Lion Electric Investor Presentation Deck

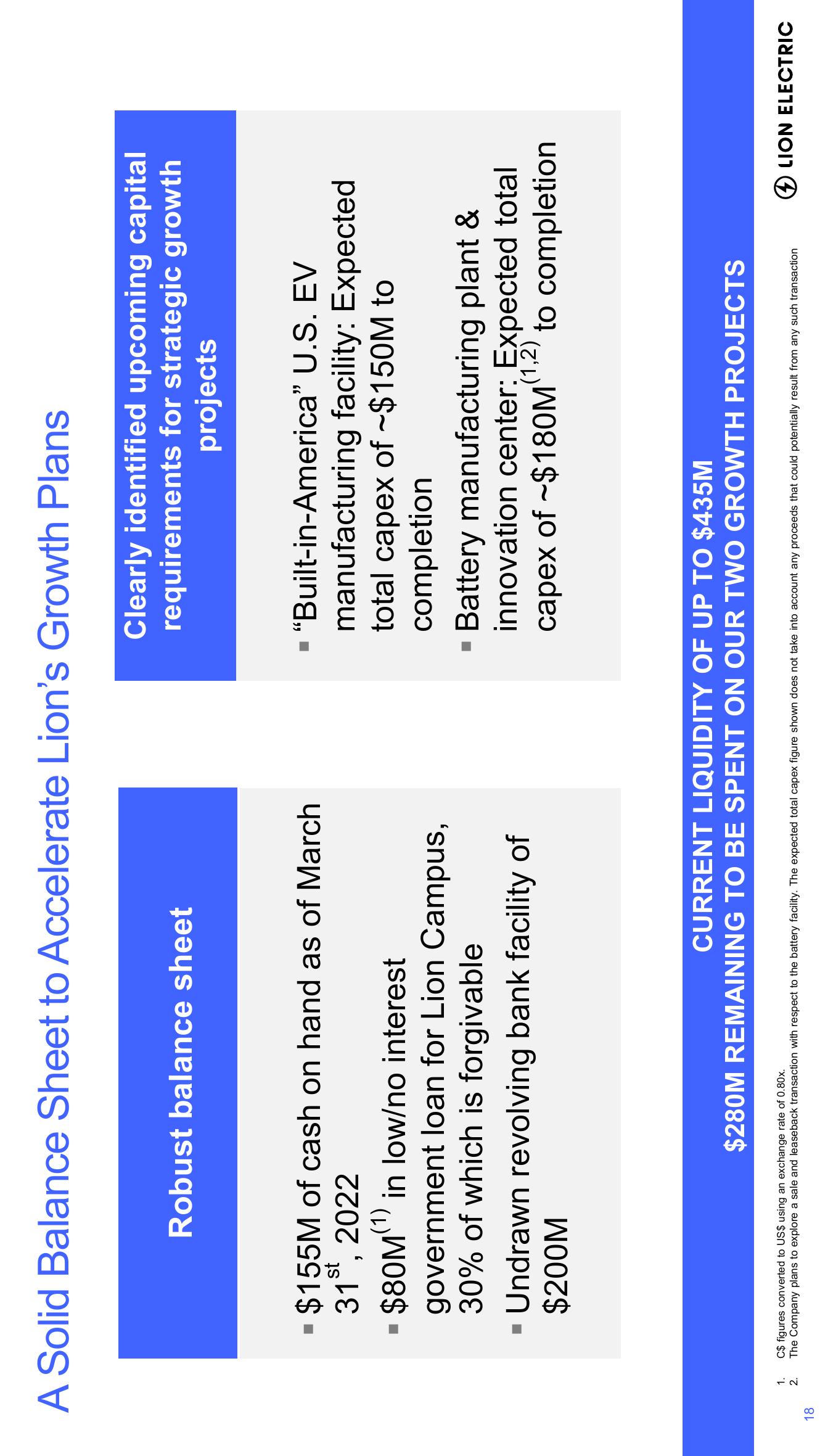

A Solid Balance Sheet to Accelerate Lion's Growth Plans

18

1.

2.

Robust balance sheet

▪ $155M of cash on hand as of March

31st, 2022

$80M(¹) in low/no interest

government loan for Lion Campus,

30% of which is forgivable

Undrawn revolving bank facility of

$200M

Clearly identified upcoming capital

requirements for strategic growth

projects

"Built-in-America” U.S. EV

manufacturing facility: Expected

total capex of ~$150M to

completion

Battery manufacturing plant &

innovation center: Expected total

capex of ~$180M(¹,2) to completion

CURRENT LIQUIDITY OF UP TO $435M

$280M REMAINING TO BE SPENT ON OUR TWO GROWTH PROJECTS

C$ figures converted to US$ using an exchange rate of 0.80x.

The Company plans to explore a sale and leaseback transaction with respect to the battery facility. The expected total capex figure shown does not take into account any proceeds that could potentially result from any such transaction

LION ELECTRICView entire presentation