Hydrafacial SPAC Presentation Deck

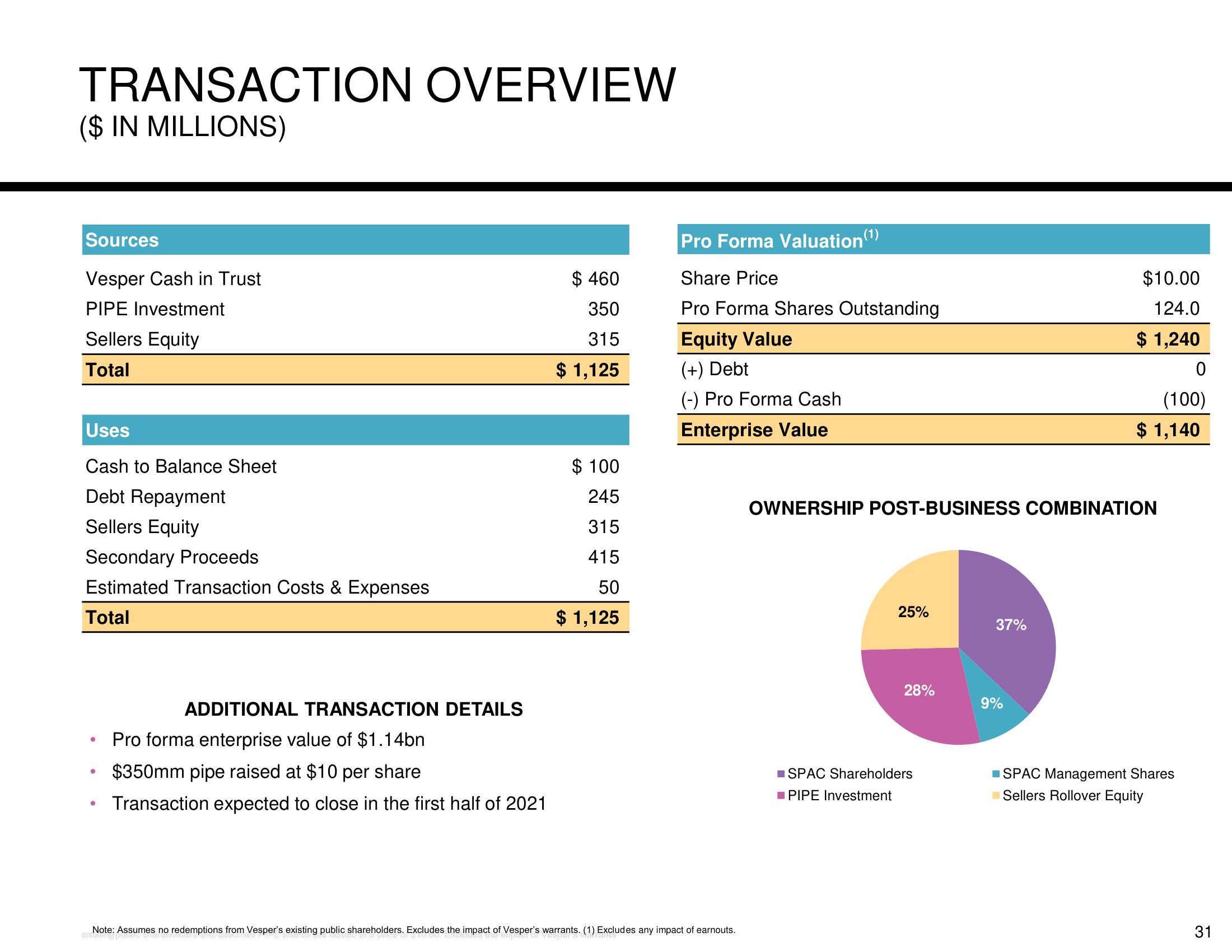

TRANSACTION OVERVIEW

($ IN MILLIONS)

Sources

Vesper Cash in Trust

PIPE Investment

Sellers Equity

Total

Uses

Cash to Balance Sheet

Debt Repayment

Sellers Equity

Secondary Proceeds

Estimated Transaction Costs & Expenses

Total

Ⓡ

●

ADDITIONAL TRANSACTION DETAILS

Pro forma enterprise value of $1.14bn

$350mm pipe raised at $10 per share

Transaction expected to close in the first half of 2021

$ 460

350

315

$ 1,125

$100

245

315

415

50

$ 1,125

(1)

Pro Forma Valuation

Share Price

Pro Forma Shares Outstanding

Equity Value

(+) Debt

(-) Pro Forma Cash

Enterprise Value

Note: Assumes no redemptions from Vesper's existing public shareholders. Excludes the impact of Vesper's warrants. (1) Excludes any impact of earnouts.

existingi

25%

OWNERSHIP POST-BUSINESS COMBINATION

28%

■SPAC Shareholders

■ PIPE Investment

37%

$10.00

124.0

$ 1,240

9%

0

(100)

$ 1,140

■SPAC Management Shares

Sellers Rollover Equity

31View entire presentation