Crocs Results Presentation Deck

cr

CS

cr

OCS

CI

OC

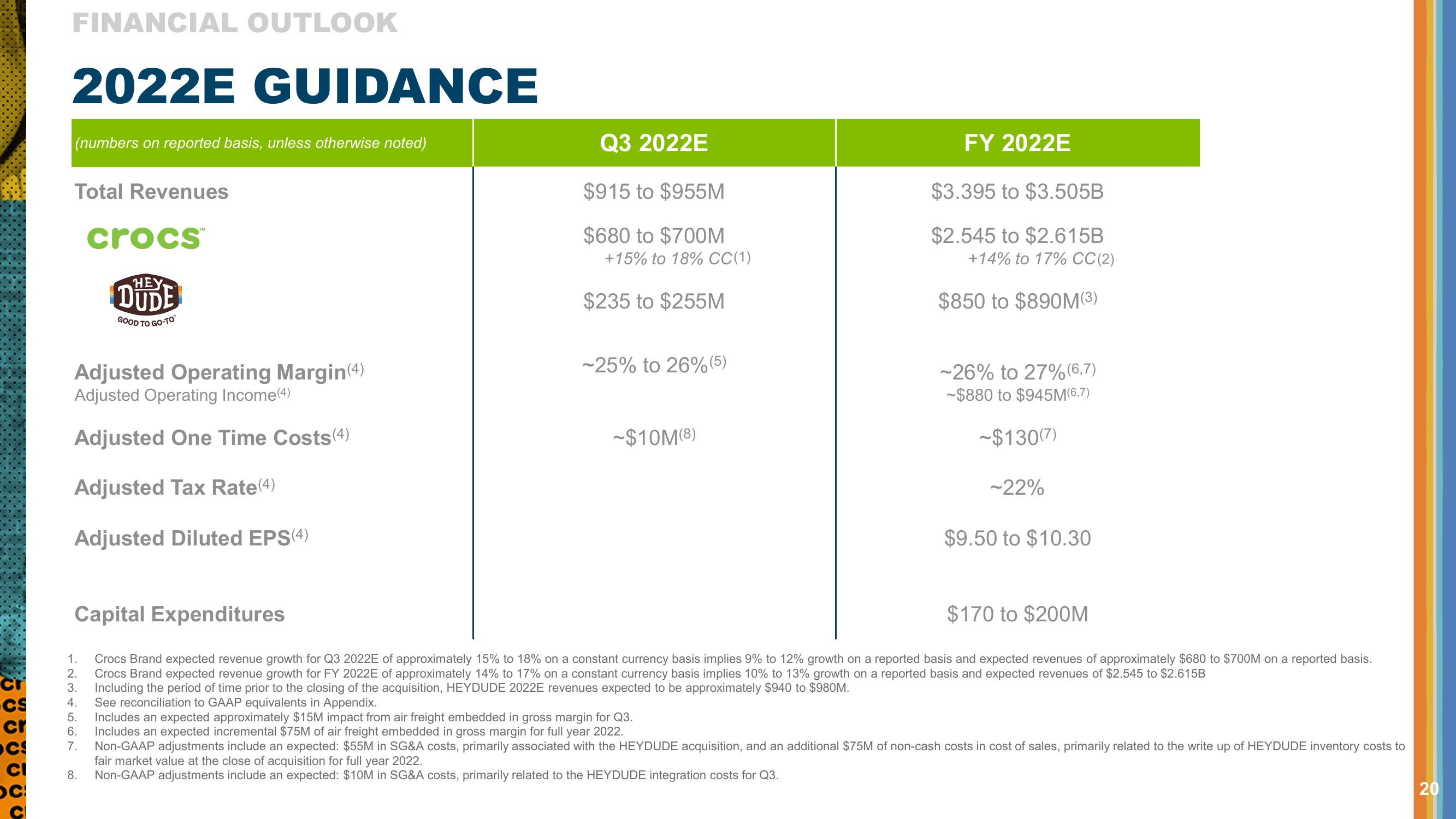

FINANCIAL OUTLOOK

2022E GUIDANCE

(numbers on reported basis, unless otherwise noted)

Total Revenues

crocs™

HEY

DUDE

GOOD TO GO-TO

Adjusted Operating Margin(4)

Adjusted Operating Income(4)

Adjusted One Time Costs (4)

Adjusted Tax Rate(4)

Adjusted Diluted EPS(4)

8.

Q3 2022E

$915 to $955M

$680 to $700M

+15% to 18% CC(1)

$235 to $255M

-25% to 26% (5)

~$10M(8)

FY 2022E

$3.395 to $3.505B

$2.545 to $2.615B

+14% to 17% CC (2)

$850 to $890M (3)

-26% to 27% (6,7)

-$880 to $945M(6,7)

~$130(7)

~22%

$9.50 to $10.30

Capital Expenditures

$170 to $200M

1.

Crocs Brand expected revenue growth for Q3 2022E of approximately 15% to 18% on a constant currency basis implies 9% to 12% growth on a reported basis and expected revenues of approximately $680 to $700M on a reported basis.

2. Crocs Brand expected revenue growth for FY 2022E of approximately 14% to 17% on a constant currency basis implies 10% to 13% growth on a reported basis and expected revenues of $2.545 to $2.615B

3.

Including the period of time prior to the closing of the acquisition, HEYDUDE 2022E revenues expected to be approximately $940 to $980M.

4.

See reconciliation

GAAP equivalents in Appendix.

5.

6.

7.

Includes an expected approximately $15M impact from air freight embedded in gross margin for Q3.

Includes an expected incremental $75M of air freight embedded in gross margin for full year 2022.

Non-GAAP adjustments include an expected: $55M in SG&A costs, primarily associated with the HEYDUDE acquisition, and an additional $75M of non-cash costs in cost of sales, primarily related to the write up of HEYDUDE inventory costs to

fair market value at the close of acquisition for full year 2022.

Non-GAAP adjustments include an expected: $10M in SG&A costs, primarily related to the HEYDUDE integration costs for Q3.

20View entire presentation