Nextdoor SPAC Presentation Deck

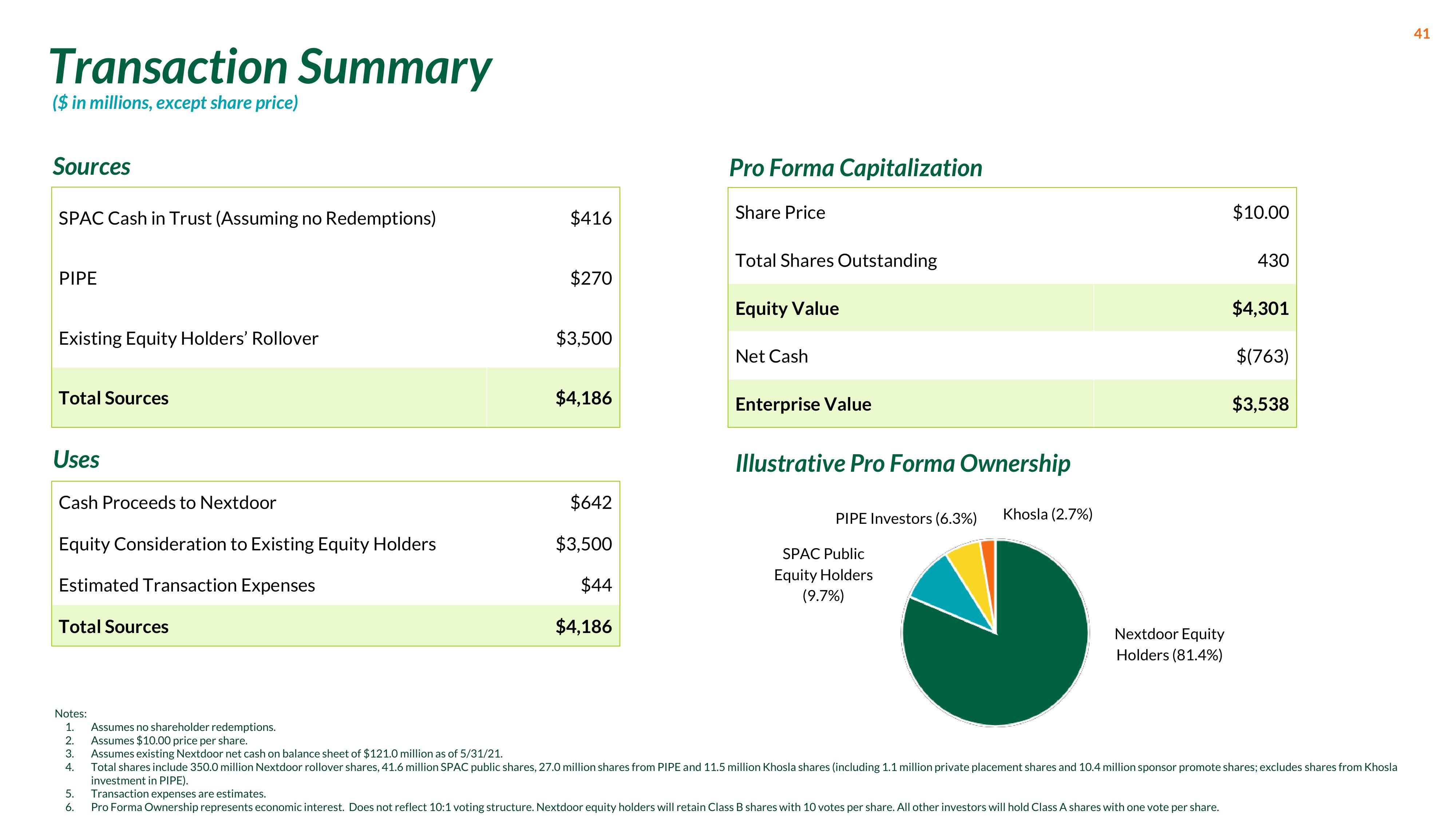

Transaction Summary

($ in millions, except share price)

Sources

SPAC Cash in Trust (Assuming no Redemptions)

PIPE

Existing Equity Holders' Rollover

Total Sources

Uses

Cash Proceeds to Nextdoor

Equity Consideration to Existing Equity Holders

Estimated Transaction Expenses

Total Sources

Notes:

1.

2.

3.

4.

5.

6.

$416

$270

$3,500

$4,186

$642

$3,500

$44

$4,186

Pro Forma Capitalization

Share Price

Total Shares Outstanding

Equity Value

Net Cash

Enterprise Value

Illustrative Pro Forma Ownership

PIPE Investors (6.3%)

SPAC Public

Equity Holders

(9.7%)

Khosla (2.7%)

Nextdoor Equity

Holders (81.4%)

$10.00

430

$4,301

$(763)

$3,538

Assumes no shareholder redemptions.

Assumes $10.00 price per share.

Assumes existing Nextdoor net cash on balance sheet of $121.0 million as of 5/31/21.

Total shares include 350.0 million Nextdoor rollover shares, 41.6 million SPAC public shares, 27.0 million shares from PIPE and 11.5 million Khosla shares (including 1.1 million private placement shares and 10.4 million sponsor promote shares; excludes shares from Khosla

investment in PIPE).

Transaction expenses are estimates.

Pro Forma Ownership represents economic interest. Does not reflect 10:1 voting structure. Nextdoor equity holders will retain Class B shares with 10 votes per share. All other investors will hold Class A shares with one vote per share.

41View entire presentation