Blackwells Capital Activist Presentation Deck

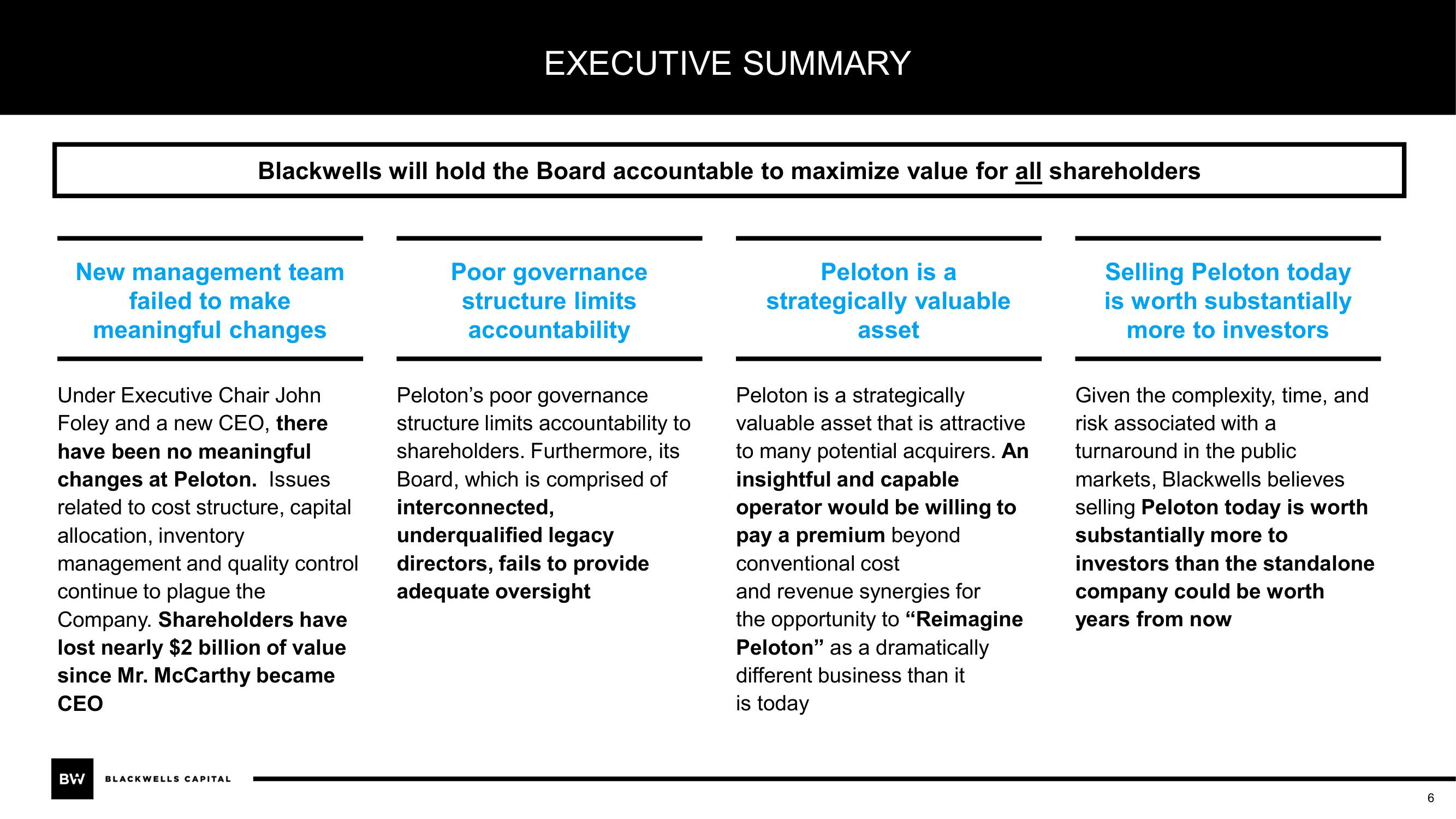

New management team

failed to make

meaningful changes

Blackwells will hold the Board accountable to maximize value for all shareholders

Under Executive Chair John

Foley and a new CEO, there

have been no meaningful

changes at Peloton. Issues

related to cost structure, capital

allocation, inventory

management and quality control

continue to plague the

Company. Shareholders have

lost nearly $2 billion of value

since Mr. McCarthy became

CEO

BW BLACKWELLS CAPITAL

EXECUTIVE SUMMARY

Poor governance

structure limits

accountability

Peloton's poor governance

structure limits accountability to

shareholders. Furthermore, its

Board, which is comprised of

interconnected,

underqualified legacy

directors, fails to provide

adequate oversight

Peloton is a

strategically valuable

asset

Peloton is a strategically

valuable asset that is attractive

to many potential acquirers. An

insightful and capable

operator would be willing to

pay a premium beyond

conventional cost

and revenue synergies for

the opportunity to "Reimagine

Peloton" as a dramatically

different business than it

is today

Selling Peloton today

is worth substantially

more to investors

Given the complexity, time, and

risk associated with a

turnaround in the public

markets, Blackwells believes

selling Peloton today is worth

substantially more to

investors than the standalone

company could be worth

years from now

6View entire presentation