Tudor, Pickering, Holt & Co Investment Banking

AR Historical and Projected Taxes

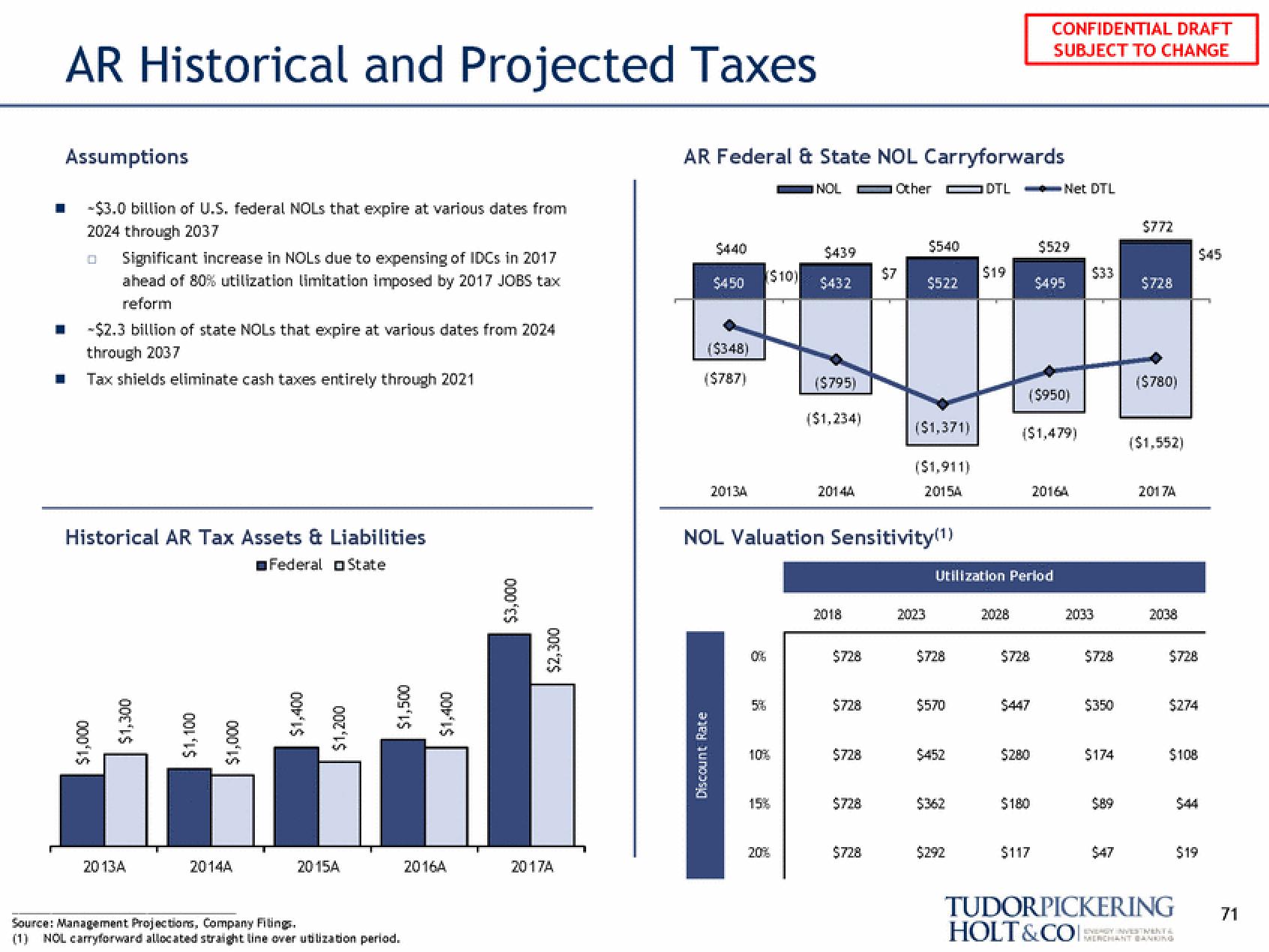

Assumptions

-$3.0 billion of U.S. federal NOLs that expire at various dates from

2024 through 2037

0 Significant increase in NOLS due to expensing of IDCs in 2017

ahead of 80% utilization limitation imposed by 2017 JOBS tax

reform

-$2.3 billion of state NOLS that expire at various dates from 2024

through 2037

Tax shields eliminate cash taxes entirely through 2021

Historical AR Tax Assets & Liabilities

Federal State

$1,000

$1,300

2013A

$1,100

$1,000

2014A

$1,400

$1,200

2015A

$1,500

$1,400

Source: Management Projections, Company Filings.

(1) NOL carryforward allocated straight line over utilization period.

2016A

$3,000

$2,300

2017A

AR Federal & State NOL Carryforwards

NOL

Other DTL

$440

$450

($348)

($787)

Discount Rate

2013A

($10)

06

5%

10%

15%

$439

$432

20%

($795)

($1,234)

NOL Valuation Sensitivity(¹)

2014A

2018

$728

$728

$728

$728

$7

$728

$540

$522

($1,371)

($1,911)

2015A

2023

$728

$570

$452

$362

$19

$292

Utilization Period

2028

$728

$447

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

($950)

($1,479)

$280

$180

$117

Net DTL

$529

$495

2016A

$33

2033

$728

$350

$174

$89

$47

$772

$728

($780)

($1,552)

2017A

2038

$728

$274

$108

TUDORPICKERING

HOLT&CO

EVERGY INVESTMENTS

MERCHANT BANKING

$45

$44

$19

71View entire presentation