Crocs Investor Presentation Deck

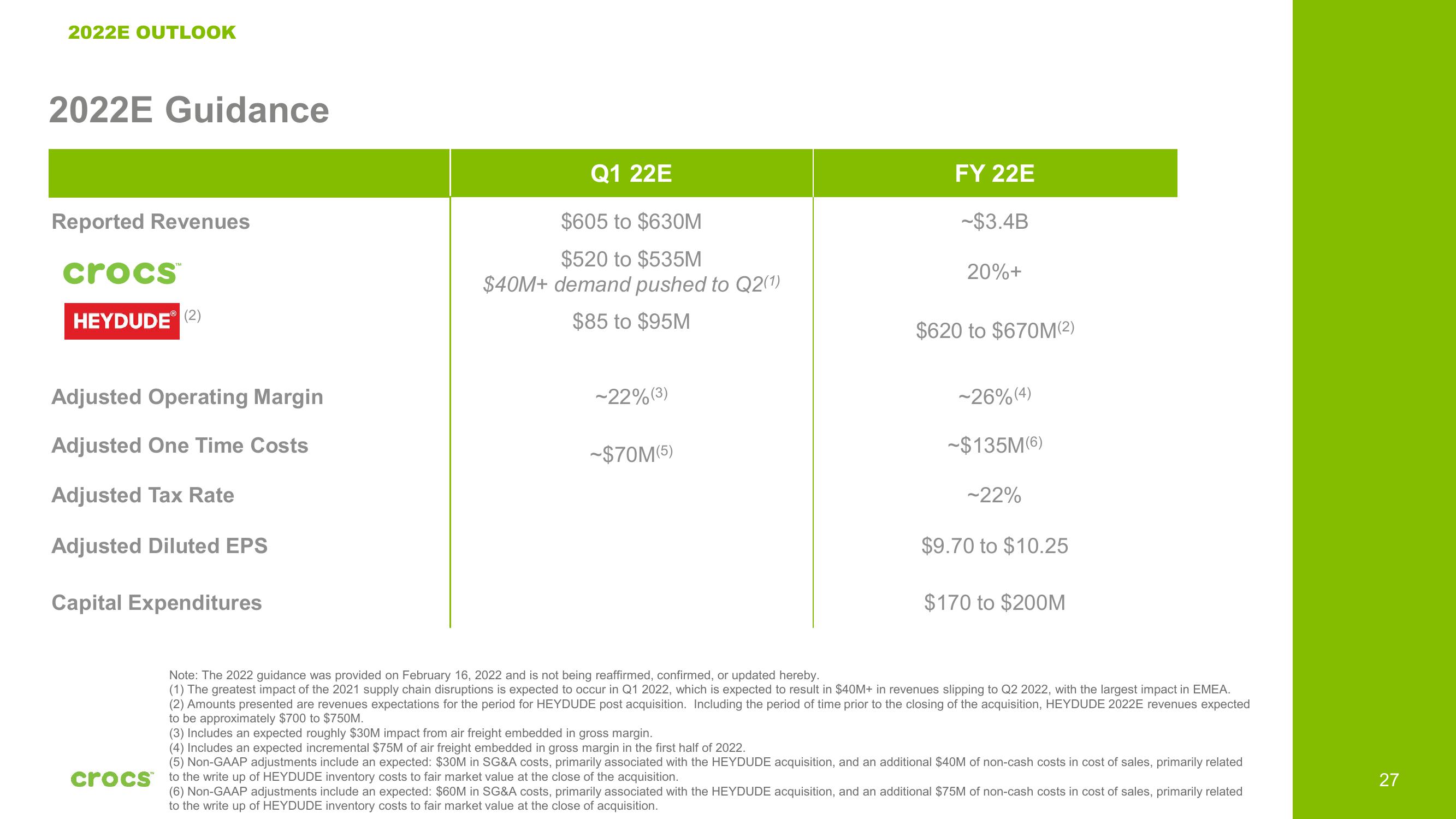

2022E OUTLOOK

2022E Guidance

Reported Revenues

crocs™

HEYDUDEⓇ (2)

Adjusted Operating Margin

Adjusted One Time Costs

Adjusted Tax Rate

Adjusted Diluted EPS

Capital Expenditures

Q1 22E

$605 to $630M

$520 to $535M

$40M+ demand pushed to Q2(1)

$85 to $95M

-22% (3)

~$70M(5)

FY 22E

~$3.4B

20%+

$620 to $670M(2)

-26% (4)

~$135M(6)

~22%

$9.70 to $10.25

$170 to $200M

Note: The 2022 guidance was provided on February 16, 2022 and is not being reaffirmed, confirmed, or updated hereby.

(1) The greatest impact of the 2021 supply chain disruptions is expected to occur in Q1 2022, which is expected to result in $40M+ in revenues slipping to Q2 2022, with the largest impact in EMEA.

(2) Amounts presented are revenues expectations for the period for HEYDUDE post acquisition. Including the period of time prior to the closing of the acquisition, HEYDUDE 2022E revenues expected

to be approximately $700 to $750M.

(3) Includes an expected roughly $30M impact from air freight embedded in gross margin.

(4) Includes an expected incremental $75M of air freight embedded in gross margin in the first half of 2022.

(5) Non-GAAP adjustments include an expected: $30M in SG&A costs, primarily associated with the HEYDUDE acquisition, and an additional $40M of non-cash costs in cost of sales, primarily related

crocs to the write up of HEYDUDE inventory costs to fair market value at the close of the acquisition.

(6) Non-GAAP adjustments include an expected: $60M in SG&A costs, primarily associated with the HEYDUDE acquisition, and an additional $75M of non-cash costs in cost of sales, primarily related

to the write up of HEYDUDE inventory costs to fair market value at the close of acquisition.

27View entire presentation