Q2 2018 Fixed Income Investor Conference Call

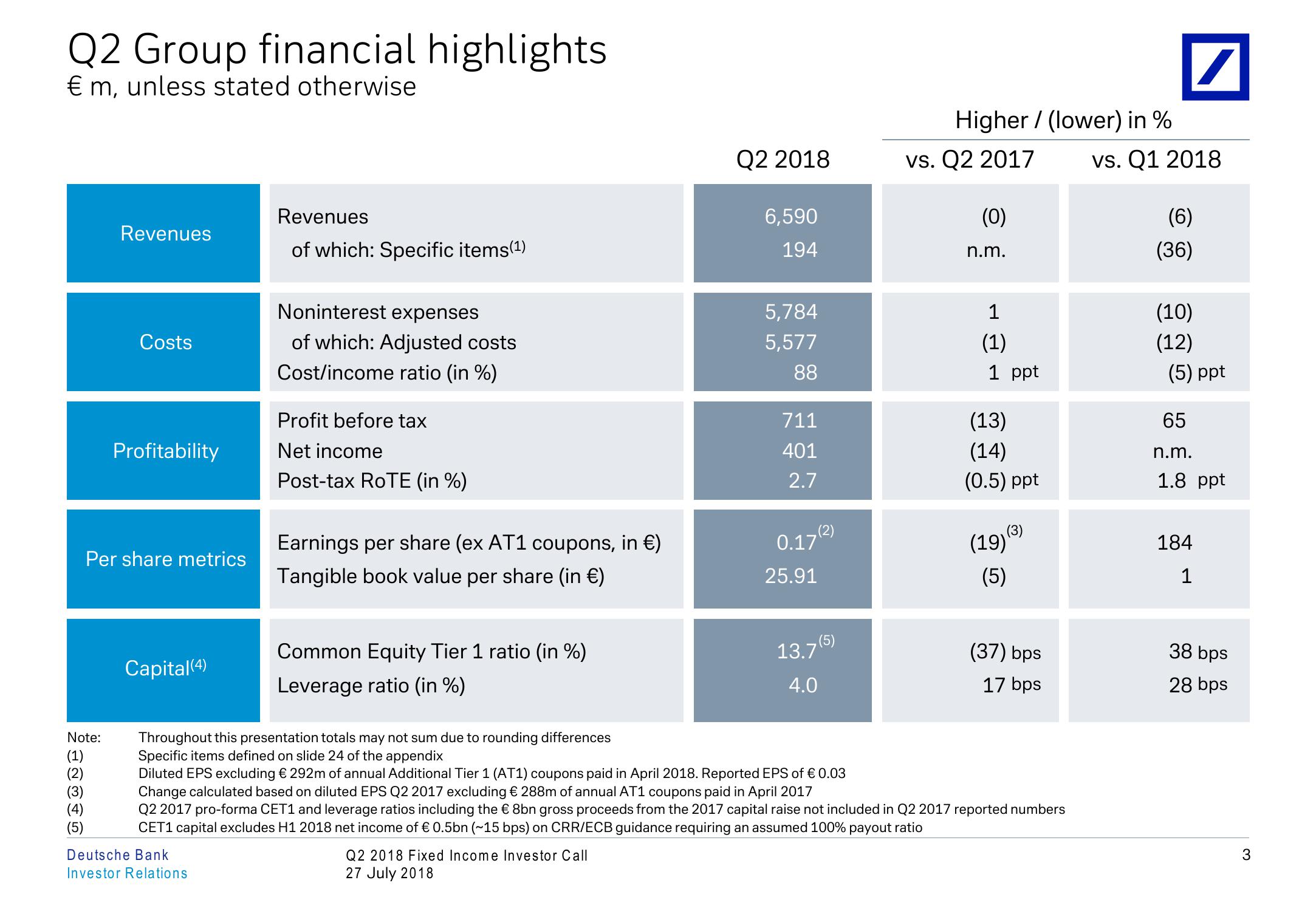

Q2 Group financial highlights

€ m, unless stated otherwise

Higher (lower) in %

Revenues

Revenues

of which: Specific items(1)

Q2 2018

vs. Q2 2017

6,590

(0)

194

n.m.

vs. Q1 2018

(6)

(36)

Noninterest expenses

5,784

1

(10)

Costs

of which: Adjusted costs

5,577

(1)

(12)

Cost/income ratio (in %)

88

1 ppt

(5) ppt

Profit before tax

711

(13)

65

Profitability

Net income

401

(14)

n.m.

Post-tax RoTE (in %)

2.7

(0.5) ppt

1.8 ppt

Earnings per share (ex AT1 coupons, in €)

0.17(2)

Per share metrics

Tangible book value per share (in €)

25.91

(19)

(5)

184

1

Capital(4)

Common Equity Tier 1 ratio (in %)

Leverage ratio (in %)

13.7(5)

(37) bps

38 bps

4.0

17 bps

28 bps

Note:

Throughout this presentation totals may not sum due to rounding differences

(1)

Specific items defined on slide 24 of the appendix

(2)

(3)

Diluted EPS excluding € 292m of annual Additional Tier 1 (AT1) coupons paid in April 2018. Reported EPS of € 0.03

Change calculated based on diluted EPS Q2 2017 excluding € 288m of annual AT1 coupons paid in April 2017

(4)

(5)

Q2 2017 pro-forma CET1 and leverage ratios including the € 8bn gross proceeds from the 2017 capital raise not included in Q2 2017 reported numbers

CET1 capital excludes H1 2018 net income of € 0.5bn (~15 bps) on CRR/ECB guidance requiring an assumed 100% payout ratio

Deutsche Bank

Investor Relations

Q2 2018 Fixed Income Investor Call

27 July 2018

3View entire presentation