Affirm Results Presentation Deck

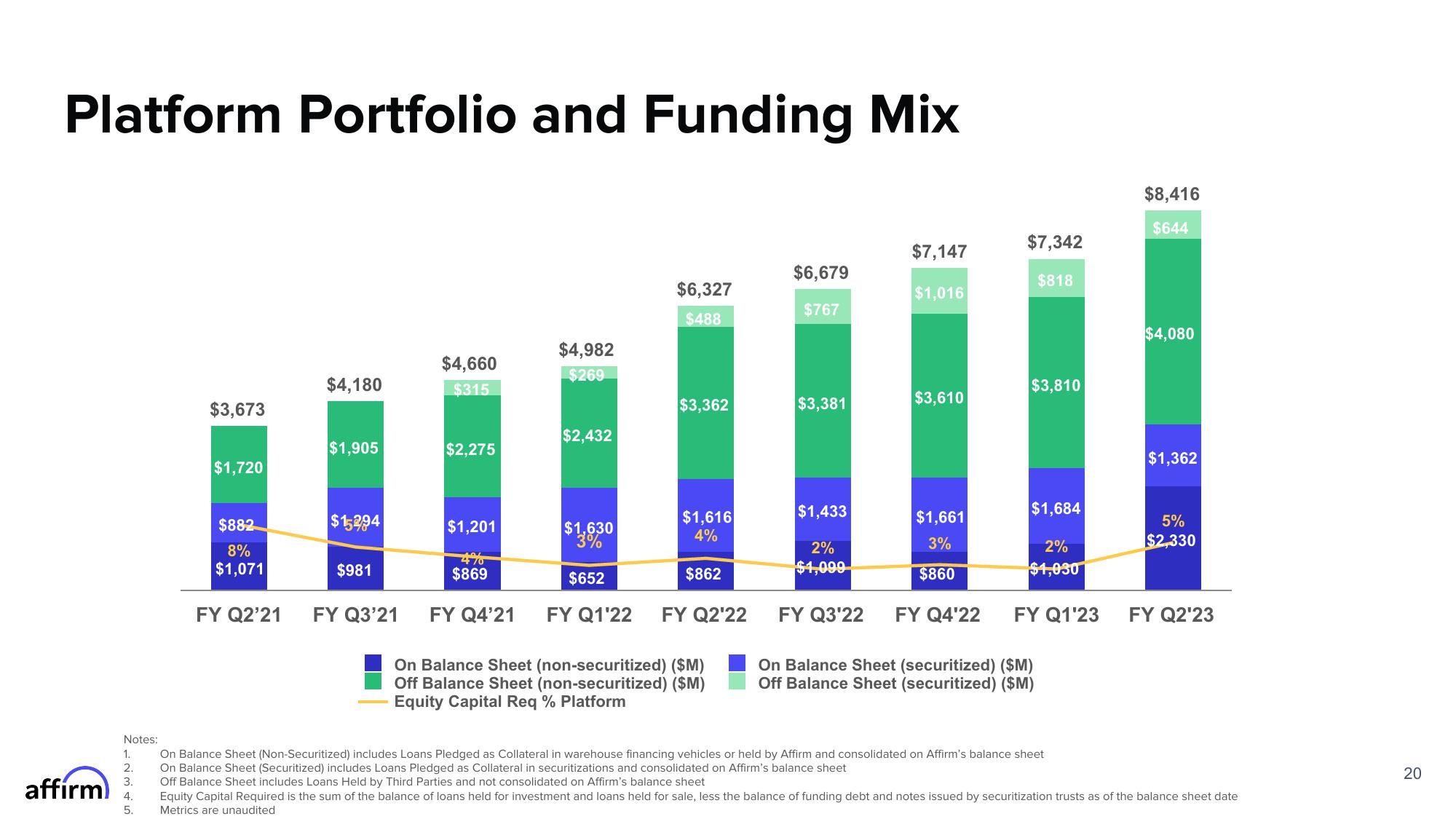

Platform Portfolio and Funding Mix

affirm

Notes:

1.

2.

3.

4.

5.

$3,673

$1,720

$882

8%

$1,071

$4,180

$1,905

$15294

$981

FY Q2'21 FY Q3'21

$4,660

$315

$2,275

$1,201

4%

$869

FY Q4'21

$4,982

$269

$2,432

$1,630

$652

$6,327

$488

$3,362

$1,616

4%

$862

FY Q1'22 FY Q2'22

On Balance Sheet (non-securitized) ($M)

Off Balance Sheet (non-securitized) ($M)

Equity Capital Req % Platform

$6,679

$767

$3,381

$1,433

2%

$1,099

$7,147

$1,016

$3,610

$1,661

3%

$860

$7,342

$818

$3,810

$1,684

2%

$1,030

On Balance Sheet (securitized) ($M)

Off Balance Sheet (securitized) ($M)

$8,416

$644

On Balance Sheet (Non-Securitized) includes Loans Pledged as Collateral in warehouse financing vehicles or held by Affirm and consolidated on Affirm's balance sheet

On Balance Sheet (Securitized) includes Loans Pledged as Collateral in securitizations and consolidated on Affirm's balance sheet

Off Balance Sheet includes Loans Held by Third Parties and not consolidated on Affirm's balance sheet

$4,080

$1,362

FY Q3'22 FY Q4'22 FY Q1'23 FY Q2'23

5%

$2,330

Equity Capital Required is the sum of the balance of loans held for investment and loans held for sale, less the balance of funding debt and notes issued by securitization trusts as of the balance sheet date

Metrics are unaudited

20View entire presentation