Bank of America Investment Banking Pitch Book

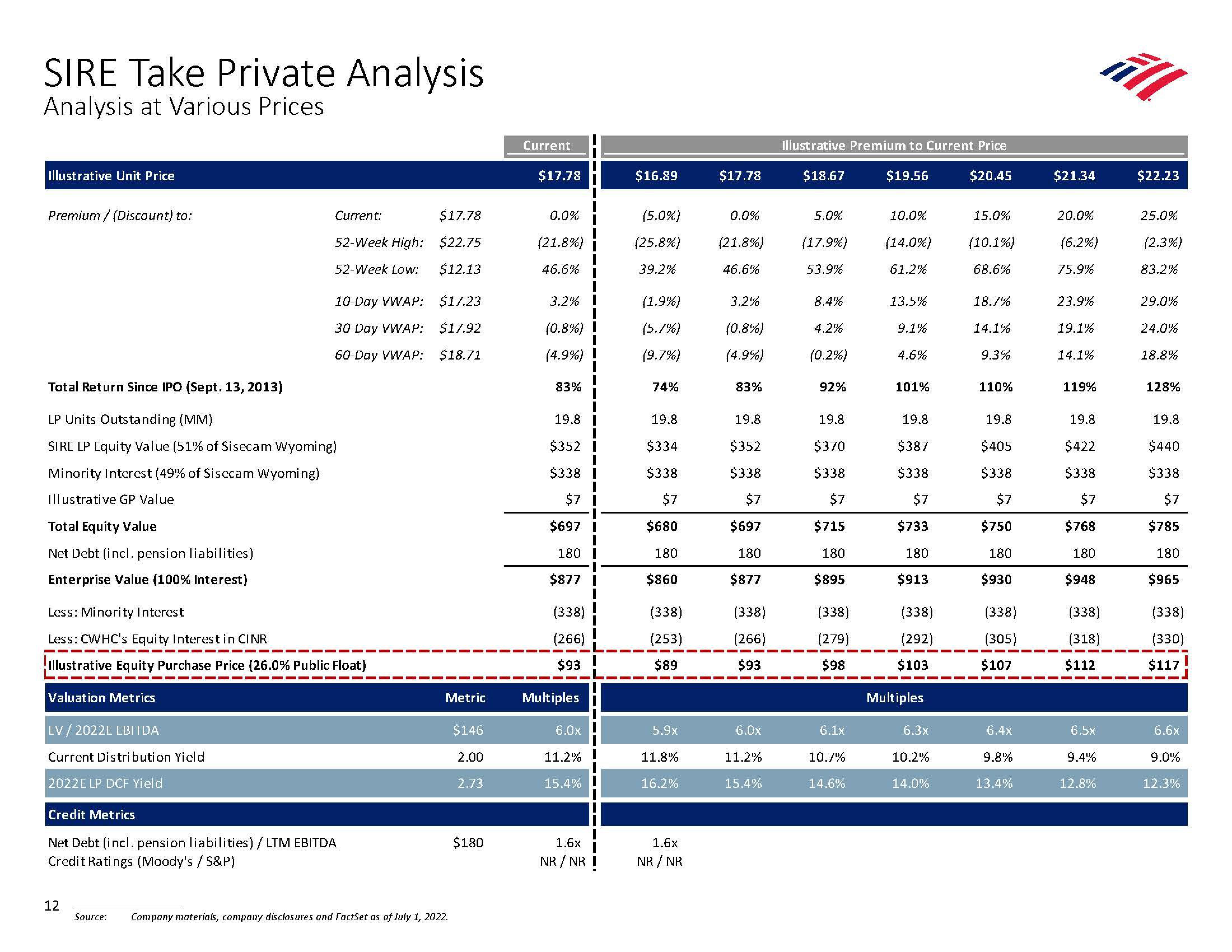

SIRE Take Private Analysis

Analysis at Various Prices

Illustrative Unit Price

Premium/(Discount) to:

Total Equity Value

Net Debt (incl. pension liabilities)

Enterprise Value (100% Interest)

Total Return Since IPO (Sept. 13, 2013)

LP Units Outstanding (MM)

SIRE LP Equity Value (51% of Sisecam Wyoming)

Minority Interest (49% of Sisecam Wyoming)

Illustrative GP Value

Current:

52-Week High:

52-Week Low:

EV/ 2022E EBITDA

Current Distribution Yield

2022E LP DCF Yield

10-Day VWAP:

30-Day VWAP:

60-Day VWAP:

Less: Minority Interest

Less: CWHC's Equity Interest in CINR

Illustrative Equity Purchase Price (26.0% Public Float)

Valuation Metrics

12

Credit Metrics

Net Debt (incl. pension liabilities) / LTM EBITDA

Credit Ratings (Moody's / S&P)

$17.78

$22.75

$12.13

$17.23

$17.92

$18.71

Metric

Source: Company materials, company disclosures and FactSet as of July 1, 2022.

$146

2.00

2.73

$180

Current

$17.78

0.0%

(21.8%) i

46.6%

3.2%

(0.8%) !

(4.9%) I

83%

19.8 I

$352

$338 I

$7

$697 I

180

$877

(338)

(266)

$93

Multiples

6.0x

11.2%

15.4%

1.6x

NR/NR I

$16.89

(5.0%)

(25.8%)

39.2%

(1.9%)

(5.7%)

(9.7%)

74%

19.8

$334

$338

$7

$680

180

$860

(338)

(253)

$89

5.9x

11.8%

16.2%

1.6x

NR / NR

$17.78

0.0%

(21.8%)

46.6%

3.2%

(0.8%)

(4.9%)

83%

19.8

$352

$338

$7

$697

180

$877

(338)

(266)

$93

6.0x

11.2%

15.4%

Illustrative Premium to Current Price

$18.67

5.0%

(17.9%)

53.9%

8.4%

4.2%

(0.2%)

92%

19.8

$370

$338

$7

$715

180

$895

(338)

(279)

$98

6.1x

10.7%

14.6%

$19.56

10.0%

(14.0%)

61.2%

13.5%

9.1%

4.6%

101%

19.8

$387

$338

$7

$733

180

$913

(338)

(292)

$103

Multiples

6.3x

10.2%

14.0%

$20.45

15.0%

(10.1%)

68.6%

18.7%

14.1%

9.3%

110%

19.8

$405

$338

$7

$750

180

$930

(338)

(305)

$107

6.4x

9.8%

13.4%

$21.34

20.0%

(6.2%)

75.9%

23.9%

19.1%

14.1%

119%

19.8

$422

$338

$7

$768

180

$948

(338)

(318)

$112

6.5x

9.4%

12.8%

$22.23

25.0%

(2.3%)

83.2%

29.0%

24.0%

18.8%

128%

19.8

$440

$338

$7

$785

180

$965

(338)

(330)

$117

6.6x

9.0%

12.3%View entire presentation