Goldman Sachs Investment Banking Pitch Book

Goldman

Sachs

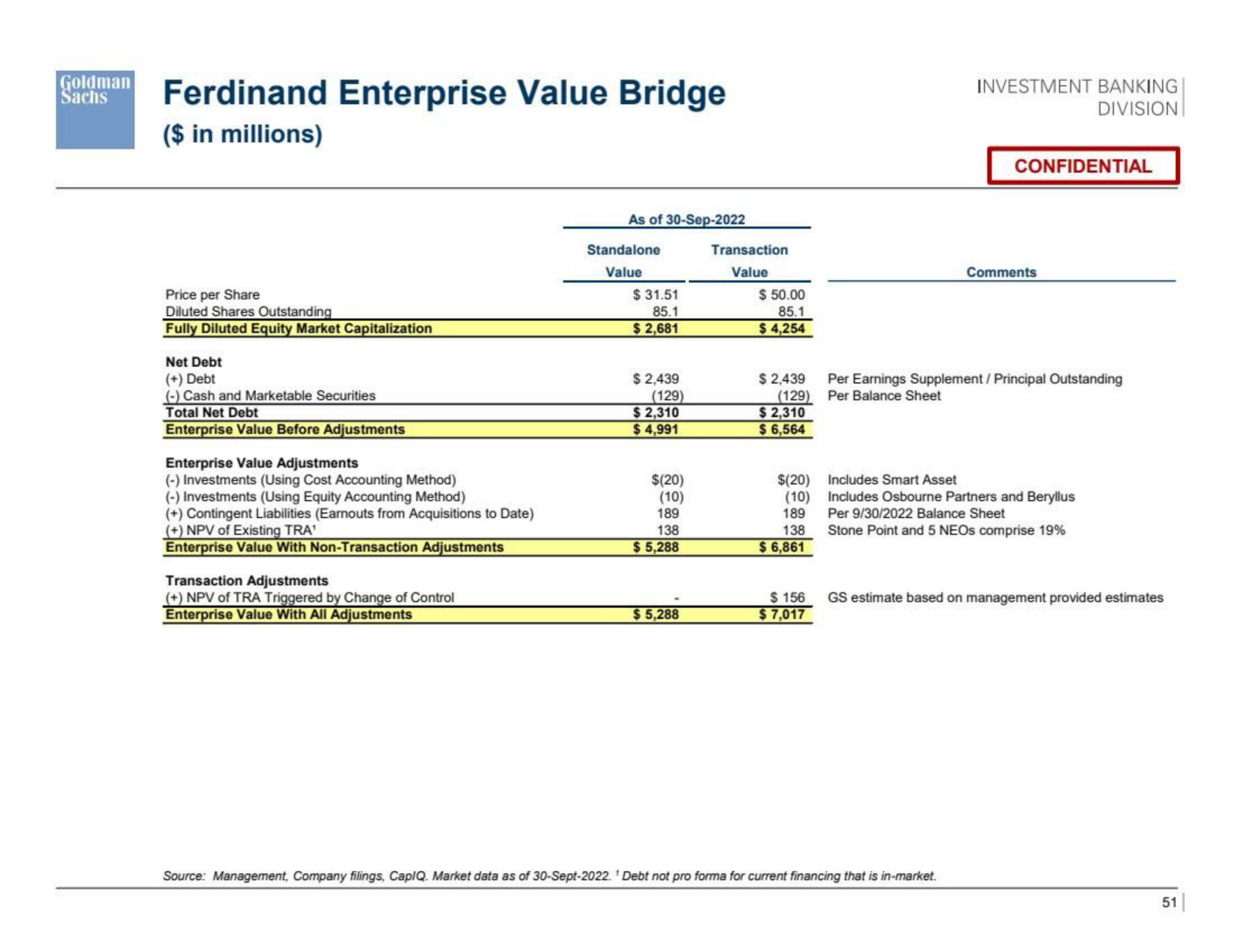

Ferdinand Enterprise Value Bridge

($ in millions)

Price per Share

Diluted Shares Outstanding

Fully Diluted Equity Market Capitalization

Net Debt

(+) Debt

(-) Cash and Marketable Securities

Total Net Debt

Enterprise Value Before Adjustments

Enterprise Value Adjustments

(-) Investments (Using Cost Accounting Method)

(-) Investments (Using Equity Accounting Method)

(+) Contingent Liabilities (Earnouts from Acquisitions to Date)

(+) NPV of Existing TRA¹

Enterprise Value With Non-Transaction Adjustments

Transaction Adjustments

(+) NPV of TRA Triggered by Change of Control

Enterprise Value With All Adjustments

As of 30-Sep-2022

Standalone

Value

$31.51

85.1

$ 2,681

$ 2,439

(129)

$ 2,310

$4,991

$(20)

(10)

189

138

$ 5,288

$5,288

Transaction

Value

$ 50.00

85.1

$ 4,254

$ 2,439

(129)

$2,310

$6,564

$(20) Includes Smart Asset

(10)

189

138

$6,861

$ 156

$7,017

INVESTMENT BANKING

DIVISION

CONFIDENTIAL

Per Earnings Supplement / Principal Outstanding

Per Balance Sheet

Comments

Includes Osbourne Partners and Beryllus

Source: Management, Company filings, CapIQ. Market data as of 30-Sept-2022.¹ Debt not pro forma for current financing that is in-market.

Per 9/30/2022 Balance Sheet

Stone Point and 5 NEOs comprise 19%

GS estimate based on management provided estimates

51|View entire presentation