PJT Partners Investment Banking Pitch Book

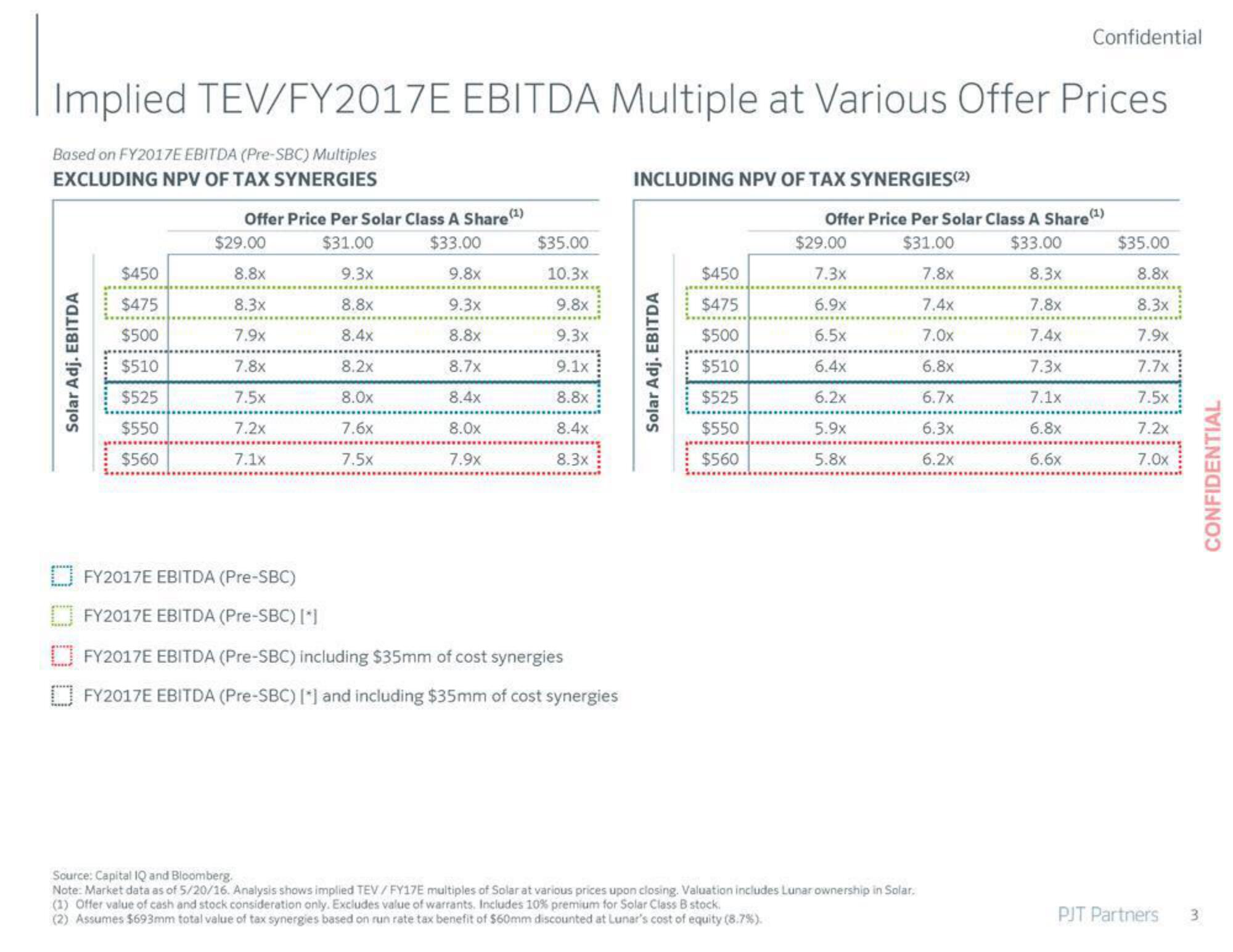

Implied TEV/FY2017E EBITDA Multiple at Various Offer Prices

Based on FY2017E EBITDA (Pre-SBC) Multiples

EXCLUDING NPV OF TAX SYNERGIES

Solar Adj. EBITDA

$450

$475

$500

$510

$525

$550

$560

Offer Price Per Solar Class A Share (¹)

$31.00

$33.00

9.3x

9.8x

8.8x

9.3x

8.4x

8.8x

8.2x

8.7x

8.0x

8.4x

7.6x

8.0x

7.5x

7.9x

$29.00

8.8x

8.3x

7.9x

7.8x

7.5x

7.2x

7.1x

$35.00

10.3x

9.8x

9.3x

9.1x

8.8x

8.4x

8.3x

FY2017E EBITDA (Pre-SBC)

FY2017E EBITDA (Pre-SBC) [*]

FY2017E EBITDA (Pre-SBC) including $35mm of cost synergies

FY2017E EBITDA (Pre-SBC) [*] and including $35mm of cost synergies

INCLUDING NPV OF TAX SYNERGIES(2)

Solar Adj. EBITDA

$450

$475

$500

$510

$525

$550

$560

Confidential

Offer Price Per Solar Class A Share (¹)

$31.00

$33.00

7.8x

8.3x

7.4x

7.8x

7.0x

7.4x

6.8x

7.3x

6.7x

7.1x

6.3x

6.8x

6.2x

6.6x

$29.00

7.3x

6.9x

6.5x

6.4x

6.2x

5.9x

5.8x

Source: Capital IQ and Bloomberg.

Note: Market data as of 5/20/16. Analysis shows implied TEV/FY17E multiples of Solar at various prices upon closing. Valuation includes Lunar ownership in Solar,

(1) Offer value of cash and stock consideration only. Excludes value of warrants. Includes 10% premium for Solar Class B stock.

(2) Assumes $693mm total value of tax synergies based on run rate tax benefit of $60mm discounted at Lunar's cost of equity (8.7%).

$35.00

8.8x

8.3x

7.9x

7.7x

7.5x

7.2x

7.0x

PJT Partners

3

CONFIDENTIALView entire presentation