Third Quarter 2022 Earnings Conference Call

Corporate & Commercial Banking

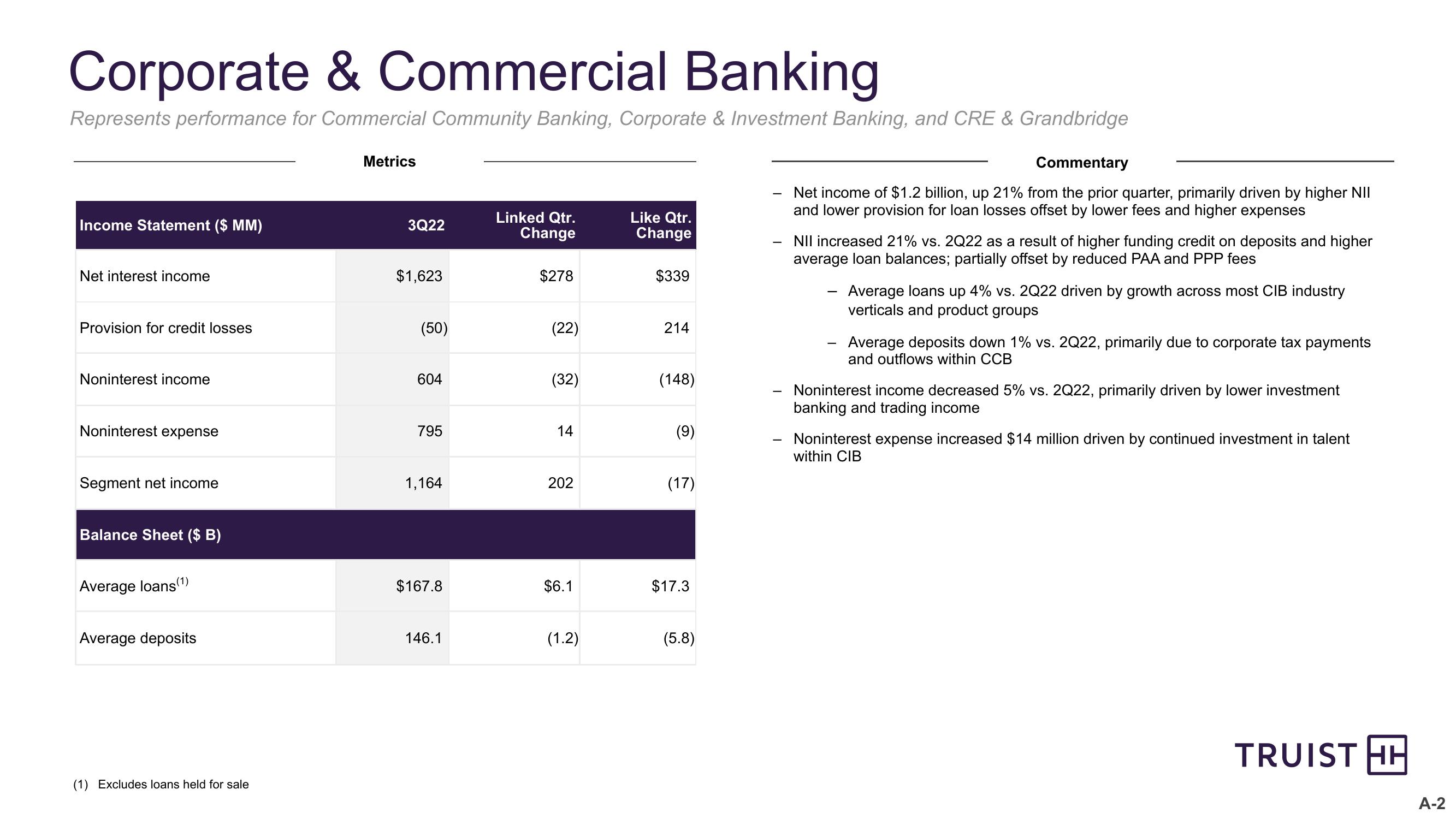

Represents performance for Commercial Community Banking, Corporate & Investment Banking, and CRE & Grandbridge

Income Statement ($ MM)

Net interest income

Provision for credit losses

Noninterest income

Metrics

3Q22

Linked Qtr.

Change

Like Qtr.

Change

$278

$339

$1,623

(50)

(22)

214

604

(32)

(148)

-

Noninterest expense

795

14

(9)

Segment net income

1,164

202

(17)

Balance Sheet ($ B)

Average loans (1)

$167.8

$6.1

$17.3

Average deposits

146.1

(1.2)

(5.8)

Commentary

Net income of $1.2 billion, up 21% from the prior quarter, primarily driven by higher NII

and lower provision for loan losses offset by lower fees and higher expenses

NII increased 21% vs. 2Q22 as a result of higher funding credit on deposits and higher

average loan balances; partially offset by reduced PAA and PPP fees

-

Average loans up 4% vs. 2Q22 driven by growth across most CIB industry

verticals and product groups

Average deposits down 1% vs. 2Q22, primarily due to corporate tax payments

and outflows within CCB

Noninterest income decreased 5% vs. 2Q22, primarily driven by lower investment

banking and trading income

Noninterest expense increased $14 million driven by continued investment in talent

within CIB

(1) Excludes loans held for sale

TRUIST HH

A-2View entire presentation