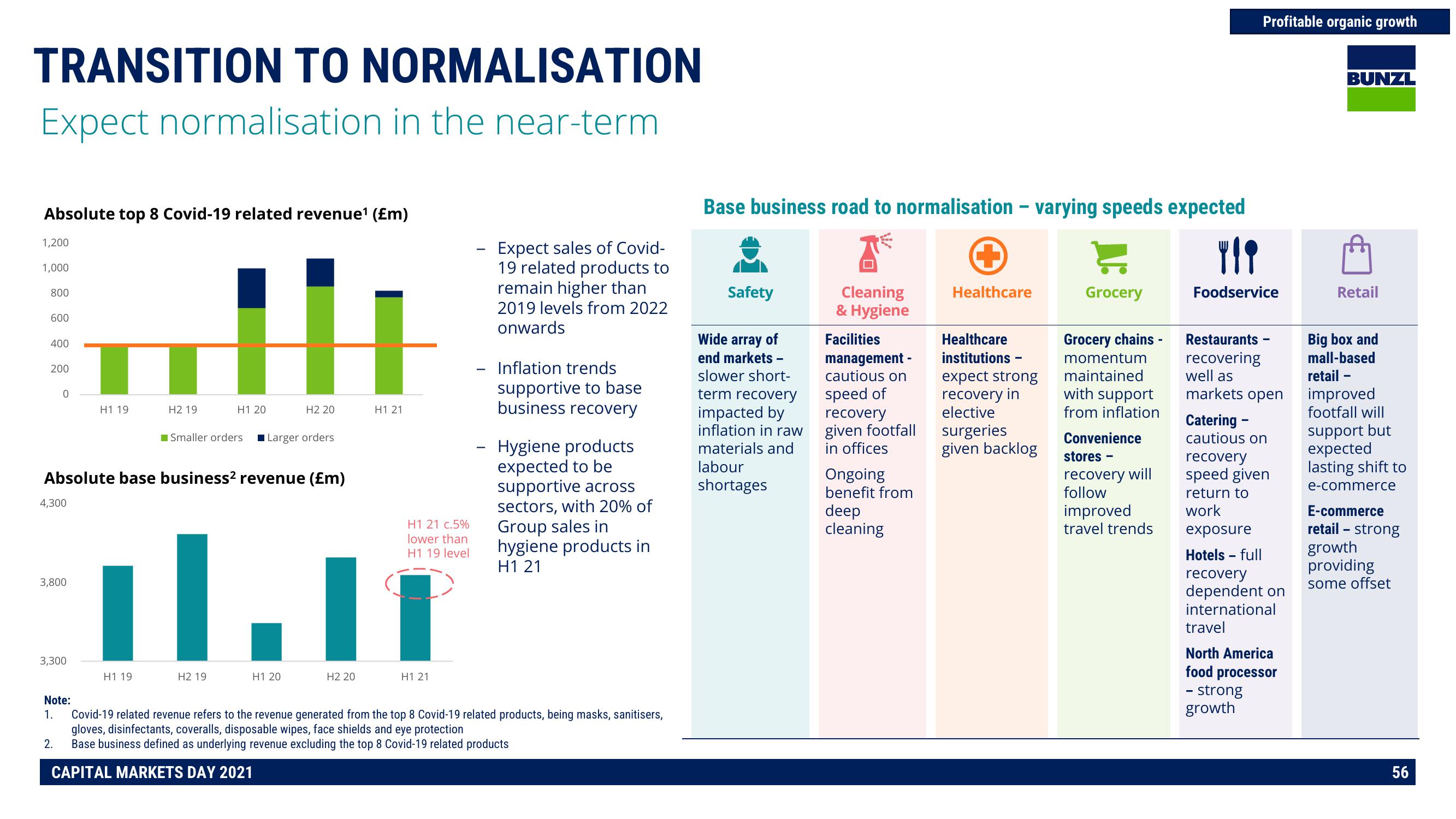

Expect normalisation in the near-term

Absolute top 8 Covid-19 related revenue¹ (£m)

1,200

1,000

800

600

400

200

0

4,300

3,800

3,300

Note:

1.

1

2.

H119

H2 19

Absolute base business² revenue (£m)

H119

H

H1 20

■Smaller orders

H2 19

H2 20

■Larger orders

H1 20

H121

H1 21 c.5%

lower than

H1 19 level

.11

H2 20

H1 21

Expect sales of Covid-

19 related products to

remain higher than

2019 levels from 2022

onwards

Inflation trends

supportive to base

business recovery

Hygiene products

expected to be

supportive across

sectors, with 20% of

Group sales in

hygiene products in

H1 21

Covid-19 related revenue refers to the revenue generated from the top 8 Covid-19 related products, being masks, sanitisers,

gloves, disinfectants, coveralls, disposable wipes, face shields and eye protection

Base business defined as underlying revenue excluding the top 8 Covid-19 related products

CAPITAL MARKETS DAY 2021

Base business road to normalisation - varying speeds expected

Y!?

Foodservice

Safety

Wide array of

end markets -

slower short-

term recovery

impacted by

inflation in raw

materials and

labour

shortages

Cleaning

& Hygiene

Facilities

management -

cautious on

speed of

recovery

given footfall

in offices

Ongoing

benefit from

deep

cleaning

+

Healthcare

Healthcare

institutions

expect strong

recovery in

elective

surgeries

given backlog

Grocery

Grocery chains -

momentum

maintained

with support

from inflation

Convenience

stores -

recovery will

follow

improved

travel trends

Profitable organic growth

Restaurants

recovering

well as

markets open

Catering -

cautious on

recovery

speed given

return to

work

exposure

Hotels - full

recovery

dependent on

international

travel

North America

food processor

- strong

growth

BUNZL

Retail

Big box and

mall-based

retail -

improved

footfall will

support but

expected

lasting shift to

e-commerce

E-commerce

retail - strong

growth

providing

some offset

56View entire presentation