Stoneridge Strategic Outlook

Stoneridge Evolution and Overview

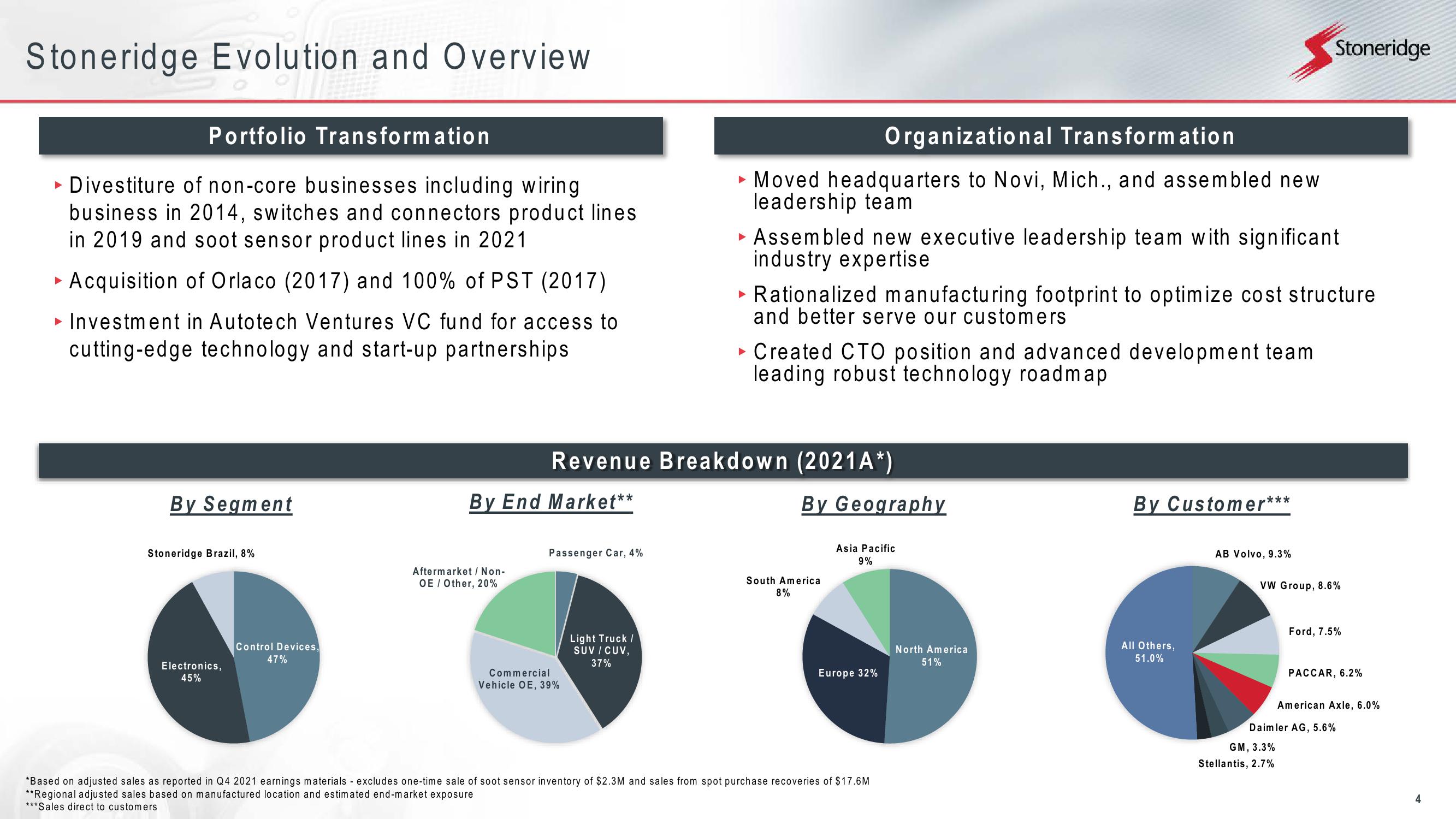

Portfolio Transformation

▸ Divestiture of non-core businesses including wiring

business in 2014, switches and connectors product lines

in 2019 and soot sensor product lines in 2021

► Acquisition of Orlaco (2017) and 100% of PST (2017)

► Investment in Autotech Ventures VC fund for access to

cutting-edge technology and start-up partnerships

By Segment

Stoneridge Brazil, 8%

Electronics,

45%

Control Devices,

47%

By End Market**

Aftermarket / Non-

OE / Other, 20%

Passenger Car, 4%

Commercial

Vehicle OE, 39%

Organizational Transformation

► Moved headquarters to Novi, Mich., and assembled new

leadership team

Revenue Breakdown (2021A*)

Light Truck /

SUV / CUV,

37%

▸ Assembled new executive leadership team with significant

industry expertise

► Rationalized manufacturing footprint to optimize cost structure

and better serve our customers

► Created CTO position and advanced development team

leading robust technology roadmap

By Geography

Asia Pacific

9%

South America

8%

Europe 32%

*Based on adjusted sales as reported in Q4 2021 earnings materials - excludes one-time sale of soot sensor inventory of $2.3M and sales from spot purchase recoveries of $17.6M

**Regional adjusted sales based on manufactured location and estimated end-market exposure

***Sales direct to customers

North America

51%

By Customer*

All Others,

51.0%

.***

Stoneridge

AB Volvo, 9.3%

VW Group, 8.6%

GM, 3.3%

Stellantis, 2.7%

Ford, 7.5%

PACCAR, 6.2%

American Axle, 6.0%

Daimler AG, 5.6%

4View entire presentation