First Busey Results Presentation Deck

2Q23 Earnings Investor Presentation

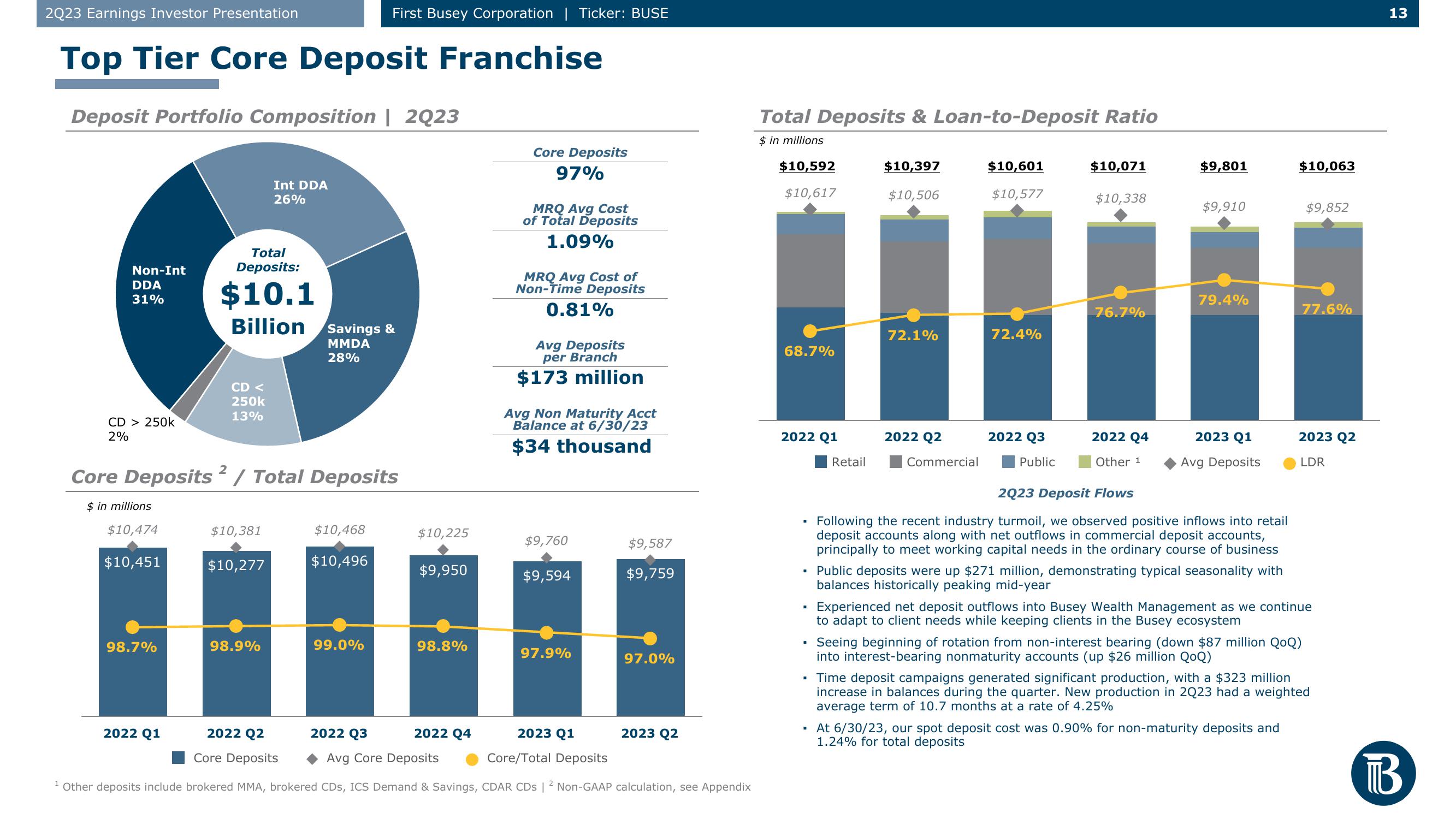

Top Tier Core Deposit Franchise

Deposit Portfolio Composition | 2Q23

Non-Int

DDA

31%

CD > 250k

2%

$10,474

$10,451

98.7%

Total

Deposits:

$10.1

Billion

CD <

250k

13%

2022 Q1

Core Deposits/Total Deposits

$ in millions

$10,381

Int DDA

26%

$10,277

98.9%

First Busey Corporation | Ticker: BUSE

Savings &

MMDA

28%

$10,468

$10,496

99.0%

2022 Q3

$10,225

$9,950

98.8%

Core Deposits

97%

2022 Q4

MRQ Avg Cost

of Total Deposits

1.09%

MRQ Avg Cost of

Non-Time Deposits

0.81%

Avg Deposits

per Branch

$173 million

Avg Non Maturity Acct

Balance at 6/30/23

$34 thousand

$9,760

$9,594

97.9%

2022 Q2

Core Deposits

2023 Q1

Core/Total Deposits

Avg Core Deposits

¹ Other deposits include brokered MMA, brokered CDs, ICS Demand & Savings, CDAR CDs | 2 Non-GAAP calculation, see Appendix

$9,587

$9,759

97.0%

2023 Q2

Total Deposits & Loan-to-Deposit Ratio

$ in millions

$10,592

$10,617

68.7%

2022 Q1

■

■

I

.

·

■

Retail

$10,397

$10,506

72.1%

2022 Q2

Commercial

$10,601

$10,577

72.4%

2022 Q3

Public

$10,071

$10,338

76.7%

2022 Q4

Other 1

$9,801

$9,910

79.4%

2023 Q1

Avg Deposits

2023 Deposit Flows

Following the recent industry turmoil, we observed positive inflows into retail

deposit accounts along with net outflows in commercial deposit accounts,

principally to meet working capital needs in the ordinary course of business

Public deposits were up $271 million, demonstrating typical seasonality with

balances historically peaking mid-year

$10,063

$9,852

77.6%

At 6/30/23, our spot deposit cost was 0.90% for non-maturity deposits and

1.24% for total deposits

2023 Q2

LDR

Experienced net deposit outflows into Busey Wealth Management as we continue

to adapt to client needs while keeping clients in the Busey ecosystem

Seeing beginning of rotation from non-interest bearing (down $87 million QoQ)

into interest-bearing nonmaturity accounts (up $26 million QoQ)

Time deposit campaigns generated significant production, with a $323 million

increase in balances during the quarter. New production in 2Q23 had a weighted

average term of 10.7 months at a rate of 4.25%

13

BView entire presentation