Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

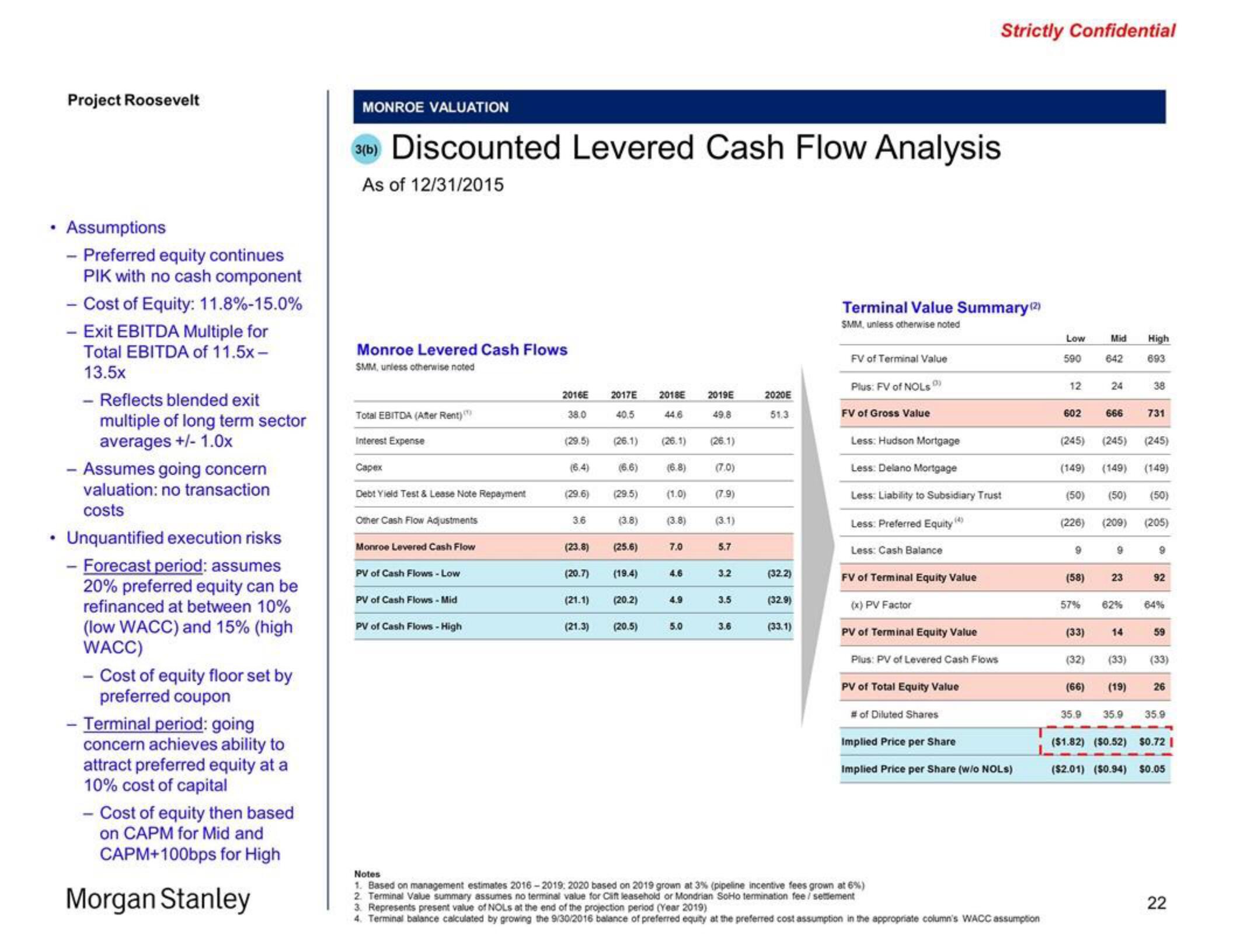

Assumptions

- Preferred equity continues

PIK with no cash component

- Cost of Equity: 11.8%-15.0%

- Exit EBITDA Multiple for

Total EBITDA of 11.5x-

13.5x

- Reflects blended exit

multiple of long term sector

averages +/- 1.0x

- Assumes going concern

valuation: no transaction

costs

Unquantified execution risks

- Forecast period: assumes

20% preferred equity can be

refinanced at between 10%

(low WACC) and 15% (high

WACC)

- Cost of equity floor set by

preferred coupon

- Terminal period: going

concern achieves ability to

attract preferred equity at a

10% cost of capital

- Cost of equity then based

on CAPM for Mid and

CAPM+100bps for High

Morgan Stanley

MONROE VALUATION

3(b) Discounted Levered Cash Flow Analysis

As of 12/31/2015

Monroe Levered Cash Flows

SMM, unless otherwise noted

Total EBITDA (After Rent)

Interest Expense

Capex

Debt Yield Test & Lease Note Repayment

Other Cash Flow Adjustments

Monroe Levered Cash Flow

PV of Cash Flows-Low

PV of Cash Flows - Mid

PV of Cash Flows - High

2016E

38.0

(29.5)

(6.4)

(29.6)

3.6

(23.8)

(20.7)

2017E

40.5

(21.3)

(29.5)

(26.1) (26.1)

(6.6)

(3.8)

(25.6)

(19.4)

(21.1) (20.2)

2018E

(20.5)

44.6

(6.8)

(1.0)

(3.8)

7.0

4.6

4.9

5.0

2019E

49.8

(26.1)

(7.0)

(7.9)

(3.1)

5.7

3.2

3.5

3.6

2020E

51.3

(32.2)

(32.9)

(33.1)

Strictly Confidential

Terminal Value Summary (2²)

SMM, unless otherwise noted

FV of Terminal Value

Plus: FV of NOLs)

FV of Gross Value

Less: Hudson Mortgage

Less: Delano Mortgage

Less: Liability to Subsidiary Trust

Less: Preferred Equity (4)

Less: Cash Balance

FV of Terminal Equity Value

(x) PV Factor

PV of Terminal Equity Value

Plus: PV of Levered Cash Flows

PV of Total Equity Value

# of Diluted Shares

Implied Price per Share

Implied Price per Share (w/o NOLs)

Notes

1. Based on management estimates 2016-2019 2020 based on 2019 grown at 3% (pipeline incentive fees grown at 6%)

2. Terminal Value summary assumes no terminal value for Cift leasehold or Mondrian SoHo termination fee /settlement

3. Represents present value of NOLS at the end of the projection period (Year 2019)

4. Terminal balance calculated by growing the 9/30/2016 balance of preferred equity at the preferred cost assumption in the appropriate column's WACC assumption

Low

590

12

602

(245)

9

(58)

57%

(33)

(149) (149)

(50) (50)

(226)

(209)

(32)

Mid

(66)

35.9

642

24

666

(245)

9

23

62%

14

(33)

(19)

High

693

35.9

38

731

(245)

(149)

(50)

(205)

9

92

64%

59

(33)

26

35.9

($1.82) ($0.52) $0.72 |

($2.01) ($0.94) $0.05

22View entire presentation