Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Strong

foundation

Growing

ECM

Investing for growth

PERFORMANCE

Expanding

coverage

Diversifying

Investment

Banking

income

Global IB

Fee Share¹

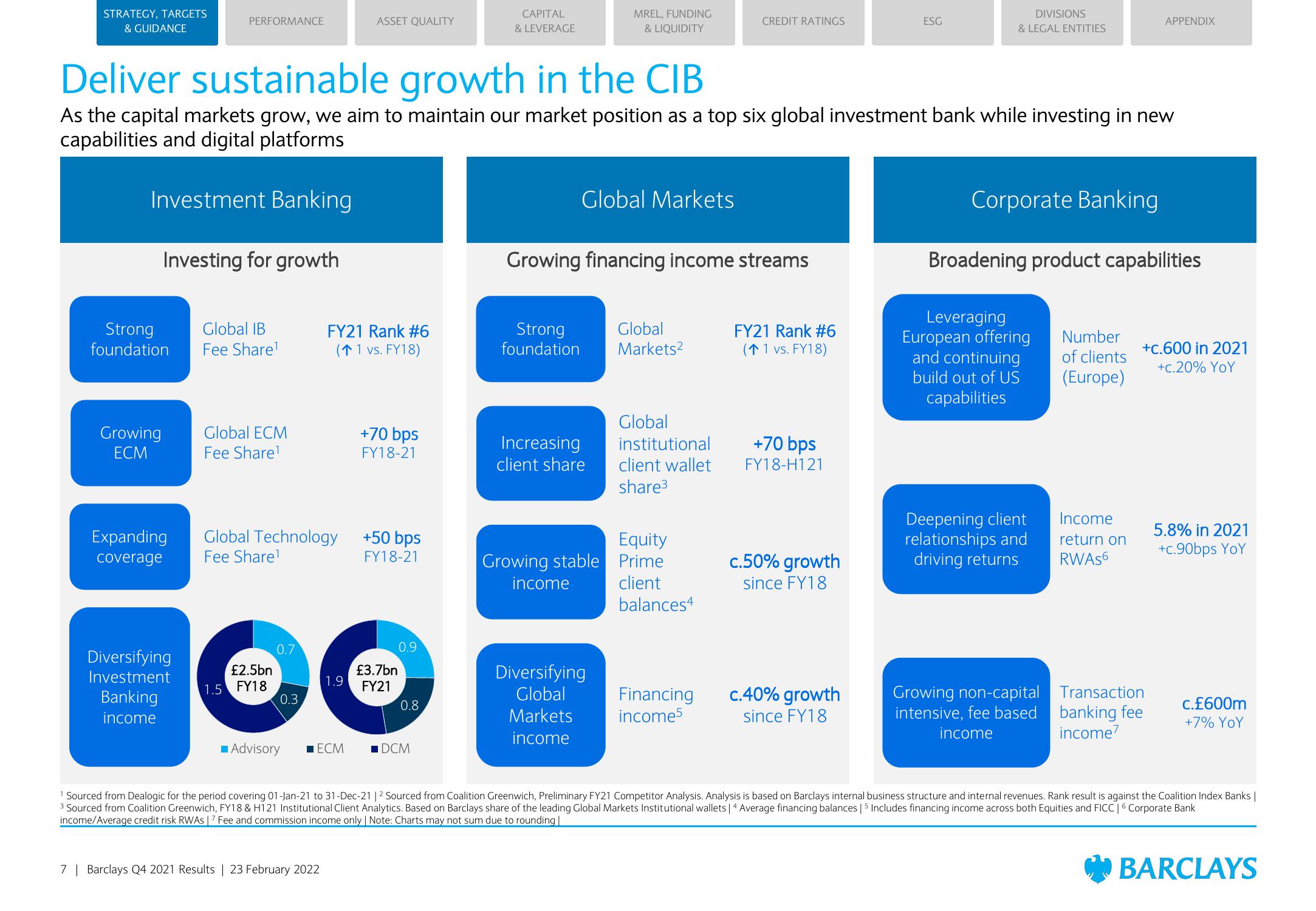

Deliver sustainable growth in the CIB

As the capital markets grow, we aim to maintain our market position as a top six global investment bank while investing in new

capabilities and digital platforms

Investment Banking

Global ECM

Fee Share¹

Global Technology

Fee Share¹

£2.5bn

1.5 FY18

0.7

0.3

■Advisory

FY21 Rank #6

(↑ 1 vs. FY18)

ASSET QUALITY

1.9

ECM

7 | Barclays Q4 2021 Results | 23 February 2022

+70 bps

FY18-21

+50 bps

FY18-21

£3.7bn

FY21

0.9

0.8

CAPITAL

& LEVERAGE

DCM

Strong

foundation

Global Markets

MREL, FUNDING

& LIQUIDITY

Growing financing income streams

Increasing

client share

Growing stable

income

Diversifying

Global

Markets

income

Global

Markets²

Global

institutional

client wallet

share³

CREDIT RATINGS

Equity

Prime

client

balances4

Financing

income5

FY21 Rank #6

(↑ 1 vs. FY18)

+70 bps

FY18-H121

c.50% growth

since FY18

ESG

c.40% growth

since FY18

DIVISIONS

& LEGAL ENTITIES

Corporate Banking

Broadening product capabilities

Leveraging

European offering

and continuing

build out of US

capabilities

Deepening client

relationships and

driving returns

Growing non-capital

intensive, fee based

income

Number

of clients

(Europe)

APPENDIX

Income

return on

RWAS6

+c.600 in 2021

+c.20% YoY

Transaction

banking fee

income?

5.8% in 2021

+c.90bps YOY

c.£600m

+7% YoY

1 Sourced from Dealogic for the period covering 01-Jan-21 to 31-Dec-21 | 2 Sourced from Coalition Greenwich, Preliminary FY21 Competitor Analysis. Analysis is based on Barclays internal business structure and internal revenues. Rank result is against the Coalition Index Banks |

3 Sourced from Coalition Greenwich, FY18 & H121 Institutional Client Analytics. Based on Barclays share of the leading Global Markets Institutional wallets | 4 Average financing balances | 5 Includes financing income across both Equities and FICC | 6 Corporate Bank

income/Average credit risk RWAS | 7 Fee and commission income only | Note: Charts may not sum due to rounding |

BARCLAYSView entire presentation