Silicon Valley Bank Results Presentation Deck

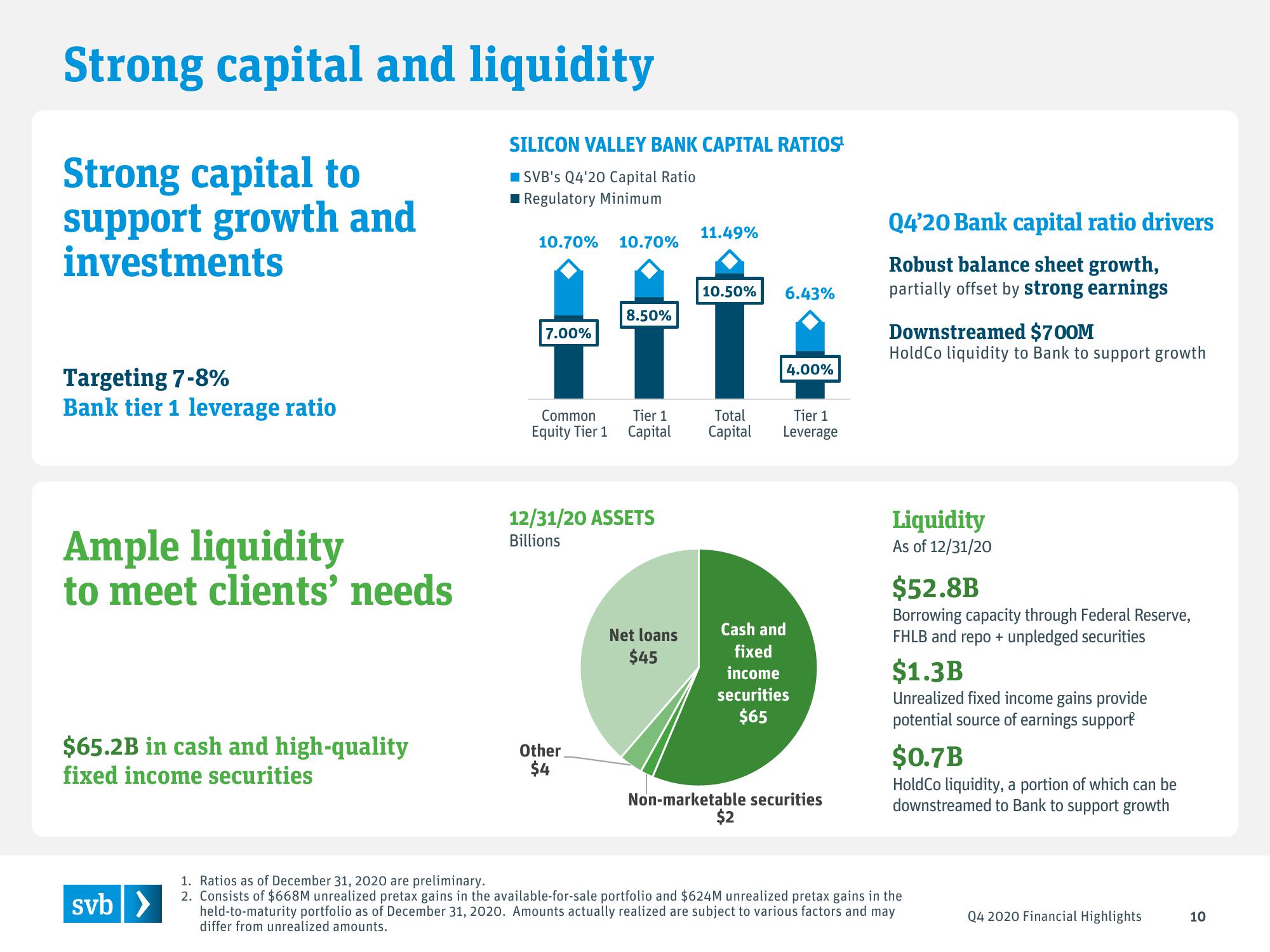

Strong capital and liquidity

Strong capital to

support growth and

investments

Targeting 7-8%

Bank tier 1 leverage ratio

Ample liquidity

to meet clients' needs

$65.2B in cash and high-quality

fixed income securities

svb >

SILICON VALLEY BANK CAPITAL RATIOS¹

SVB's Q4'20 Capital Ratio

I Regulatory Minimum

10.70% 10.70%

7.00%

Common

Equity Tier 1

Other

$4

Tier 1

Capital

12/31/20 ASSETS

Billions

8.50%

TT

11.49%

Net loans

$45

10.50% 6.43%

Total

Capital

4.00%

Tier 1

Leverage

Cash and

fixed

income

securities

$65

$2

Non-marketable securities

Q4'20 Bank capital ratio drivers

Robust balance sheet growth,

partially offset by strong earnings

Downstreamed $700M

HoldCo liquidity to Bank to support growth

Liquidity

As of 12/31/20

$52.8B

Borrowing capacity through Federal Reserve,

FHLB and repo + unpledged securities

$1.3B

Unrealized fixed income gains provide

potential source of earnings support

$0.7B

HoldCo liquidity, a portion of which can be

downstreamed to Bank to support growth

1. Ratios as of December 31, 2020 are preliminary.

2. Consists of $668M unrealized pretax gains in the available-for-sale portfolio and $624M unrealized pretax gains in the

held-to-maturity portfolio as of December 31, 2020. Amounts actually realized are subject to various factors and may

differ from unrealized amounts.

Q4 2020 Financial Highlights

10View entire presentation