Polestar Investor Presentation Deck

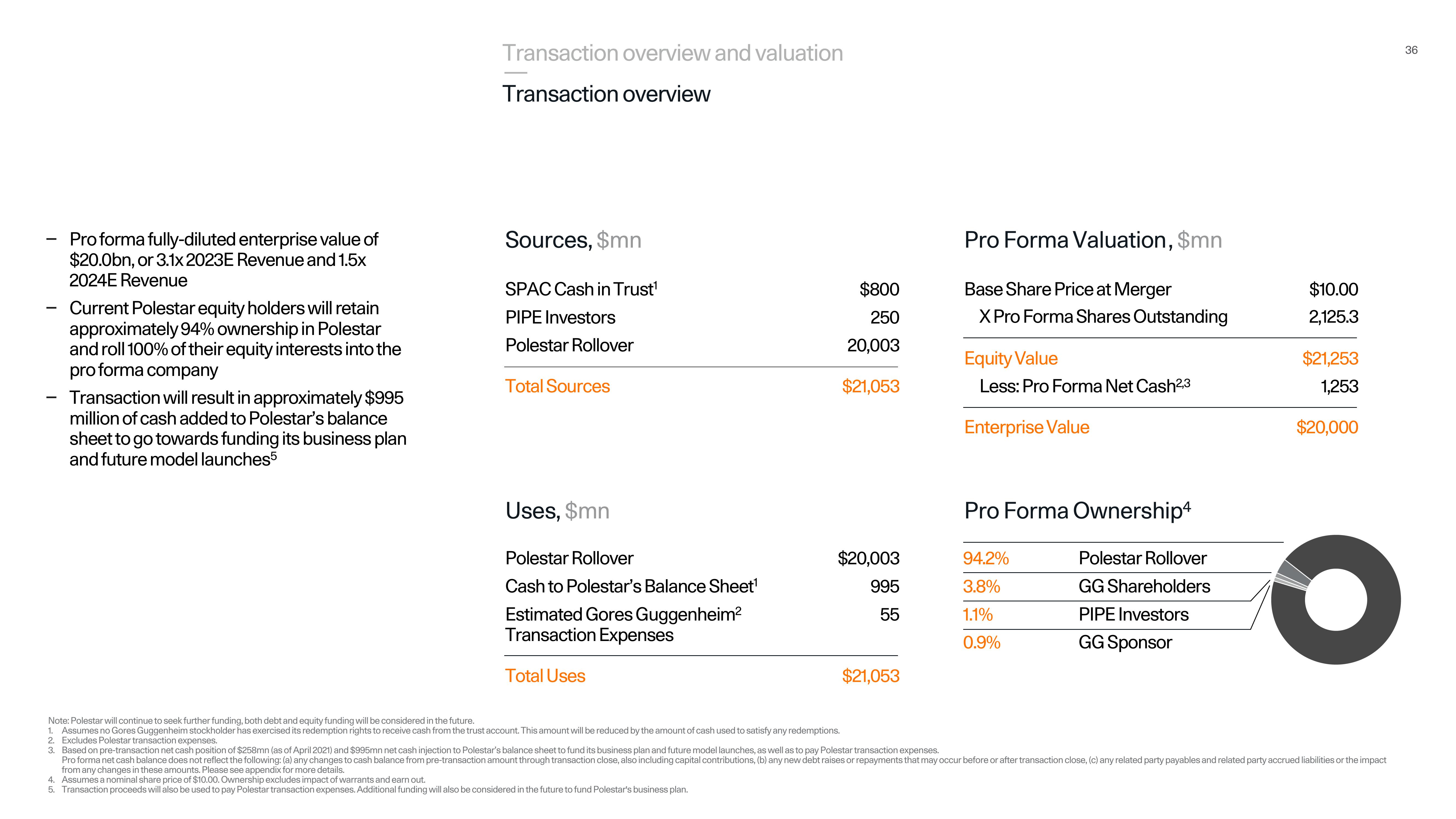

Proforma fully-diluted enterprise value of

$20.0bn, or 3.1x 2023E Revenue and 1.5x

2024E Revenue

Current Polestar equity holders will retain

approximately 94% ownership in Polestar

and roll 100% of their equity interests into the

pro forma company

Transaction will result in approximately $995

million of cash added to Polestar's balance

sheet to go towards funding its business plan

and future model launches5

Transaction overview and valuation

Transaction overview

Sources, $mn

SPAC Cash in Trust¹

PIPE Investors

Polestar Rollover

Total Sources

Uses, $mn

Polestar Rollover

Cash to Polestar's Balance Sheet¹

Estimated Gores Guggenheim²

Transaction Expenses

Total Uses

Note: Polestar will continue to seek further funding, both debt and equity funding will be considered in the future.

1. Assumes no Gores Guggenheim stockholder has exercised its redemption rights to receive cash from the trust account. This amount will be reduced by the amount of cash used to satisfy any redemptions.

$800

250

20,003

$21,053

$20,003

995

55

4. Assumes a nominal share price of $10.00. Ownership excludes impact of warrants and earn out.

5. Transaction proceeds will also be used to pay Polestar transaction expenses. Additional funding will also be considered in the future to fund Polestar's business plan.

$21,053

Pro Forma Valuation, $mn

Base Share Price at Merger

X Pro Forma Shares Outstanding

Equity Value

Less: Pro Forma Net Cash²,3

Enterprise Value

Pro Forma Ownership4

94.2%

3.8%

1.1%

0.9%

Polestar Rollover

GG Shareholders

PIPE Investors

GG Sponsor

$10.00

2,125.3

$21,253

1,253

$20,000

2. Excludes Polestar transaction expenses.

3. Based on pre-transaction net cash position of $258mn (as of April 2021) and $995mn net cash injection to Polestar's balance sheet to fund its business plan and future model launches, as well as to pay Polestar transaction expenses.

Pro forma net cash balance does not reflect the following: (a) any changes to cash balance from pre-transaction amount through transaction close, also including capital contributions, (b) any new debt raises or repayments that may occur before or after transaction close, (c) any related party payables and related party accrued liabilities or the impact

from any changes in these amounts. Please see appendix for more details.

36View entire presentation