ValueAct Capital Activist Presentation Deck

Transformation

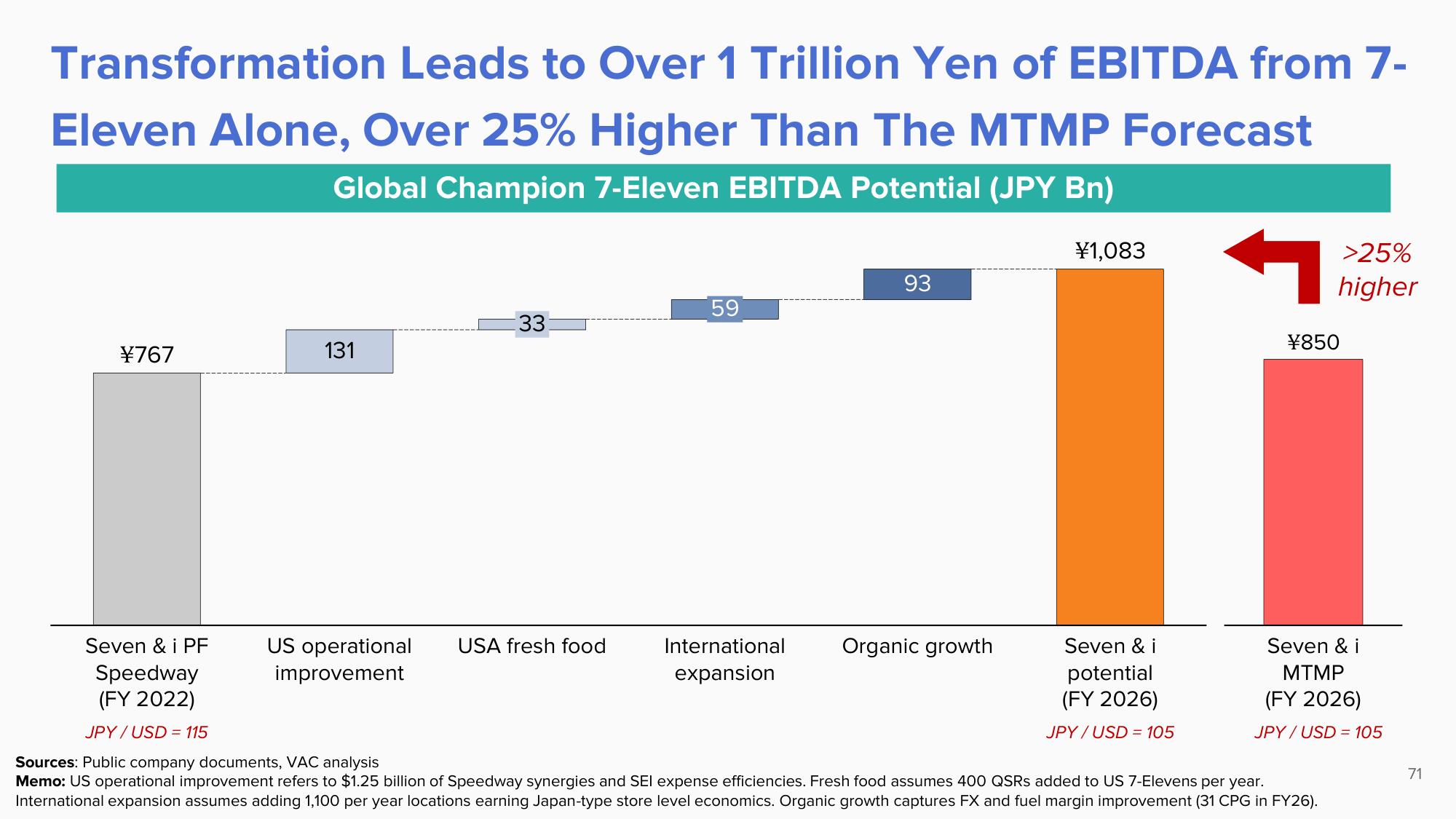

Leads to Over 1 Trillion Yen of EBITDA from 7-

Eleven Alone, Over 25% Higher Than The MTMP Forecast

Global Champion 7-Eleven EBITDA Potential (JPY Bn)

¥767

131

US operational

improvement

33

USA fresh food

59

International

expansion

93

Organic growth

¥1,083

Seven & i PF

Speedway

(FY 2022)

JPY/USD = 115

Sources: Public company documents, VAC analysis

Memo: US operational improvement refers to $1.25 billion of Speedway synergies and SEI expense efficiencies. Fresh food assumes 400 QSRs added to US 7-Elevens per year.

International expansion assumes adding 1,100 per year locations earning Japan-type store level economics. Organic growth captures FX and fuel margin improvement (31 CPG in FY26).

Seven & i

potential

(FY 2026)

JPY/USD = 105

>25%

higher

¥850

Seven & i

MTMP

(FY 2026)

JPY/USD = 105

71View entire presentation