Credit Suisse Results Presentation Deck

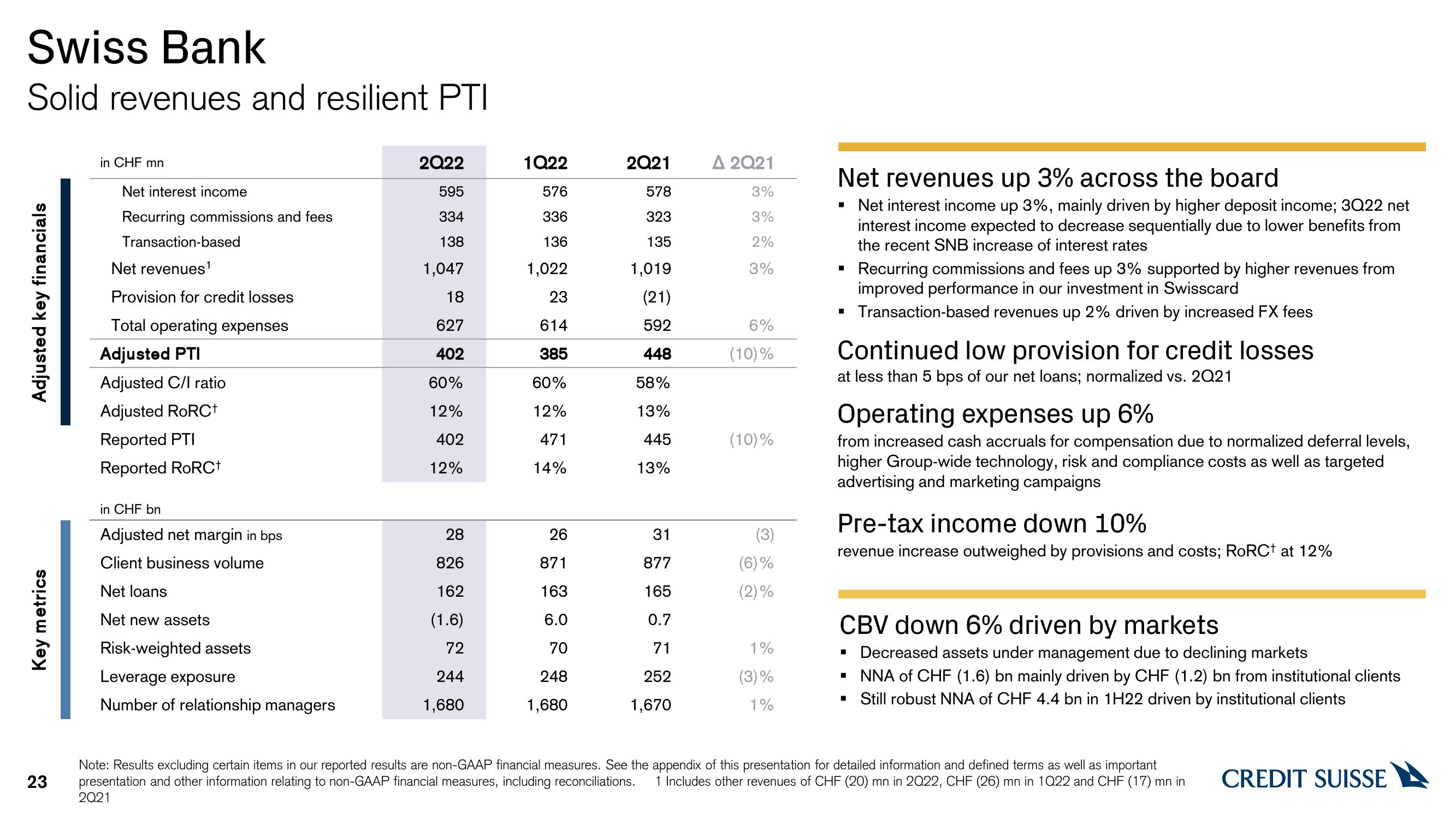

Swiss Bank

Solid revenues and resilient PTI

Adjusted key financials

Key metrics

23

in CHF mn

Net interest income

Recurring commissions and fees

Transaction-based

Net revenues¹

Provision for credit losses

Total operating expenses

Adjusted PTI

Adjusted C/I ratio

Adjusted RoRC+

Reported PTI

Reported RoRC+

in CHF bn

Adjusted net margin in bps

Client business volume

Net loans

Net new assets

Risk-weighted assets

Leverage exposure

Number of relationship managers

2022

595

334

138

1,047

18

627

402

60%

12%

402

12%

28

826

162

(1.6)

72

244

1,680

1Q22

576

336

136

1,022

23

614

385

60%

12%

471

14%

26

871

163

6.0

70

248

1,680

2Q21

578

323

135

1,019

(21)

592

448

58%

13%

445

13%

31

877

165

0.7

71

252

1,670

Δ 2021

3%

3%

2%

3%

6%

(10)%

(10)%

(3)

(6)%

(2)%

1%

(3)%

1%

Net revenues up 3% across the board

Net interest income up 3%, mainly driven by higher deposit income; 3Q22 net

interest income expected to decrease sequentially due to lower benefits from

the recent SNB increase of interest rates

Recurring commissions and fees up 3% supported by higher revenues from

improved performance in our investment Swisscard

▪ Transaction-based revenues up 2% driven by increased FX fees

Continued low provision for credit losses

at less than 5 bps of our net loans; normalized vs. 2Q21

Operating expenses up 6%

from increased cash accruals for compensation due to normalized deferral levels,

higher Group-wide technology, risk and compliance costs as well as targeted

advertising and marketing campaigns

Pre-tax income down 10%

revenue increase outweighed by provisions and costs; RoRC+ at 12%

CBV down 6% driven by markets

▪ Decreased assets under management due to declining markets

NNA of CHF (1.6) bn mainly driven by CHF (1.2) bn from institutional clients

Still robust NNA of CHF 4.4 bn in 1H22 driven by institutional clients

■

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes other revenues of CHF (20) mn in 2022, CHF (26) mn in 1022 and CHF (17) mn in

2021

CREDIT SUISSEView entire presentation