Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

●

13,886

299

4,302

PERFORMANCE

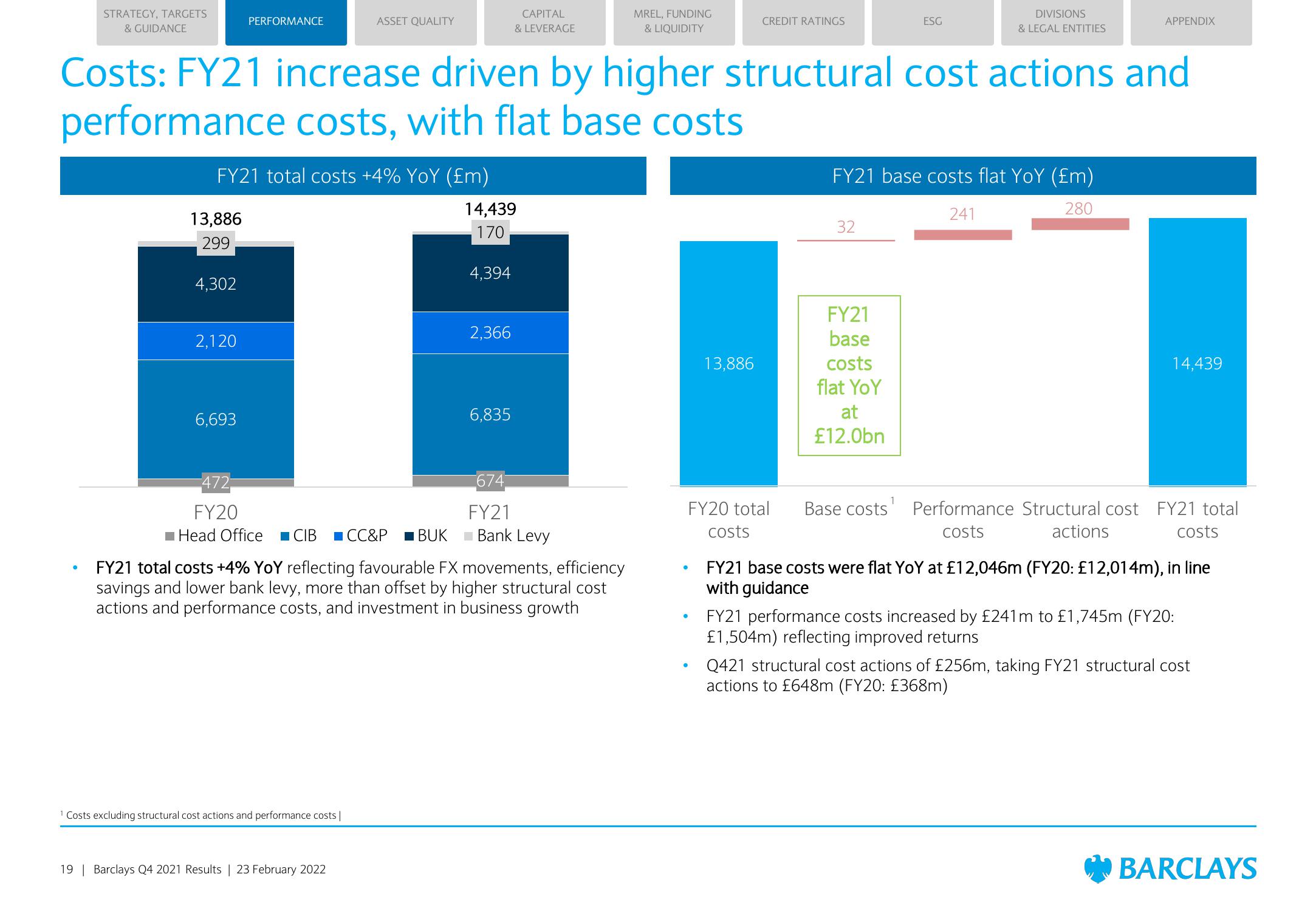

FY21 total costs +4% YoY (£m)

14,439

170

2,120

6,693

ASSET QUALITY

Costs: FY21 increase driven by higher structural cost actions and

performance costs, with flat base costs

472

FY20

Head Office ■CIB ■CC&P ■BUK

¹ Costs excluding structural cost actions and performance costs |

19 | Barclays Q4 2021 Results | 23 February 2022

4,394

CAPITAL

& LEVERAGE

2,366

6,835

FY21 total costs +4% YoY reflecting favourable FX movements, efficiency

savings and lower bank levy, more than offset by higher structural cost

actions and performance costs, and investment in business growth

674

FY21

Bank Levy

MREL, FUNDING

& LIQUIDITY

CREDIT RATINGS

13,886

ESG

32

DIVISIONS

& LEGAL ENTITIES

FY21 base costs flat YoY (Em)

280

241

FY21

base

costs

flat YoY

at

£12.0bn

APPENDIX

14,439

FY20 total Base costs Performance Structural cost FY21 total

costs

costs

actions

costs

FY21 base costs were flat YoY at £12,046m (FY20: £12,014m), in line

with guidance

FY21 performance costs increased by £241m to £1,745m (FY20:

£1,504m) reflecting improved returns

Q421 structural cost actions of £256m, taking FY21 structural cost

actions to £648m (FY20: £368m)

BARCLAYSView entire presentation