TPG Results Presentation Deck

Annual Pro Forma GAAP Statements of Operations Footnotes

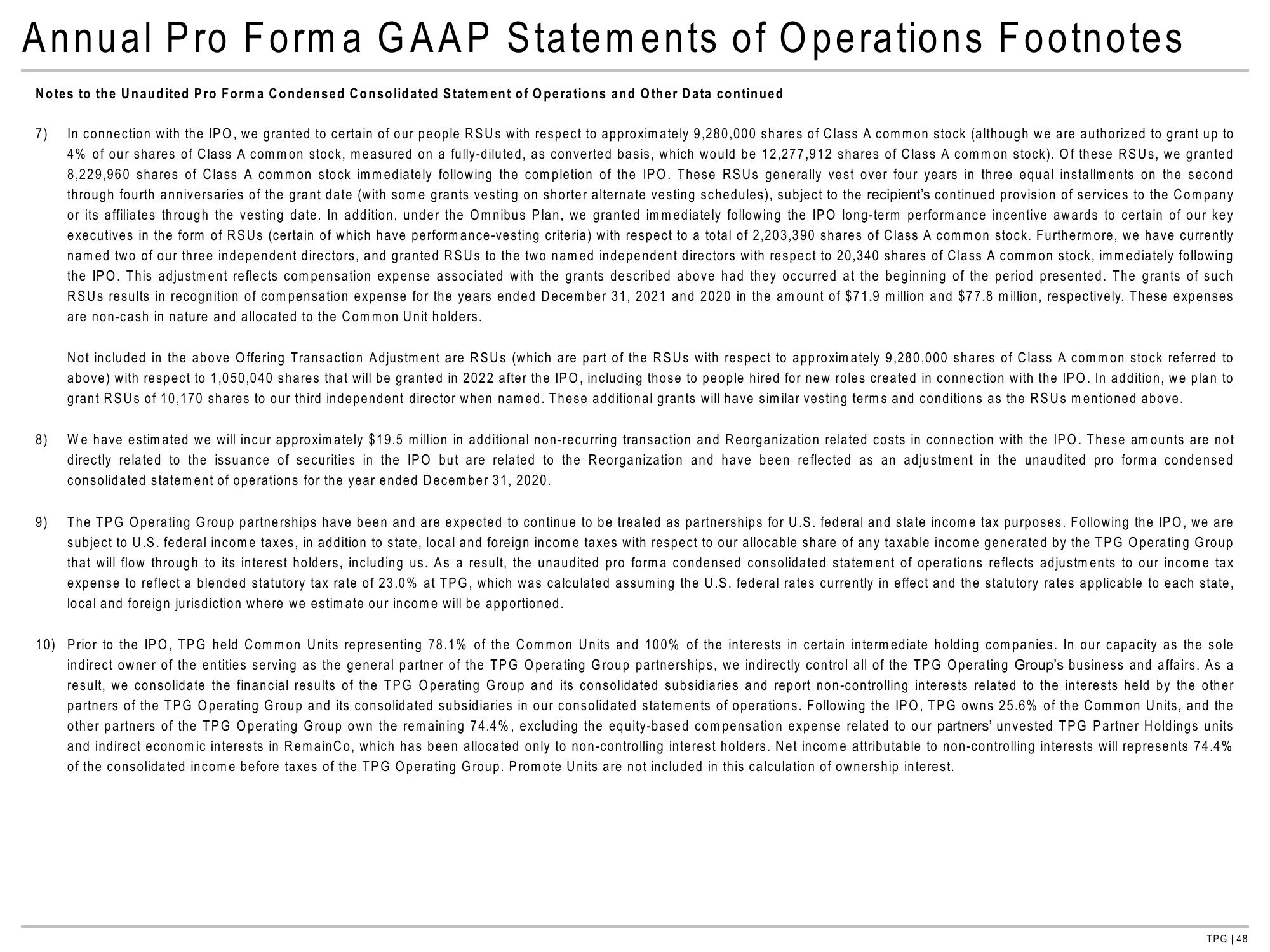

Notes to the Unaudited Pro Forma Condensed Consolidated Statement of Operations and Other Data continued

7)

In connection with the IPO, we granted to certain of our people RSUS with respect to approximately 9,280,000 shares of Class A common stock (although we are authorized to grant up to

4% of our shares of Class A common stock, measured on a fully-diluted, as converted basis, which would be 12,277,912 shares of Class A common stock). Of these RSUS, we granted

8,229,960 shares of Class A common stock immediately following the completion of the IPO. These RSUS generally vest over four years in three equal installments on the second

through fourth anniversaries of the grant date (with some grants vesting on shorter alternate vesting schedules), subject to the recipient's continued provision of services to the Company

or its affiliates through the vesting date. In addition, under the Omnibus Plan, we granted immediately following the IPO long-term performance incentive awards to certain of our key

executives in the form of RSUS (certain of which have performance-vesting criteria) with respect to a total of 2,203,390 shares of Class A common stock. Furthermore, we have currently

named two of our three independent directors, and granted RSUS to the two named independent directors with respect to 20,340 shares of Class A common stock, immediately following

the IPO. This adjustment reflects compensation expense associated with the grants described above had they occurred at the beginning of the period presented. The grants of such

RSUS results in recognition of compensation expense for the years ended December 31, 2021 and 2020 in the amount of $71.9 million and $77.8 million, respectively. These expenses

are non-cash in nature and allocated to the Common Unit holders.

Not included in the above Offering Transaction Adjustment are RSUS (which are part of the RSUs with respect to approximately 9,280,000 shares of Class A common stock referred to

above) with respect to 1,050,040 shares that will be granted in 2022 after the IPO, including those to people hired for new roles created in connection with the IPO. In addition, we plan to

grant RSUS of 10,170 shares to our third independent director when named. These additional grants will have similar vesting terms and conditions as the RSUS mentioned above.

8)

We have estimated we will incur approximately $19.5 million in additional non-recurring transaction and Reorganization related costs in connection with the IPO. These amounts are not

directly related to the issuance of securities in the IPO but are related to the Reorganization and have been reflected as an adjustment in the unaudited pro forma condensed

consolidated statement of operations for the year ended December 31, 2020.

9)

The TPG Operating Group partnerships have been and are expected to continue to be treated as partnerships for U.S. federal and state income tax purposes. Following the IPO, we are

subject to U.S. federal income taxes, in addition to state, local and foreign income taxes with respect to our allocable share of any taxable income generated by the TPG Operating Group

that will flow through to its interest holders, including us. As a result, the unaudited pro forma condensed consolidated statement of operations reflects adjustments to our income tax

expense to reflect a blended statutory tax rate of 23.0% at TPG, which was calculated assuming the U.S. federal rates currently in effect and the statutory rates applicable to each state,

local and foreign jurisdiction where we estimate our income will be apportioned.

10) Prior to the IPO, TPG held Common Units representing 78.1% of the Common Units and 100% of the interests in certain intermediate holding companies. In our capacity as the sole

indirect owner of the entities serving as the general partner of the TPG Operating Group partnerships, we indirectly control all of the TPG Operating Group's business and affairs. As a

result, we consolidate the financial results of the TPG Operating Group and its consolidated subsidiaries and report non-controlling interests related to the interests held by the other

partners of the TPG Operating Group and its consolidated subsidiaries in our consolidated statements of operations. Following the IPO, TPG owns 25.6% of the Common Units, and the

other partners of the TPG Operating Group own the remaining 74.4%, excluding the equity-based compensation expense related to our partners' unvested TPG Partner Holdings units

and indirect economic interests in RemainCo, which has been allocated only to non-controlling interest holders. Net income attributable to non-controlling interests will represents 74.4%

of the consolidated income before taxes of the TPG Operating Group. Promote Units are not included in this calculation of ownership interest.

TPG | 48View entire presentation