Cadre Holdings IPO Presentation Deck

ACQUISITIONS

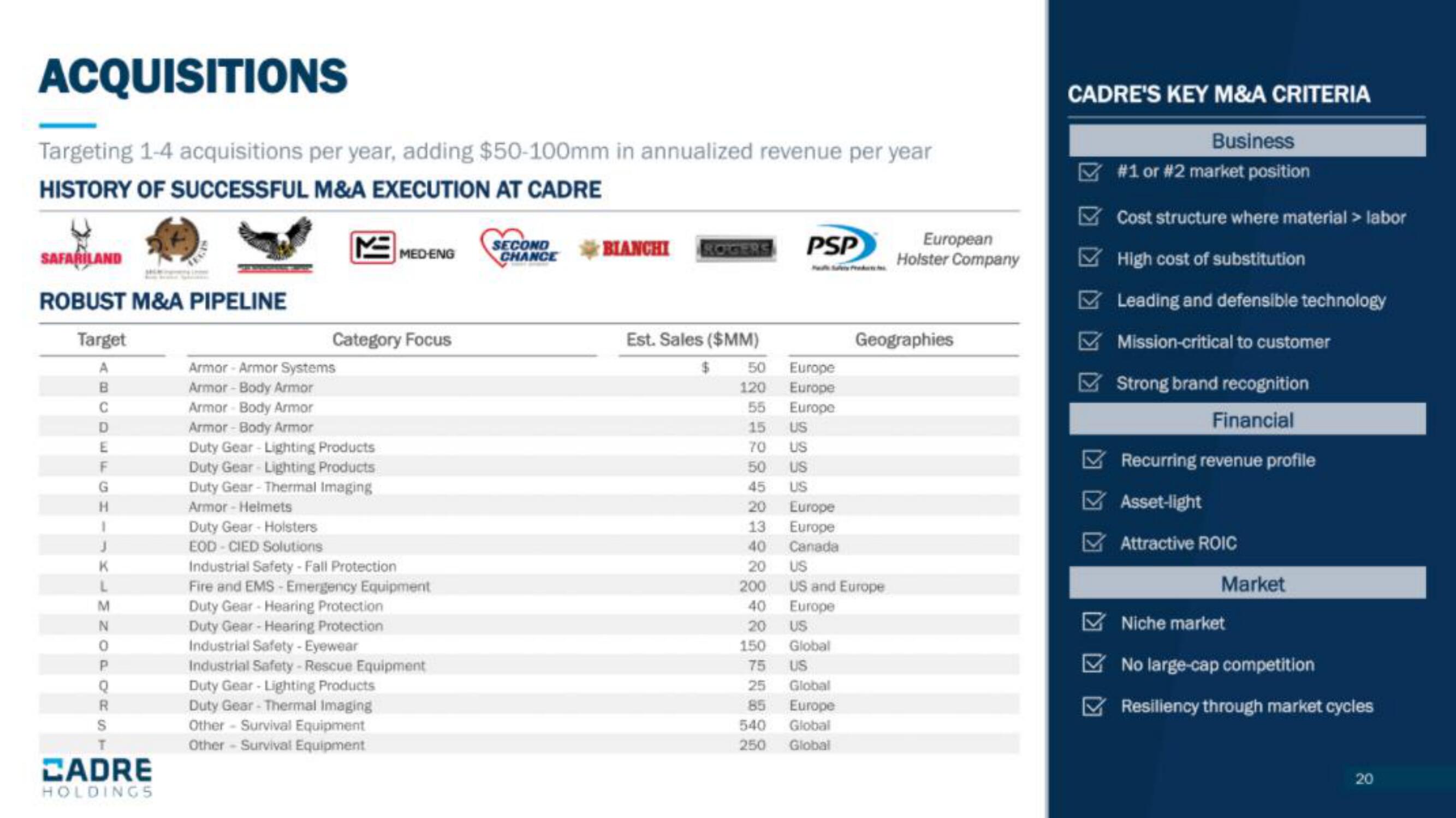

Targeting 1-4 acquisitions per year, adding $50-100mm in annualized revenue per year

HISTORY OF SUCCESSFUL M&A EXECUTION AT CADRE

SAFARILAND

ROBUST M&A PIPELINE

Target

D

G

H

1

K

M

0

R

S

CADRE

HOLDINGS

Armor-Armor Systems

Armor-Body Armor

Armor-Body Armor

Armor-Body Armor

Category Focus

Duty Gear -Lighting Products

Duty Gear Lighting Products

Duty Gear - Thermal Imaging

Armor-Helmets

Duty Gear Holsters

EOD-CIED Solutions

MED-ENG

Industrial Safety - Fall Protection

Fire and EMS- Emergency Equipment

Duty Gear Hearing Protection

Duty Gear- Hearing Protection

Industrial Safety-Eyewear

Industrial Safety - Rescue Equipment

Duty Gear -Lighting Products

Duty Gear - Thermal Imaging

Other Survival Equipment

Other - Survival Equipment

SECOND

CHANCE

BIANCHI

ROGERS

Est. Sales ($MM)

50

120

55

PSP

85

540

250

Europe

Europe

Europe

15

US

70

US

50

US

45 US

20

Europe

13 Europe

40

Canada

20

200

40

20

150

75

25

US

US and Europe

Europe

US

Global

US

Global

Europe

Global

Global

European

Holster Company

Geographies

CADRE'S KEY M&A CRITERIA

Business

#1 or #2 market position

Cost structure where material > labor

High cost of substitution

Leading and defensible technology

Mission-critical to customer

Strong brand recognition

Financial

Recurring revenue profile

Asset-light

Attractive ROIC

Market

Niche market

No large-cap competition

Resiliency through market cycles

20View entire presentation